California Debt Adjustment Agreement with Creditor

Description

How to fill out Debt Adjustment Agreement With Creditor?

Have you ever found yourself in a situation where you require documentation for either commercial or specific objectives almost all the time.

There are numerous authentic document templates available online, but finding those you can trust is challenging.

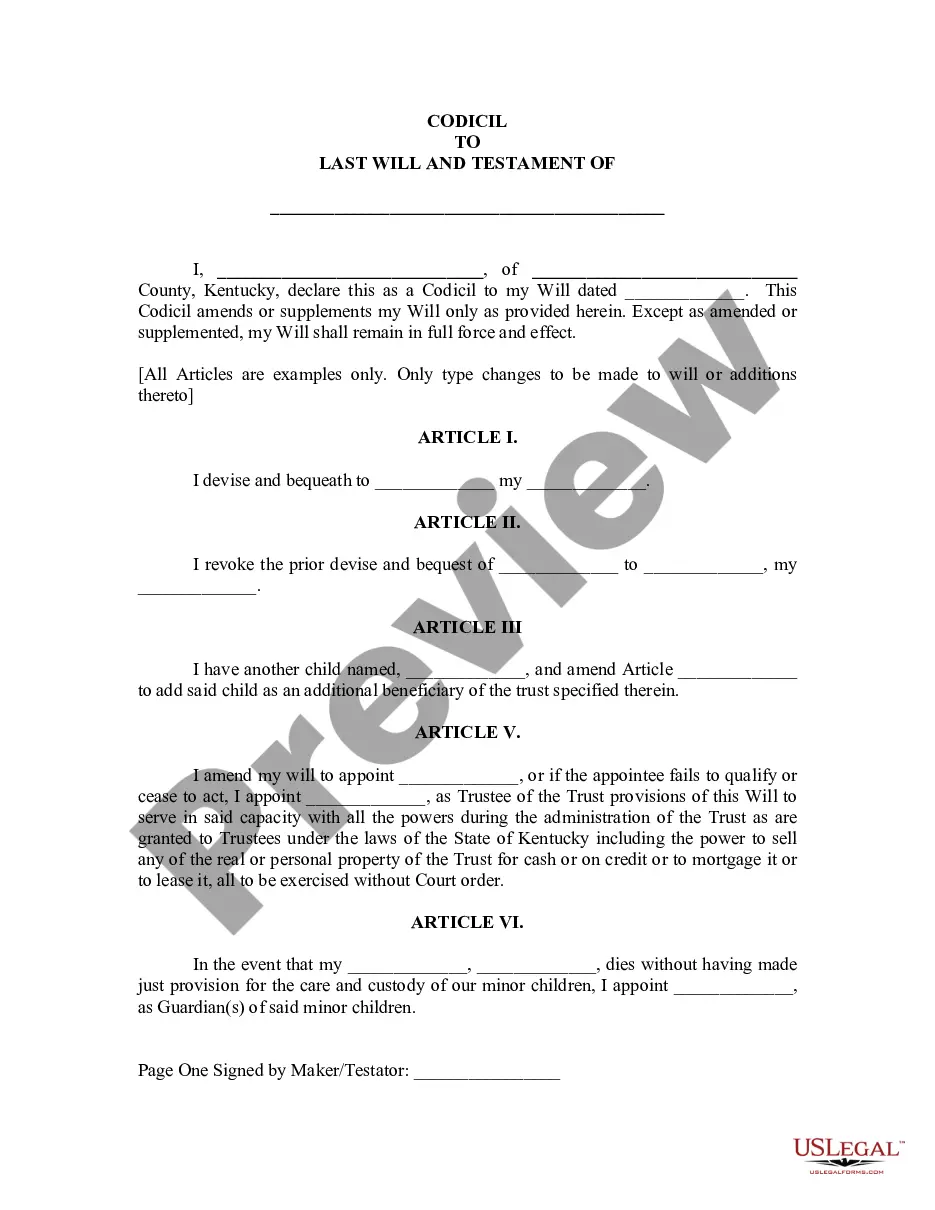

US Legal Forms offers a vast array of form templates, such as the California Debt Adjustment Agreement with Creditor, designed to fulfill federal and state requirements.

Once you find the appropriate form, click Purchase now.

Select the payment plan you prefer, provide the necessary information to create your account, and complete the purchase using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the California Debt Adjustment Agreement with Creditor template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it corresponds to the correct city/state.

- Utilize the Preview button to review the form.

- Check the description to confirm that you have selected the correct document.

- If the form does not match your search, use the Lookup field to locate the form that suits your needs.

Form popularity

FAQ

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

A statute of limitations is a law that tells you how long someone has to sue you. In California, most credit card companies and their debt collectors have only four years to do so. Once that period elapses, the credit card company or collector loses its right to file a lawsuit against you.

Occasionally, when a debt goes to collections you may be able to negotiate with the collector to accept a smaller amount than what you originally owed. An agent may decide it's worthwhile to accept partial payment now rather than go through a prolonged collection process.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

In California, the statute of limitations on most debts is four years. With some limited exceptions, creditors and debt buyers can't sue to collect debt that is more than four years old. When the debt is based on a verbal agreement, that time is reduced to two years.

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly.

California has a statute of limitations of four years for most types of debt (20 years for state tax debt). The only exception are debts taken on via an oral contract, which are subject to a statute of limitations of two years. Be careful about paying or promising to pay debts that exceed the statute of limitations.

CaliforniaDebtRelief.org is a free resource where residents may request relief online through free do-it-yourself tools. In addition, visitors may request a free debt relief evaluation and savings estimate to find out which debts qualify for relief through state-approved debt relief providers.