Title: California Sample Letter for Settlement of Outstanding Bill of Deceased Description: If you are seeking guidance on how to settle the outstanding bills of a deceased individual in California, you can utilize a well-crafted sample letter to communicate with relevant parties involved. This detailed description will outline the purpose, key information, and steps to create an effective California sample letter for the settlement of outstanding bills of a deceased person. Keywords: California, sample letter, settlement, outstanding bill, deceased, estate, executor, creditor, debt, communication, legal process Types of California Sample Letters for Settlement of Outstanding Bill of Deceased: 1. California Sample Letter for Final Bill Settlement of Deceased: This letter can be used when all outstanding bills of the deceased have been identified, and you are ready to settle them. It includes an overview of the estate's financial situation, a request for any missing bills, and a proposal for payment. 2. California Sample Letter for Negotiating Outstanding Bill Payment: If there are disputed bills or concerns regarding the authenticity of the outstanding debts, this letter can be used to initiate negotiations with the creditors. It highlights the need for sufficient evidence and documentation to support the legitimacy of the debt and proposes a mutually agreeable resolution. 3. California Sample Letter for Disputing an Outstanding Bill of Deceased: When you believe that a particular bill should not be part of the deceased's estate due to various reasons (e.g., lack of contract, services not provided), this letter can be used to dispute the outstanding bill. It outlines the grounds for the dispute and requests the creditor to remove the debt from the deceased's account. 4. California Sample Letter for Requesting Extension of Outstanding Bill Payment: If circumstances require additional time to settle the outstanding bills, this letter is appropriate to request an extension from the creditors. It explains the reasons for the extension and proposes a new payment schedule to assure timely settlement. 5. California Sample Letter for Informing Debt Collectors of Deceased's Death: When debt collectors continue contacting you regarding the deceased's outstanding bills, this letter can be sent to inform them about the death and request that they cease all collection activities. It references relevant legal provisions and asserts that all outstanding debts will be addressed through the proper legal channels. In all types of letters, it is crucial to include accurate details such as the deceased's name, date of death, executor's name and contact information, relevant account numbers, and any supporting documents. Adapting these sample letters to your specific situation can provide a structured and professional approach to communicate with parties involved in settling the outstanding bills of a deceased individual in California.

