The California Notice of Assignment of Security Interest is a legal document used to inform interested parties about the assignment of a security interest on certain property or assets. This notice is crucial in establishing and protecting the rights and obligations of the assignor and assignee involved in the assignment. In California, there are different types of Notice of Assignment of Security Interest, which include: 1. UCC-1 Financing Statement: This form is typically used when a creditor or lender wants to secure their interest in personal property, such as equipment, inventory, or accounts receivable. By filing a UCC-1 Financing Statement with the California Secretary of State, the assignee notifies the public that they have an interest in the designated collateral. 2. Real Property Deed of Trust: Unlike personal property, real property (land or buildings) requires a different type of security interest declaration. A Notice of Assignment of Security Interest can be used in conjunction with a Real Property Deed of Trust, which establishes a lien on the property to secure a loan or debt. 3. Intellectual Property Assignment: This type of notice is used when the assignment involves intellectual property rights, such as patents, copyrights, or trademarks. The Notice of Assignment of Security Interest informs interested parties that the assignee has acquired a security interest in the intellectual property, providing them with legal recourse if needed. 4. Motor Vehicle Lien: When a lender or creditor provides financing for the purchase of a vehicle, they may secure their interest with a motor vehicle lien. The Notice of Assignment of Security Interest, in this case, serves as a legal notification to relevant authorities, potential buyers, and other parties that the assignee holds a security interest on the vehicle. It is important to note that the specific requirements and procedures for filing a California Notice of Assignment of Security Interest may vary depending on the type of property or asset and the governing laws. Therefore, it is recommended to consult with legal professionals or review the relevant statutes to ensure compliance and accuracy when preparing and submitting such notices.

Notice Of Security Interest

Description

How to fill out California Notice Of Assignment Of Security Interest?

