California Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

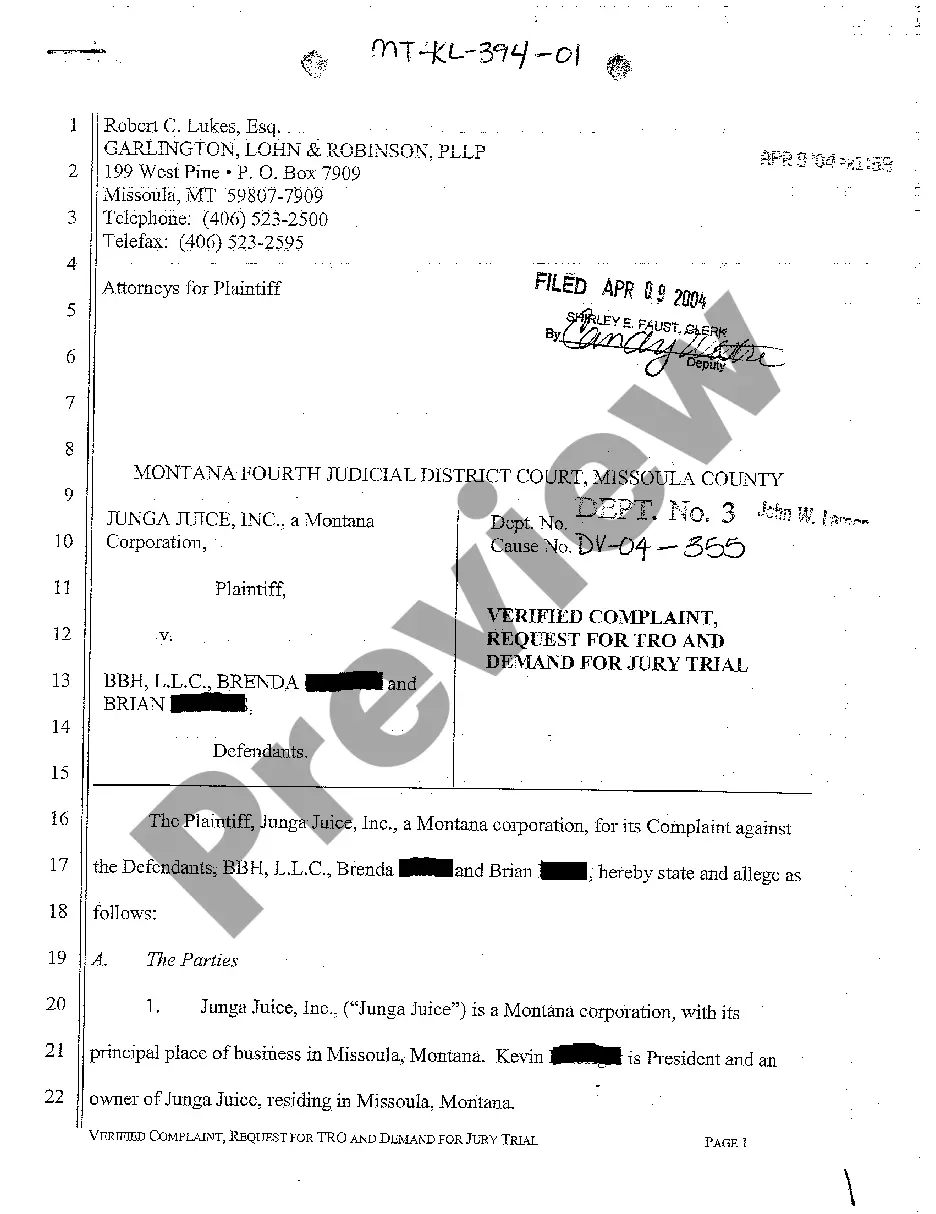

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

Are you in a scenario where you require documentation for either business or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but locating trustworthy ones can be challenging.

