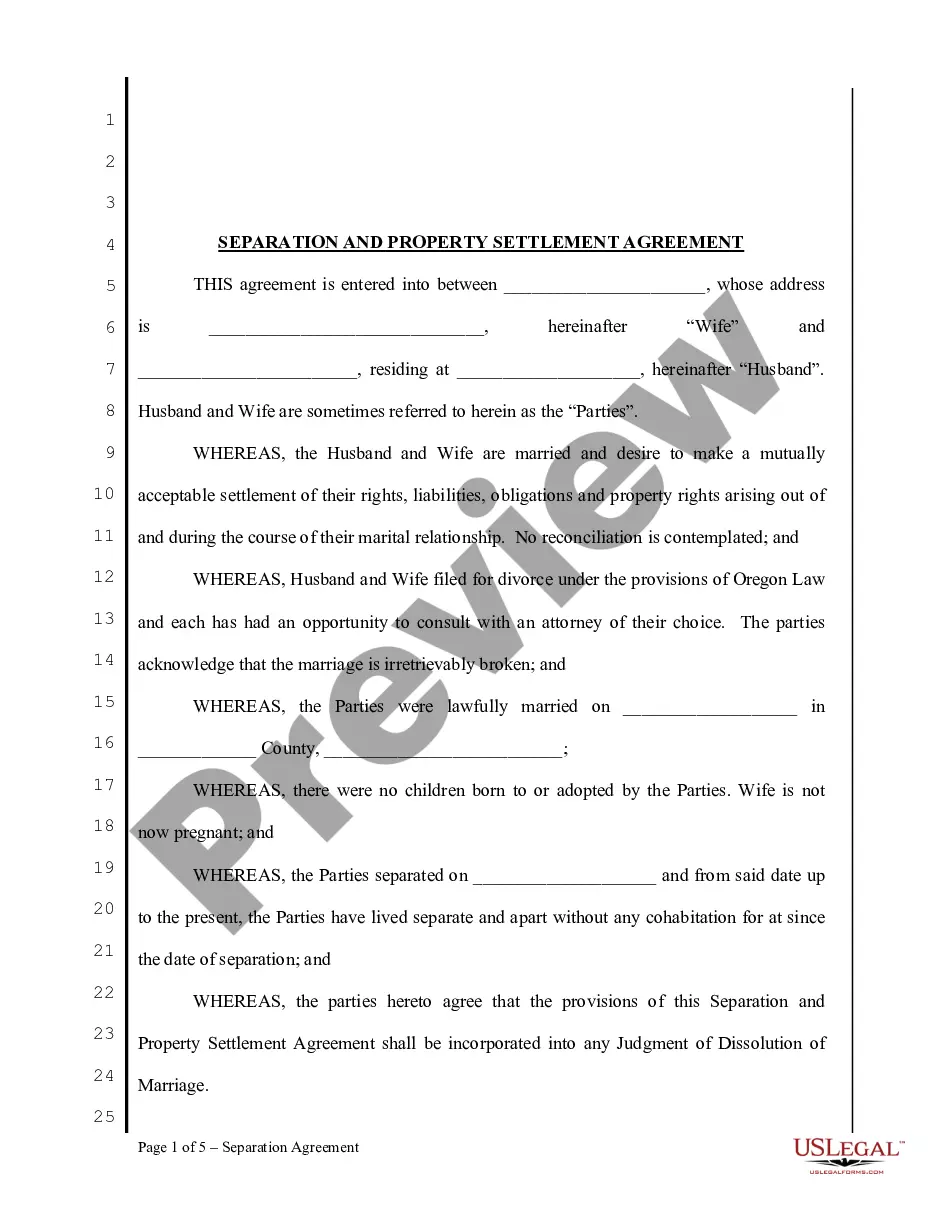

The California Agreement is a legal document designed to confirm the accuracy and finality of a statement of account. It serves as an important instrument to ensure that financial records are upheld, validated, and settled in accordance with the laws and regulations of California. This agreement is commonly employed in various financial transactions, including business dealings, employment contracts, and commercial leases. The primary purpose of the California Agreement that Statement of Account is True, Correct and Settled is to create a binding agreement between the parties involved, certifying that the financial statements provided are accurate, complete, and have been acknowledged by both parties as being true and correct. It serves as a legally binding document for evidentiary purposes and can hold substantial weight in legal proceedings. There are several types of California Agreements related to the settlement of statements of accounts: 1. Business Agreement: This type of agreement is typically used in commercial transactions and business relationships. It establishes the accuracy and finality of the financial statements between a business entity and its clients, suppliers, or partners. 2. Employment Agreement: In an employment context, the California Agreement ensures that the statement of account reflects accurate record-keeping of salaries, benefits, bonuses, and other financial obligations owed to an employee by an employer. This agreement protects the rights of both parties and helps to resolve any disputes related to payment discrepancies. 3. Rental Agreement: Landlords and tenants often utilize this agreement to confirm the accuracy and finality of the statement of account relating to rental payments, maintenance expenses, and security deposits. It provides legal protection to both parties and helps to resolve any disagreements regarding rental payment issues. 4. Loan Agreement: Lenders and borrowers often use this type of agreement to acknowledge the accuracy and finality of the statement of account related to loan transactions. It ensures that the borrower's payments, interest charges, and outstanding balances are properly recorded and agreed upon. In all types of California Agreements that Statement of Account is True, Correct and Settled, it is important to include relevant keywords such as "accuracy," "finality," "binding," "acknowledgment," and "validation" to reinforce the intent and purpose of the agreement. These keywords will help ensure clarity and precision in the understanding and execution of the agreement, leaving no room for misinterpretation or misunderstandings.

California Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out California Agreement That Statement Of Account Is True, Correct And Settled?

Discovering the right authorized record web template could be a have a problem. Obviously, there are a lot of themes available on the Internet, but how would you obtain the authorized form you will need? Take advantage of the US Legal Forms internet site. The service provides a huge number of themes, for example the California Agreement that Statement of Account is True, Correct and Settled, which you can use for company and private demands. Every one of the varieties are inspected by experts and meet up with federal and state needs.

Should you be currently listed, log in for your accounts and then click the Acquire button to obtain the California Agreement that Statement of Account is True, Correct and Settled. Utilize your accounts to search through the authorized varieties you possess acquired in the past. Proceed to the My Forms tab of your own accounts and get yet another duplicate of the record you will need.

