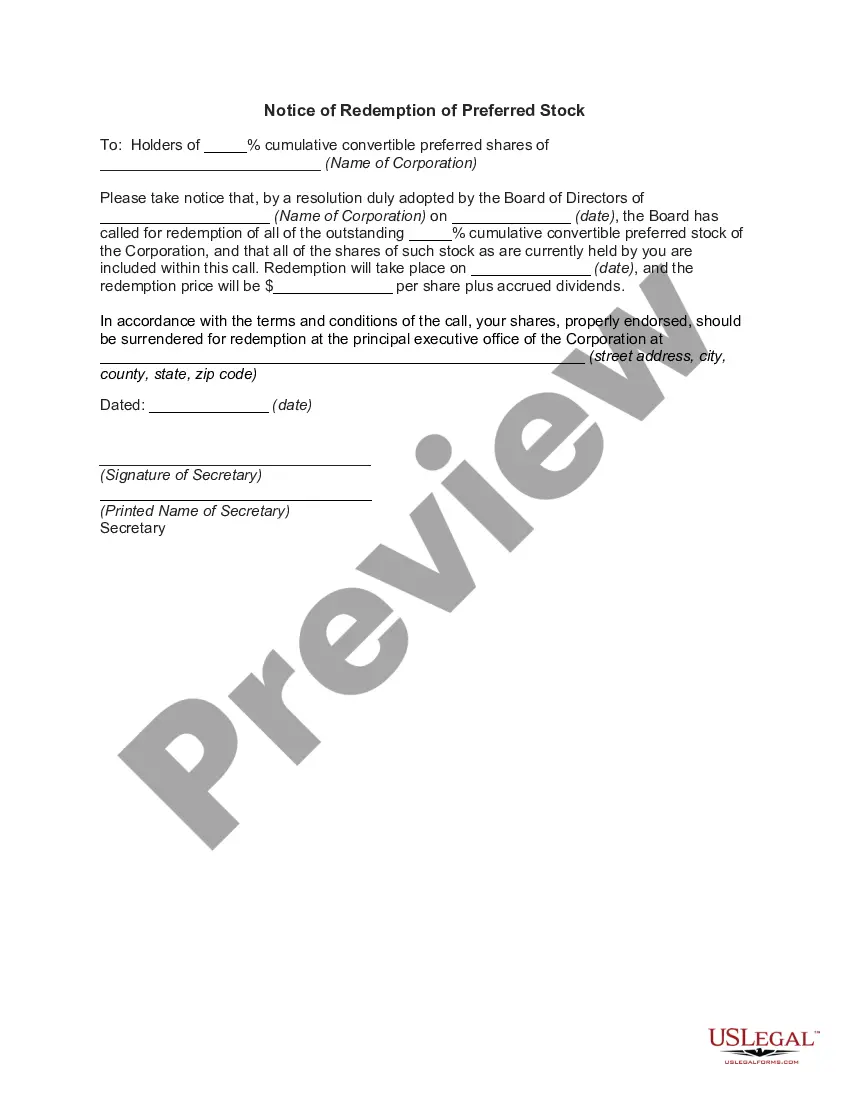

A California Notice of Redemption of Preferred Stock is a legal document that outlines the process and terms through which a company redeems its preferred stock. This notice is an essential part of corporate governance, enabling companies to repurchase their preferred shares from investors. When a business issues preferred stock, it typically includes a redemption provision in the stock agreement. This provision allows the company to buy back the preferred shares at a predetermined price or within a specified timeframe. The California Notice of Redemption of Preferred Stock is used to notify shareholders of this intention. The document contains various key elements, including the name of the company redeeming the stock, the stockholder's name and contact information, the number of preferred shares held by the stockholder, and details about the redemption process. Additionally, it clarifies the redemption price or formula used to determine the repurchase value. Different types of California Notices of Redemption of Preferred Stock may exist based on the specific terms and conditions set forth by the company. These variations could include: 1. Voluntary Redemption: This type involves a company proactively choosing to redeem its preferred stock according to the terms outlined in the initial stock agreement. 2. Mandatory Redemption: Some preferred stock agreements have mandatory redemption provisions that require the company to repurchase the shares after a certain period or under specific circumstances, such as the occurrence of a particular event or the achievement of predetermined financial goals. 3. Partial Redemption: In this case, the company repurchases only a portion of the outstanding preferred shares, reducing the total number of preferred shares in circulation. 4. Optional Redemption: Companies may grant themselves the option to redeem preferred shares at their discretion within a specified period, usually after a predetermined waiting period. The California Notice of Redemption of Preferred Stock serves as an official communication channel between the company and its shareholders, ensuring transparency and compliance with legal requirements. It provides shareholders with relevant information about the redemption process, such as the timeline for returning their shares, the delivery instructions to receive the redemption proceeds, and any necessary documentation to complete the transaction. Businesses should exercise diligence when preparing and delivering the California Notice of Redemption of Preferred Stock, ensuring that it adheres to company bylaws, applicable state laws, and any guidelines set forth by regulatory bodies. It is advisable to engage legal counsel or experienced professionals to draft and review the document to avoid inaccuracies or disputes. In conclusion, a California Notice of Redemption of Preferred Stock is a critical document used by companies to initiate the redemption process for their preferred shares. By providing comprehensive information and following the appropriate legal procedures, businesses can effectively communicate their intent to repurchase preferred stock from shareholders in a transparent and lawful manner.