California Sample Letter for Settlement of Outstanding Bill of Deceased

Description

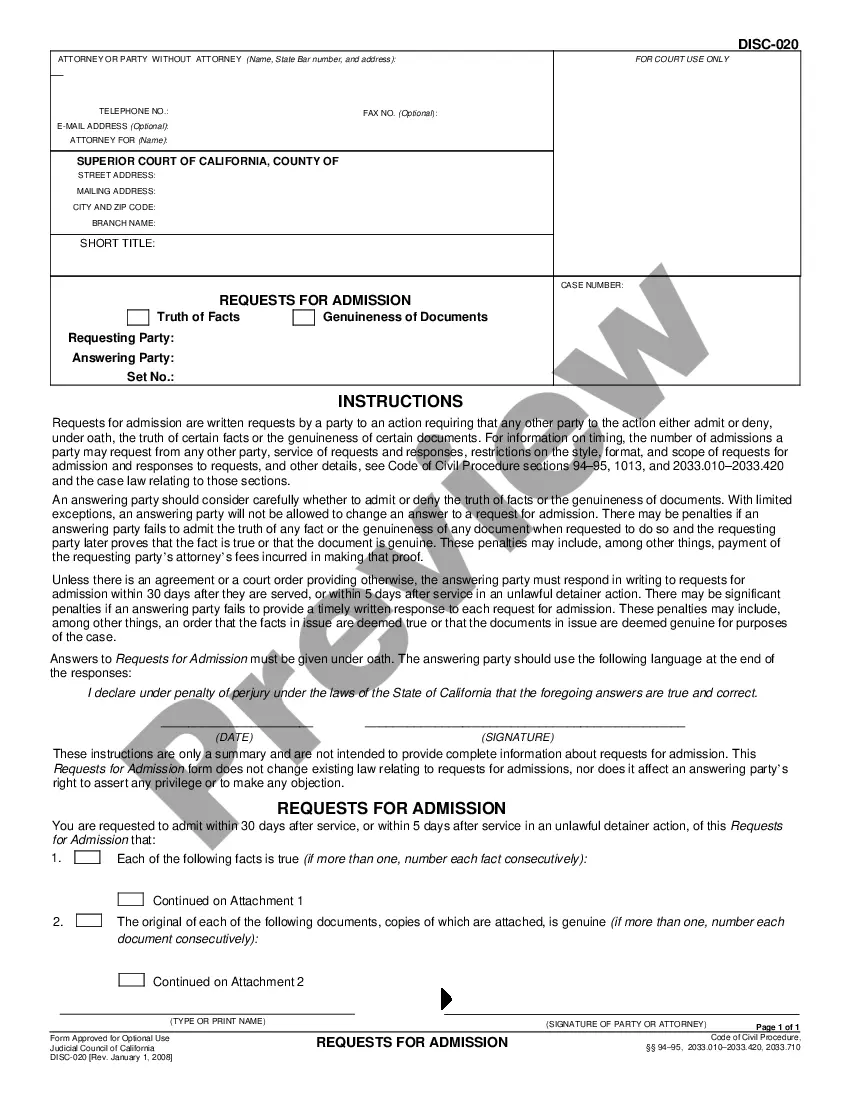

How to fill out California Sample Letter For Settlement Of Outstanding Bill Of Deceased?

If you have to comprehensive, obtain, or produce legitimate document themes, use US Legal Forms, the greatest collection of legitimate kinds, which can be found on the web. Take advantage of the site`s basic and handy look for to discover the papers you will need. Numerous themes for organization and person reasons are categorized by classes and states, or key phrases. Use US Legal Forms to discover the California Sample Letter for Settlement of Outstanding Bill of Deceased in just a handful of click throughs.

Should you be previously a US Legal Forms customer, log in for your accounts and click the Obtain option to obtain the California Sample Letter for Settlement of Outstanding Bill of Deceased. Also you can entry kinds you previously saved from the My Forms tab of your accounts.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for the appropriate city/country.

- Step 2. Take advantage of the Preview solution to look over the form`s content material. Never neglect to learn the explanation.

- Step 3. Should you be not happy using the develop, utilize the Look for field near the top of the display to locate other variations from the legitimate develop format.

- Step 4. Upon having discovered the form you will need, select the Purchase now option. Opt for the costs program you like and put your references to register for the accounts.

- Step 5. Approach the purchase. You may use your bank card or PayPal accounts to finish the purchase.

- Step 6. Choose the file format from the legitimate develop and obtain it on the system.

- Step 7. Total, modify and produce or signal the California Sample Letter for Settlement of Outstanding Bill of Deceased.

Every single legitimate document format you purchase is your own property forever. You may have acces to each and every develop you saved in your acccount. Select the My Forms portion and select a develop to produce or obtain again.

Remain competitive and obtain, and produce the California Sample Letter for Settlement of Outstanding Bill of Deceased with US Legal Forms. There are many specialist and express-certain kinds you can utilize for your personal organization or person needs.

Form popularity

FAQ

I am writing about the money which you are claiming on the above account. I can confirm that I am unable to pay the money which I owe in full. Include a paragraph explaining your circumstances and details of your financial situation that you want the creditor to take into account.

What A Settlement Letter Should Include Key facts about the incident: date, time, location, parties involved, etc. Injuries sustained. Medical treatment received. Cost of medical treatment and supplies. Other expenses. Non-economic damages you suffered (pain and suffering, emotional distress, loss of companionship, etc.)

Generally, debts are not inherited by estate beneficiaries and heirs unless there is a direct contract between the creditor and a surviving party (for example, an auto loan cosigned with a family member). Absent such direct contractual relationship, debts usually stop with settlement of the estate in probate.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank you in advance for your understanding of my situation.

When someone dies, their debts are generally paid out of the money or property left in the estate. If the estate can't pay it and there's no one who shared responsibility for the debt, it may go unpaid. Generally, when a person dies, their money and property will go towards repaying their debt.

Writing a debt settlement agreement letter: essential tips Make sure to include all the necessary information, such as the debt owed, the settlement amount, the terms of the agreement, and the date. Include the contact information of both parties in the letter.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.