A California Trademark Security Agreement refers to a legal contract that enables a party to use a trademark as collateral for a loan or other financial arrangement in the state of California. This agreement aims to protect the rights and interests of both the lender and the borrower in the event of default or non-payment. In California, there are two primary types of Trademark Security Agreements: 1. General Trademark Security Agreement: This type of agreement allows borrowers to use their registered trademarks as collateral for a loan. The agreement specifies the terms and conditions under which the lender may exercise its rights over the trademark in the event of default. It includes provisions related to the use, monitoring, and enforcement of the trademark as security. 2. Specific Trademark Security Agreement: This agreement focuses on a specific trademark or group of trademarks rather than all the trademarks owned by the borrower. It delineates the terms and conditions regarding the use and enforcement of these specific trademarks as collateral. The lender has the right to invoke its security interest in the specified trademarks if the borrower fails to fulfill their financial obligations. In addition to these types of agreements, it's important to mention the key elements typically found in California Trademark Security Agreements: a. Grant of Security Interest: The borrower grants the lender a security interest in their trademark(s) to secure repayment of the loan or other obligations. b. Collateral Description: The agreement clearly identifies the trademark(s) being used as collateral, including registration details, serial numbers, and any accompanying assets related to the trademark. c. Representations and Warranties: Parties affirm that they have the legal rights to grant and enforce the security interest and that the trademark(s) are not subject to any other liens or encumbrances. d. Default and Remedies: The agreement outlines what constitutes a default, such as non-payment or violation of other contractual terms, and specifies the remedies available to the lender in case of default, including the right to sell or transfer the trademark(s). e. Indemnification: The borrower indemnifies the lender against any losses, damages, or costs incurred due to the trademark(s) being used as collateral. f. Governing Law and Jurisdiction: The agreement establishes that California law governs the agreement and identifies the jurisdiction where any disputes will be resolved. g. Termination: The agreement may define specific conditions under which the security interest is terminated, such as full repayment or release by the lender. Overall, a California Trademark Security Agreement serves to protect both lenders and borrowers, ensuring that the use of trademarks as collateral is properly documented and executed according to legal requirements.

California Trademark Security Agreement

Description

How to fill out California Trademark Security Agreement?

Have you been within a position the place you will need files for both business or specific functions nearly every working day? There are a lot of lawful papers themes available online, but getting versions you can rely on is not straightforward. US Legal Forms provides thousands of form themes, such as the California Trademark Security Agreement, which can be written to satisfy state and federal needs.

If you are already knowledgeable about US Legal Forms site and have a merchant account, simply log in. Afterward, it is possible to obtain the California Trademark Security Agreement web template.

If you do not have an account and would like to begin using US Legal Forms, abide by these steps:

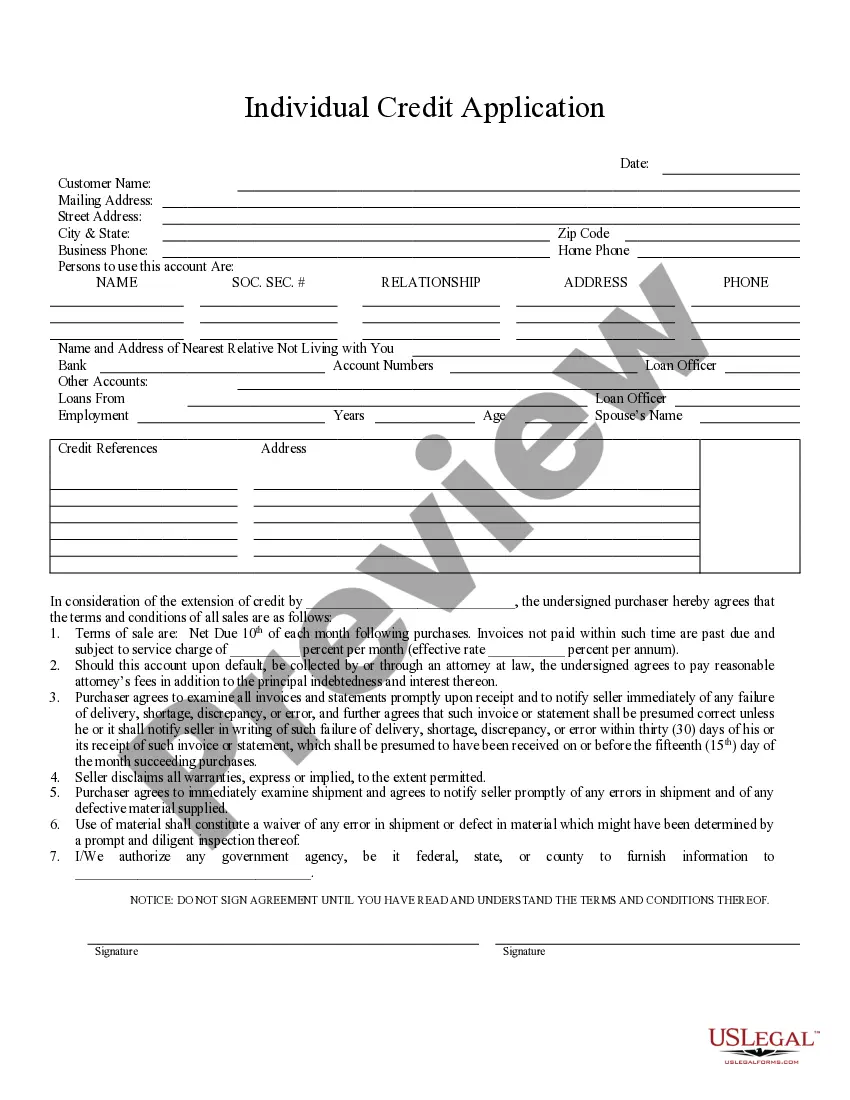

- Obtain the form you require and ensure it is for the appropriate city/region.

- Take advantage of the Review option to examine the form.

- Read the information to ensure that you have selected the proper form.

- When the form is not what you are looking for, utilize the Look for industry to obtain the form that suits you and needs.

- If you obtain the appropriate form, click on Get now.

- Select the pricing prepare you desire, fill in the specified info to produce your bank account, and pay for your order making use of your PayPal or charge card.

- Decide on a practical file structure and obtain your backup.

Discover every one of the papers themes you have bought in the My Forms food list. You may get a additional backup of California Trademark Security Agreement any time, if necessary. Just click the necessary form to obtain or produce the papers web template.

Use US Legal Forms, one of the most extensive selection of lawful varieties, in order to save time and steer clear of mistakes. The services provides professionally produced lawful papers themes which you can use for a variety of functions. Make a merchant account on US Legal Forms and start creating your lifestyle easier.