California Receipt for Loan Funds (REF) is a document that serves as proof of the transfer of funds from a lender to a borrower in the state of California. This receipt is used in loan transactions to ensure transparency, legality, and accountability. The California REF includes various details related to the loan transaction, including the loan amount, interest rates, repayment terms, payment schedule, and any additional fees or charges. It acts as a binding agreement between the lender and borrower, outlining the terms and conditions of the loan. This document is crucial for both parties as it protects the lender's investment and ensures that the borrower understands their responsibilities regarding loan repayment. It helps to eliminate confusion or disputes by clearly documenting the loan transaction and its terms. Different types of California Receipt for Loan Funds may vary based on the specific loan requirements and purpose. Some common types of California REF include: 1. Personal Loan REF: This type of receipt is used when individuals borrow money from a lender for personal reasons. It could be for expenses such as education, home improvement, medical emergencies, or debt consolidation. 2. Business Loan REF: Designed for businesses and entrepreneurs, this receipt is utilized when obtaining funding for various business-related purposes, such as working capital, equipment purchases, expansion initiatives, or meeting operational costs. 3. Mortgage Loan REF: This type of receipt is specific to real estate transactions, particularly in home purchases or refinancing. It outlines the loan details, such as the loan amount, interest rate, repayment period, and any additional costs associated with the mortgage. 4. Auto Loan REF: Used in vehicle financing, this receipt provides all relevant information regarding the loan for purchasing a car, motorcycle, or any other vehicle. It includes details like the loan amount, interest rate, down payment, and repayment schedule. 5. Student Loan REF: Tailored for educational purposes, this receipt is used when borrowing money to cover tuition fees, textbooks, living expenses, or other academic costs. It may include specifics like interest rates, enrollment status, and deferment options. 6. Emergency Loan REF: This receipt is utilized in situations where borrowers require immediate financial assistance for unexpected circumstances such as medical emergencies, natural disasters, or urgent repairs. It is important to note that these are just a few examples of California REF. The specific type of receipt for loan funds may differ based on the purpose and nature of the loan. In conclusion, the California Receipt for Loan Funds is a vital document that records the transfer of funds from a lender to a borrower. It ensures transparency and outlines the terms and conditions of the loan, protecting the interests of both parties involved.

California Receipt for loan Funds

Description

How to fill out California Receipt For Loan Funds?

Are you currently in a place in which you require paperwork for either enterprise or individual uses virtually every working day? There are a variety of legal file layouts available on the net, but discovering types you can trust is not easy. US Legal Forms offers a huge number of type layouts, like the California Receipt for loan Funds, which can be created to meet state and federal needs.

If you are presently acquainted with US Legal Forms web site and get a free account, basically log in. After that, it is possible to obtain the California Receipt for loan Funds design.

Unless you come with an bank account and would like to start using US Legal Forms, follow these steps:

- Get the type you will need and ensure it is for your proper area/region.

- Make use of the Preview button to review the shape.

- Look at the description to ensure that you have chosen the proper type.

- In the event the type is not what you`re trying to find, take advantage of the Search industry to discover the type that suits you and needs.

- Once you obtain the proper type, click Buy now.

- Pick the prices strategy you need, submit the necessary info to produce your bank account, and purchase the order with your PayPal or Visa or Mastercard.

- Select a hassle-free file formatting and obtain your backup.

Get every one of the file layouts you have bought in the My Forms menu. You may get a further backup of California Receipt for loan Funds any time, if required. Just go through the essential type to obtain or print out the file design.

Use US Legal Forms, by far the most extensive assortment of legal kinds, to save lots of time and prevent mistakes. The services offers appropriately produced legal file layouts that you can use for a variety of uses. Generate a free account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

A receipt is any document that contains the following five IRS-required elements: Name of vendor (person or company you paid) Transaction date (when you paid) Detailed description of goods or services purchased (what you bought) Amount paid. Form of payment (how you paid ? cash, check, or last four digits of credit card)

receipt agreement is a legal agreement between two parties, usually in a tort case, where the defendant lends money to the plaintiff without any interest. The plaintiff is not required to repay the loan unless they receive compensation from other parties responsible for the same injury.

A payment receipt, also known as a receipt of payment, is a document issued from a business to its customer when they have received payment for provided goods or services. Payment receipts should be issued every time a payment is made on a sale - even if it's a deposit or partial payment.

Subtract your 2020 gross receipts from your 2019 gross receipts, and divide that amount by your 2019 gross receipts. If the number is 0.25 or greater, then your business can demonstrate a 25% decrease in annual revenue.

