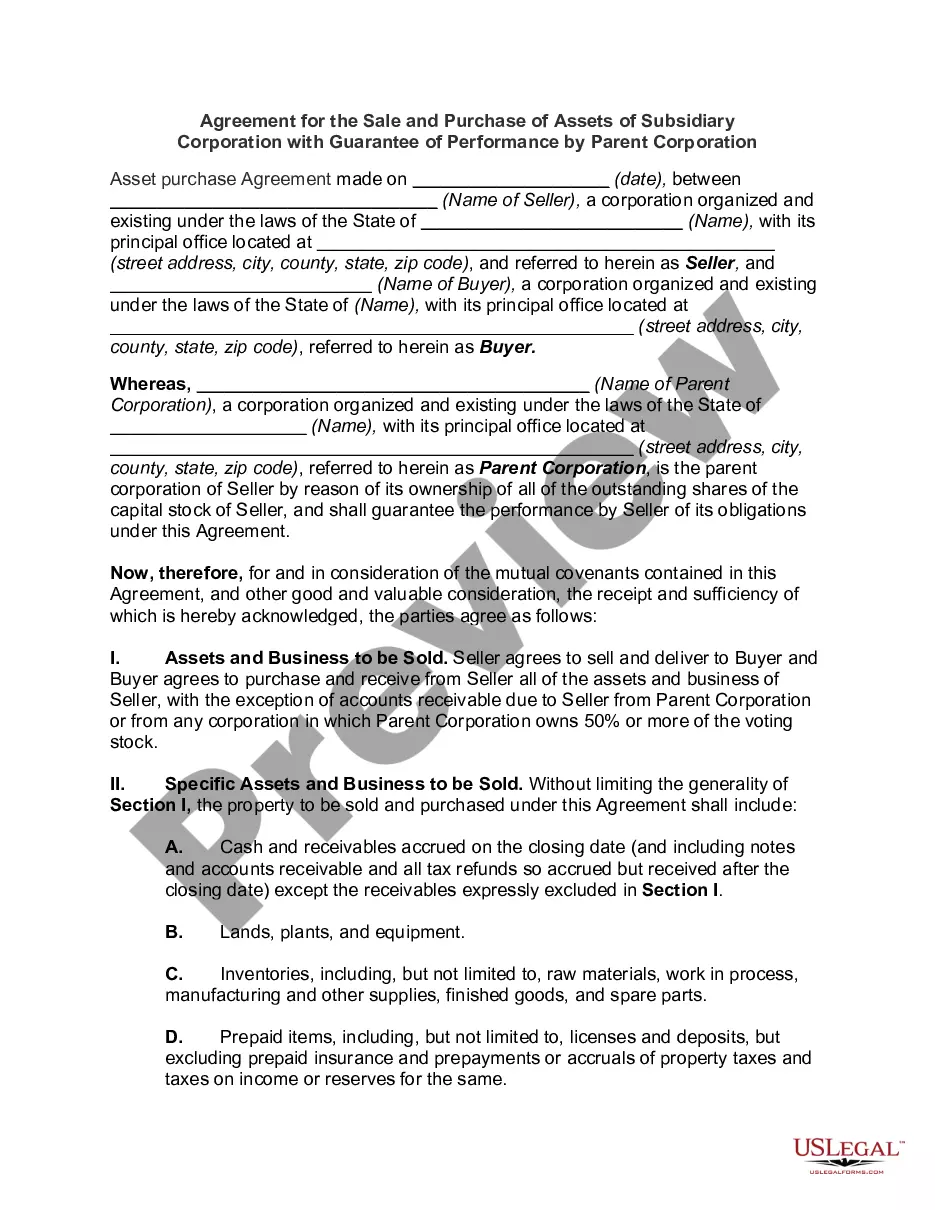

California Subsidiary Guaranty Agreement

Description

How to fill out Subsidiary Guaranty Agreement?

If you need to gather, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms that is accessible online.

Take advantage of the site’s user-friendly search feature to find the documents you require.

Varied templates for commercial and personal purposes are categorized by groups and categories, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal template.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your details to create an account.

- Use US Legal Forms to acquire the California Subsidiary Guaranty Agreement with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and then click the Download button to obtain the California Subsidiary Guaranty Agreement.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions provided below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Review option to assess the form’s content. Be sure to read through the details.

Form popularity

FAQ

An upstream guarantee, also known as a subsidiary guarantee, is a financial guarantee in which the subsidiary guarantees its parent company's debt.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

Guaranty and Security Agreement means a guaranty and security agreement, dated as of even date with the Agreement, in form and substance reasonably satisfactory to Administrative Agent, executed and delivered by each of the Borrowers and each of the Guarantors to Administrative Agent.

An upstream guarantee, also known as a subsidiary guarantee, is a financial guarantee in which the subsidiary guarantees its parent company's debt.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.