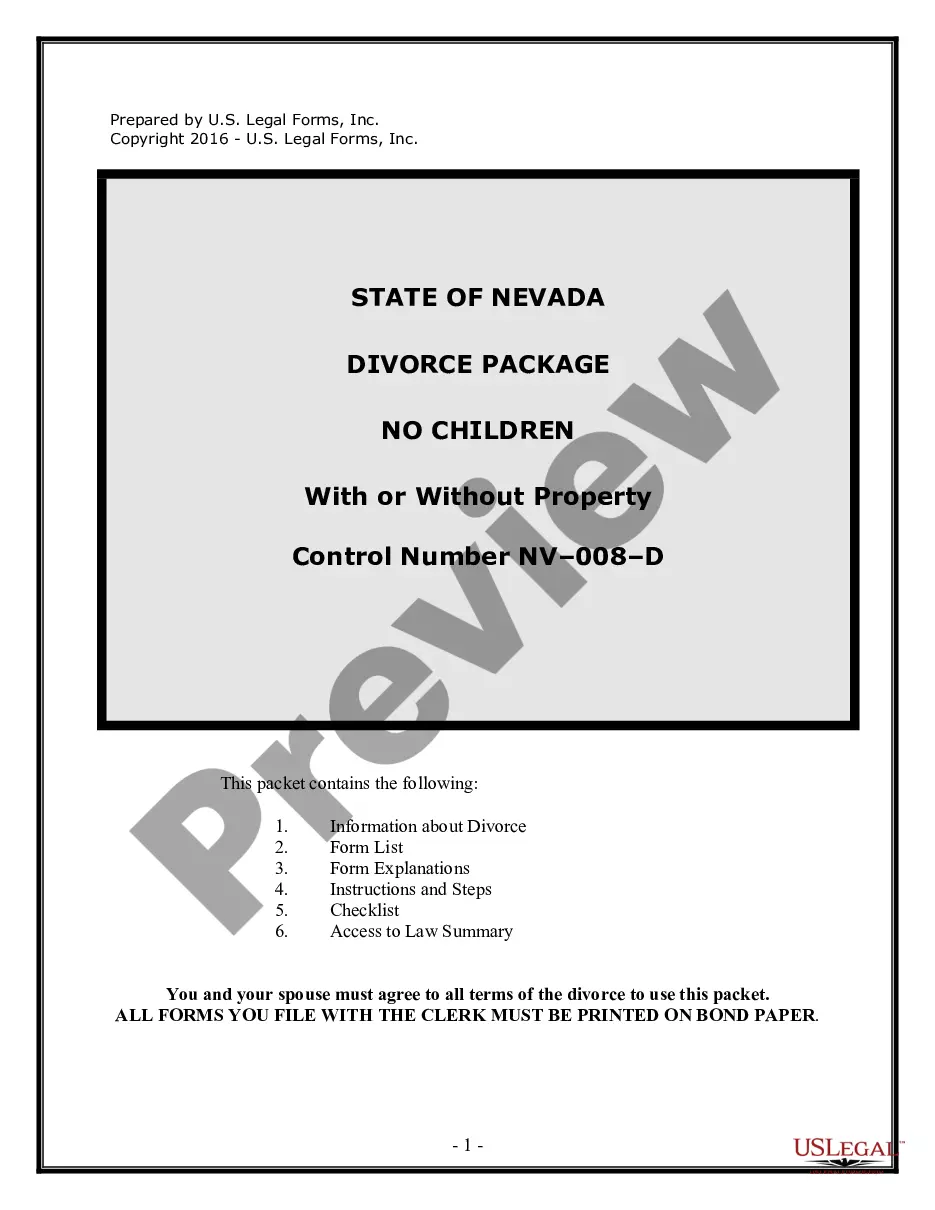

Choosing the right lawful record web template can be a struggle. Of course, there are plenty of web templates accessible on the Internet, but how can you obtain the lawful type you want? Make use of the US Legal Forms web site. The support provides 1000s of web templates, like the California Notice of Assignment of Security Interest, which you can use for business and private demands. All of the varieties are examined by professionals and fulfill federal and state demands.

Should you be currently listed, log in in your bank account and click the Acquire key to find the California Notice of Assignment of Security Interest. Make use of bank account to search through the lawful varieties you have ordered previously. Proceed to the My Forms tab of the bank account and acquire another version in the record you want.

Should you be a fresh user of US Legal Forms, listed below are basic guidelines that you can comply with:

- Initially, make sure you have chosen the appropriate type for your personal area/state. It is possible to look over the shape making use of the Review key and look at the shape outline to make certain this is basically the best for you.

- When the type is not going to fulfill your needs, utilize the Seach discipline to get the appropriate type.

- When you are certain that the shape is acceptable, go through the Get now key to find the type.

- Choose the costs strategy you would like and type in the essential information and facts. Make your bank account and pay for the transaction making use of your PayPal bank account or charge card.

- Choose the data file format and down load the lawful record web template in your system.

- Full, modify and printing and signal the acquired California Notice of Assignment of Security Interest.

US Legal Forms will be the most significant local library of lawful varieties in which you can find various record web templates. Make use of the service to down load expertly-manufactured documents that comply with state demands.

Form popularity

FAQ

If the proceeds are not identifiable cash proceeds, the perfection of the secured party's security interest in such proceeds continues for a period of 20 days.

If at any time any Grantor shall take a security interest in any property of an Account Debtor or any other person to secure payment and performance of an Account, such Grantor shall promptly assign such security interest to the Collateral Agent.

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral.

The most common way to perfect a security interest is through filing a financing statement. A financing statement is filed with the Secretary of State and it puts other creditors on notice of the secured party's security interest in the collateral.

However, generally speaking, the primary ways for a secured party to perfect a security interest are:by filing a financing statement with the appropriate public office.by possessing the collateral.by "controlling" the collateral; or.it's done automatically upon attachment of the security interest.

(1) A security interest in a deposit account may be perfected only by control under Section 9314. (2) Except as otherwise provided in subdivision (d) of Section 9308, a security interest in a letter-of-credit right may be perfected only by control under Section 9314.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

Under Article 9, a security interest is created by a security agreement, under which the debtor grants a security interest in the debtor's property as collateral for a loan or other obligation.

When granting security for a loan, it is common for a borrower to assign to the lender the benefit of its rights under any agreements it has or will enter into. This includes specific agreements already in place and other agreements it might enter into from time to time.