California Notice of Redemption of Preferred Stock

Description

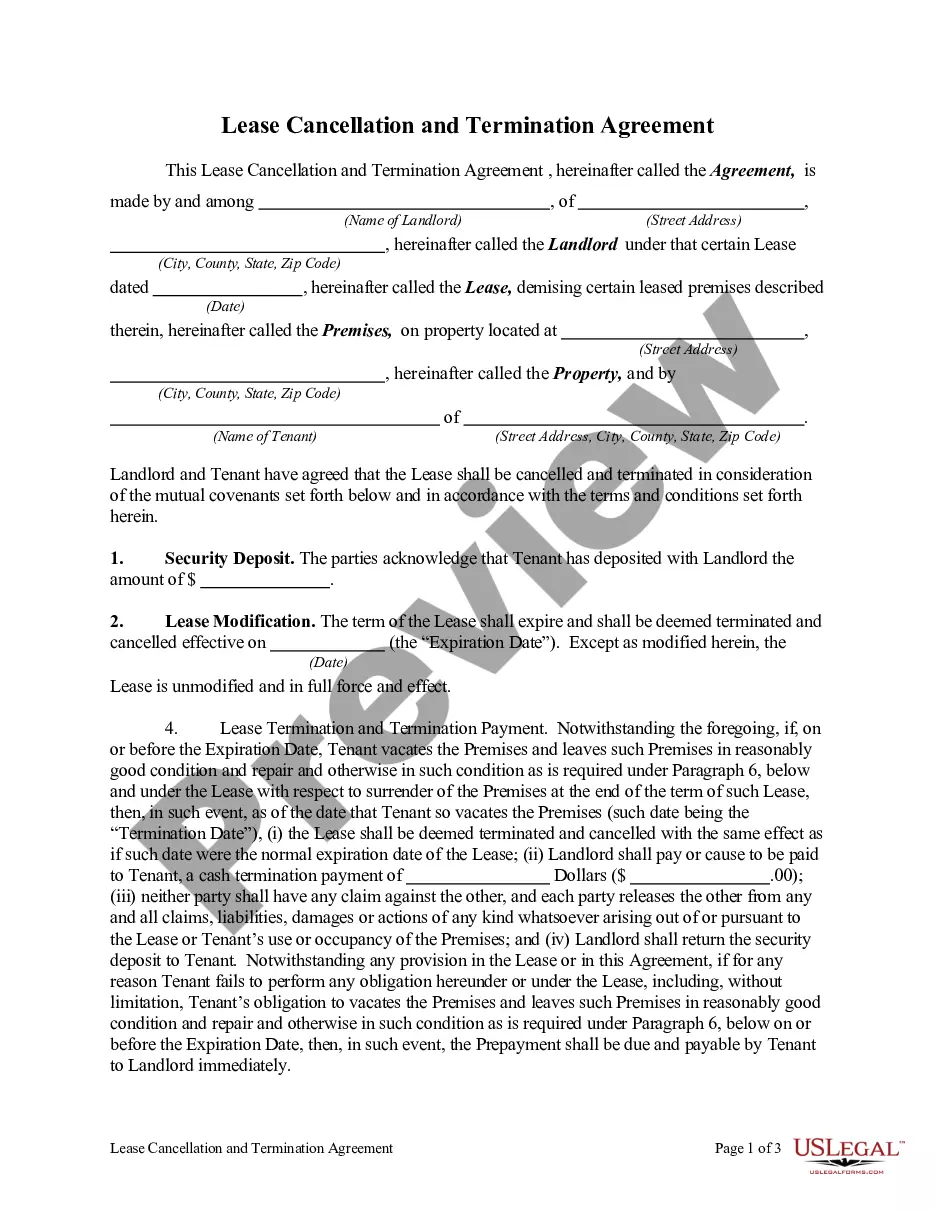

How to fill out California Notice Of Redemption Of Preferred Stock?

It is possible to spend time on-line attempting to find the lawful papers format that meets the state and federal needs you will need. US Legal Forms offers a huge number of lawful kinds which can be examined by specialists. You can actually download or print the California Notice of Redemption of Preferred Stock from your assistance.

If you currently have a US Legal Forms profile, you may log in and click the Acquire key. Afterward, you may comprehensive, modify, print, or indication the California Notice of Redemption of Preferred Stock. Each lawful papers format you get is yours eternally. To have one more copy of the purchased develop, visit the My Forms tab and click the corresponding key.

If you work with the US Legal Forms internet site for the first time, follow the simple instructions below:

- Initially, be sure that you have chosen the proper papers format to the region/metropolis of your choosing. See the develop description to make sure you have chosen the right develop. If readily available, take advantage of the Preview key to check with the papers format too.

- If you want to locate one more version of your develop, take advantage of the Research area to get the format that meets your requirements and needs.

- Upon having located the format you need, simply click Buy now to move forward.

- Pick the pricing plan you need, enter your accreditations, and register for your account on US Legal Forms.

- Full the financial transaction. You should use your bank card or PayPal profile to cover the lawful develop.

- Pick the formatting of your papers and download it in your gadget.

- Make alterations in your papers if needed. It is possible to comprehensive, modify and indication and print California Notice of Redemption of Preferred Stock.