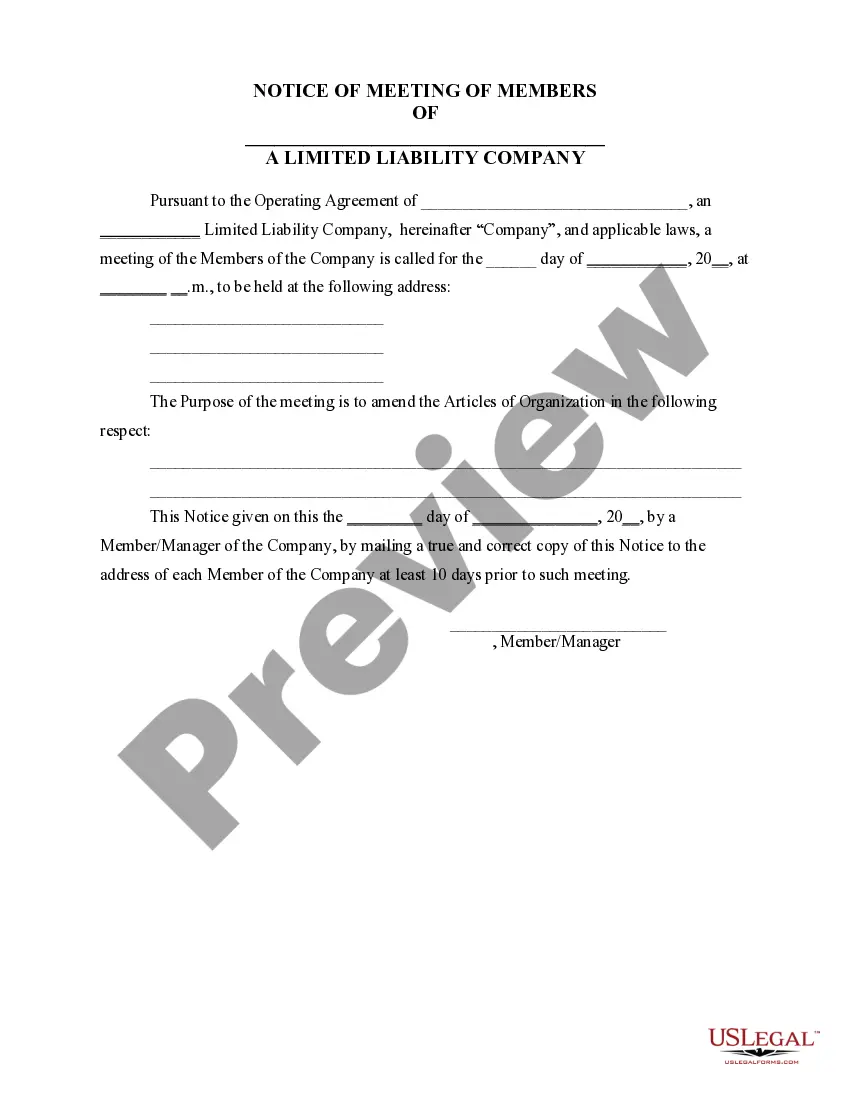

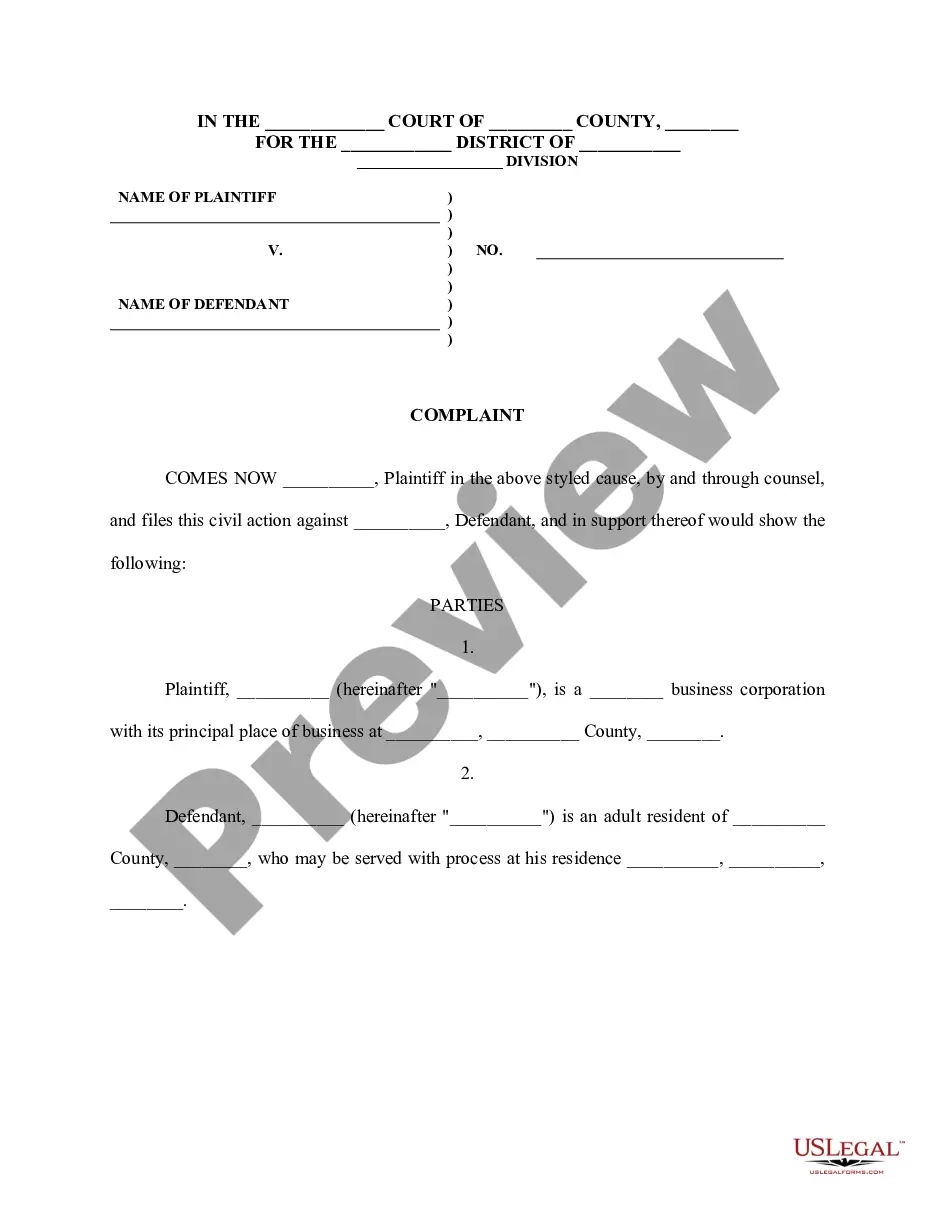

US Legal Forms offers a multitude of form templates, including the California Irrevocable Trust for Future Advantage of Trustor with Income Payable to Trustor after Specified Time, created to comply with state and federal regulations.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Select a convenient document format and download your copy.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can retrieve the California Irrevocable Trust for Future Advantage of Trustor with Income Payable to Trustor after Specified Time template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you require and ensure it is for the correct city/county.

- Utilize the Review button to evaluate the form.

- Check the outline to confirm you have selected the accurate form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your requirements.

- When you find the correct form, click Get now.

Form popularity

