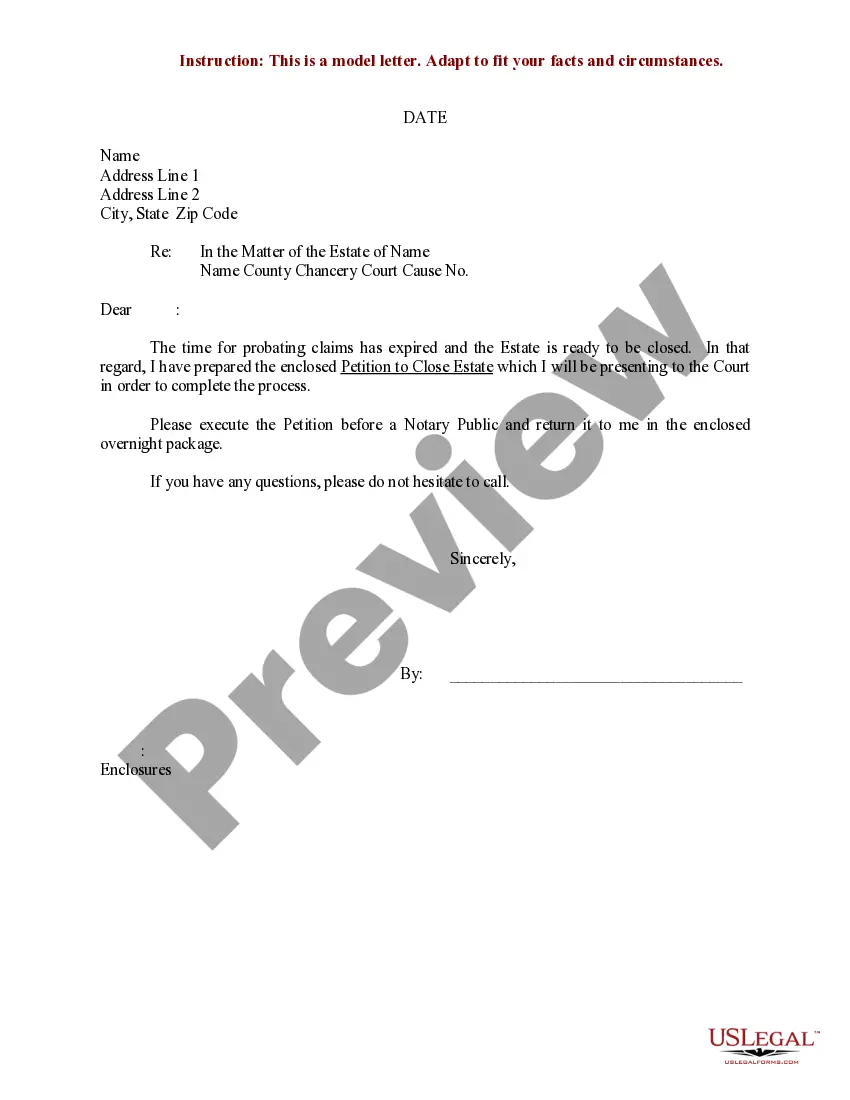

California Sample Letter for Closing of Estate - Request to Execute

Description

How to fill out Sample Letter For Closing Of Estate - Request To Execute?

US Legal Forms - one of several largest libraries of legal types in the States - provides a wide array of legal record layouts it is possible to obtain or printing. While using site, you may get a huge number of types for company and specific uses, categorized by categories, states, or keywords.You will find the latest types of types such as the California Sample Letter for Closing of Estate - Request to Execute in seconds.

If you already have a monthly subscription, log in and obtain California Sample Letter for Closing of Estate - Request to Execute from your US Legal Forms collection. The Obtain switch will appear on every type you perspective. You get access to all formerly saved types in the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, here are simple instructions to help you get started off:

- Be sure you have picked the correct type to your metropolis/region. Click the Review switch to review the form`s content material. Read the type outline to ensure that you have chosen the proper type.

- In the event the type does not satisfy your requirements, take advantage of the Search discipline at the top of the display screen to obtain the the one that does.

- Should you be happy with the shape, validate your option by clicking the Acquire now switch. Then, select the pricing strategy you like and give your accreditations to sign up to have an accounts.

- Method the financial transaction. Make use of credit card or PayPal accounts to perform the financial transaction.

- Pick the formatting and obtain the shape in your system.

- Make changes. Complete, modify and printing and signal the saved California Sample Letter for Closing of Estate - Request to Execute.

Each and every design you included with your money does not have an expiration date and it is the one you have forever. So, if you want to obtain or printing yet another backup, just go to the My Forms section and click on the type you need.

Get access to the California Sample Letter for Closing of Estate - Request to Execute with US Legal Forms, by far the most considerable collection of legal record layouts. Use a huge number of expert and state-distinct layouts that meet up with your organization or specific needs and requirements.

Form popularity

FAQ

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

The Personal Representative is required to file a petition for final distribution or a verified report on the status of the estate within one year after Letters are issued (or 18 months if a federal estate tax return is required).

An executor or executrix is the person named in a will to carry out the terms of the will. Upon petition, the Superior Court will verify the appointment of the executor in the will and issue Letters Testamentary which give the executor the right to administer the estate of the deceased and to dispose of any property.

The summons shall contain a direction that the persons summoned file with the court a written pleading in response to the petition within 30 days after service of the summons.

Seeking Legal Recourse If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit.

If the trust gives the executor discretionary authority, the executor may withhold assets from the beneficiary. However, they must be able to demonstrate that the beneficiary is not entitled to receive them at the time.

What must I do to close the estate? The Personal Representative must file a final account, report and petition for final distribution, have the petition set for hearing, give notice of the hearing to interested persons, and obtain a court order approving the final distribution.

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.