Acquire and print a huge number of papers templates using the US Legal Forms web site, that offers the largest collection of lawful kinds. Use professional and condition-specific templates to tackle your organization or personal demands.

Form popularity

FAQ

Redeemable preferred shares trade on many public stock exchanges. These preferred shares are redeemed at the discretion of the issuing company, giving it the option to buy back the stock at any time after a certain set date at a price outlined in the prospectus.

Most importantly, a stock redemption plan provides tax-free, cash resources to pay a deceased owner's surviving family for their share of the business. Without extra funds available, a business might otherwise have to liquidate or sell assets in order to stay afloat during such a challenging time.

Redemption Notice means a notice in a form approved by the Company by which a holder of Public Shares is entitled to require the Company to redeem its Public Shares, subject to any conditions contained therein.

Unlike a redemption, which is compulsory, selling shares back to the company with a repurchase is voluntary. However, a redemption typically pays investors a premium built into the call price, partly compensating them for the risk of having their shares redeemed.

Section 503: Section 503 concerns distributions to junior shares that affect cumulative dividends to senior shares that are in arrears.

A stock redemption agreement is a buy-sell agreement between a private corporation and its shareholders. The agreement stipulates that if a triggering event occurs, the company will purchase shares from the shareholder upon their exit from the company.

A stock redemption agreement is a buy-sell agreement between a private corporation and its shareholders. The agreement stipulates that if a triggering event occurs, the company will purchase shares from the shareholder upon their exit from the company.

Redemption Notice means a notice in a form approved by the Company by which a holder of Public Shares is entitled to require the Company to redeem its Public Shares, subject to any conditions contained therein.