FAQ

The 80-80 rule in California pertains to the percentage of income distributed versus retained in irrevocable trusts. Specifically, if 80% of the trust's income is distributed, the accumulated income may be taxed differently. This rule can significantly influence the tax strategy for managing a California Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.

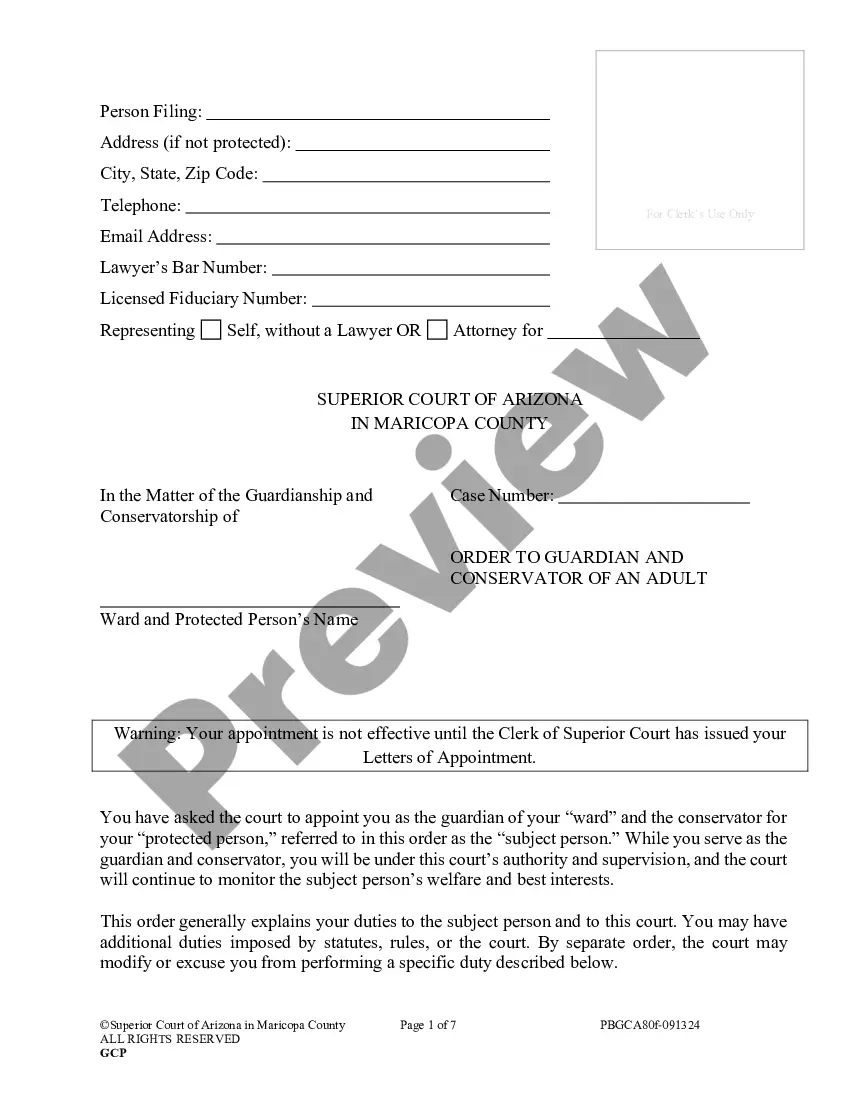

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

Retained Interest Trusts This is a trust where a grantor makes an irrevocable transfer of assets but reserves the right to receive income or enjoyment of those assets for a period of time. When the trust then subsequently terminates, the assets are passed on to others.

A credit shelter trust, also known as a bypass trust or a family trust, is a trust fund that allows the trustor to grant the recipients an amount of assets or funds up to the estate-tax exemption.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.