Should you be a whole new customer of US Legal Forms, listed below are basic recommendations that you should comply with:

- First, be sure you have chosen the appropriate form for your city/area. It is possible to check out the shape making use of the Preview button and look at the shape outline to make sure this is the best for you.

- When the form is not going to meet up with your preferences, take advantage of the Seach area to discover the appropriate form.

- Once you are certain that the shape is acceptable, click on the Get now button to obtain the form.

- Select the prices plan you need and type in the essential info. Build your accounts and buy the order utilizing your PayPal accounts or charge card.

- Choose the submit format and acquire the authorized record web template for your system.

- Comprehensive, modify and print and indication the attained California Agreement that Statement of Account is True, Correct and Settled.

US Legal Forms is definitely the greatest library of authorized varieties for which you can see different record themes. Take advantage of the company to acquire professionally-manufactured documents that comply with condition needs.

Form popularity

FAQ

Full and final settlement means an agreement ending a dispute or suit resulting in settlement and release of all pending claims between the parties.

A settlement agreement always includes monetary and/or non-monetary consideration provided to the claimant to settle known claims against the business....Waiver of Certain Claims.Earned wages.Business expense reimbursement.Unemployment insurance.COBRA.Workers' compensation insurance.

Ten Things: Settlement Agreements Making Sure it's Really OverScope of the release the claims.Scope of the release the parties.Get the logistics right.Contingencies.Confidentiality.The insurance company/indemnitor.Worry about the tax/accounting implications.Enforcing the settlement.More items...?

Final settlement often refers to a settlement agreement, which is an agreement to some resolution of the dispute and to stop future litigation. Final settlements differ depending on what the parties negotiate.

Those requirements include:An offer. This is what one party proposes to do, pay, etc.Acceptance.Valid consideration.Mutual assent.A legal purpose.A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

A signed settlement agreement is a powerful document that requires the demonstration of an extreme condition in order to render it null and void. If a party wishes to back out of the settlement, then they must prove the existence of fraud, duress, coercion, or unconscionability.

So all settlement documents must be interpreted in the same manner as any other contract would be interpreted. And a settlement agreement does not need to be in writing to be enforceable. An oral settlement agreement entered into by the parties can be enforceable so long as it does not violate the statute of frauds.

If a settlement agreement has been signed by both parties and approved by a judge, then it is legally binding and enforceable. However, after a case has been dismissed, the court no longer has the power to enforce a settlement agreement.

A settlement agreement always includes monetary and/or non-monetary consideration provided to the claimant to settle known claims against the business.

If you've come to an agreement with a creditor to settle an outstanding debt, you'll need to draft a debt settlement agreement. This is a written agreement that outlines who owes the debt (you), who the lender is, the amount of the debt, the total amount of debt that will be forgiven, and the terms of repayment.