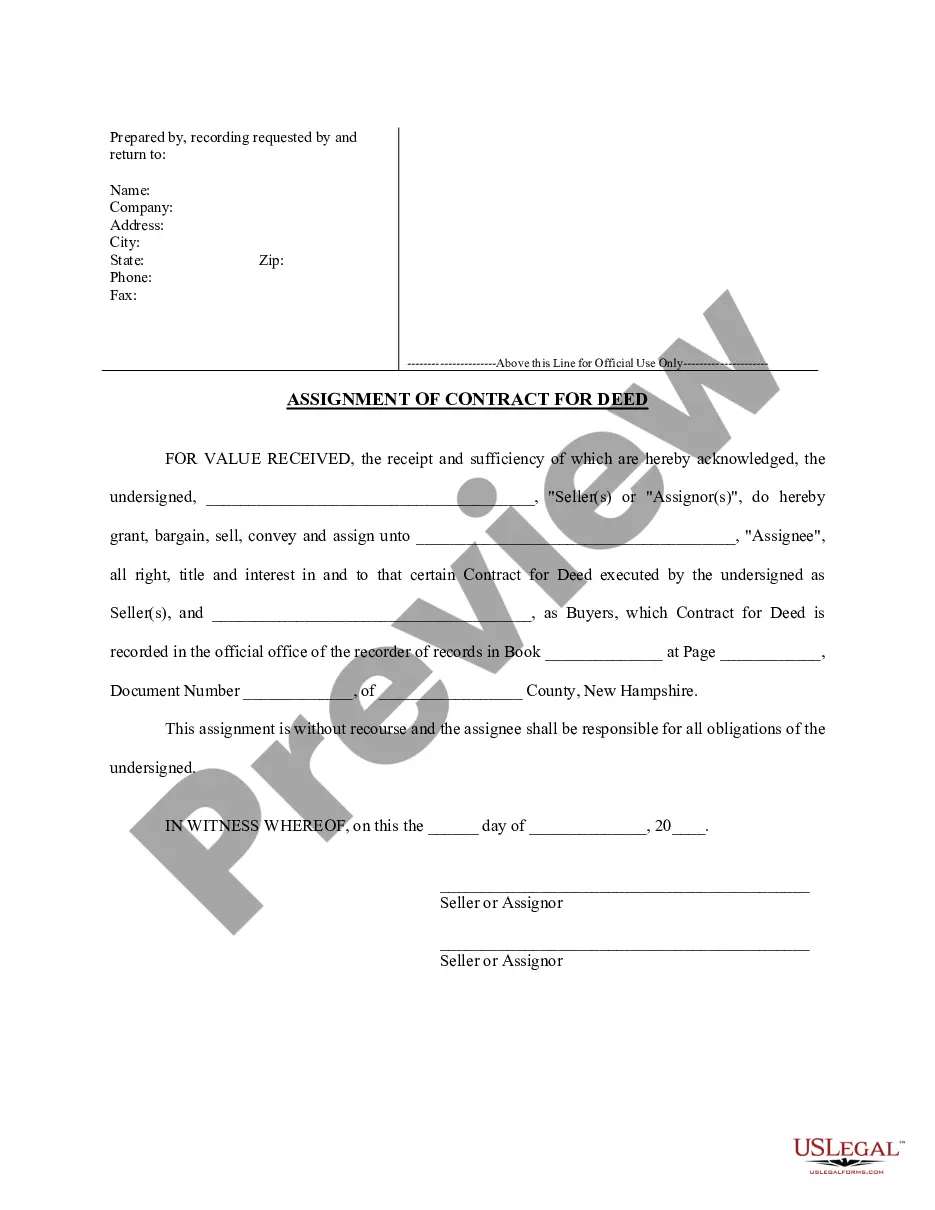

This is a form of receipt issued by a borrower to a lender acknowledging the receipt of funds in a loan transaction. This Standard Document has integrated notes with important explanations and drafting tips.

What Does Loan Receipt Mean? A loan receipt is a document that an insurance policyholder signs to signify that they have received an interest-free loan from an insurance company. These loans are typically given out when a loss has occurred and the policyholder is suing a third party for damages related to that loss.

25% reduction from gross receipts California conforms to the federal gross receipts test requiring a 25% or greater reduction in gross receipts and will therefore follow the rationale of this related federal guidance.

A receipt is a written acknowledgment that something of value has been transferred from one party to another. In addition to the receipts consumers typically receive from vendors and service providers, receipts are also issued in business-to-business dealings as well as stock market transactions.