California Employee Separation Report

Description

How to fill out Employee Separation Report?

Should you need to finalize, download, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms accessible online.

Employ the website's user-friendly search feature to locate the documents you need.

An array of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After locating the required form, click the Buy now button. Choose the pricing plan you prefer and provide your information to register for the account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the California Employee Separation Report in just a few moments.

- If you are currently a US Legal Forms user, sign in to your account and then click the Download button to retrieve the California Employee Separation Report.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the following steps.

- Step 1. Ensure you have selected the form for the correct city/state.

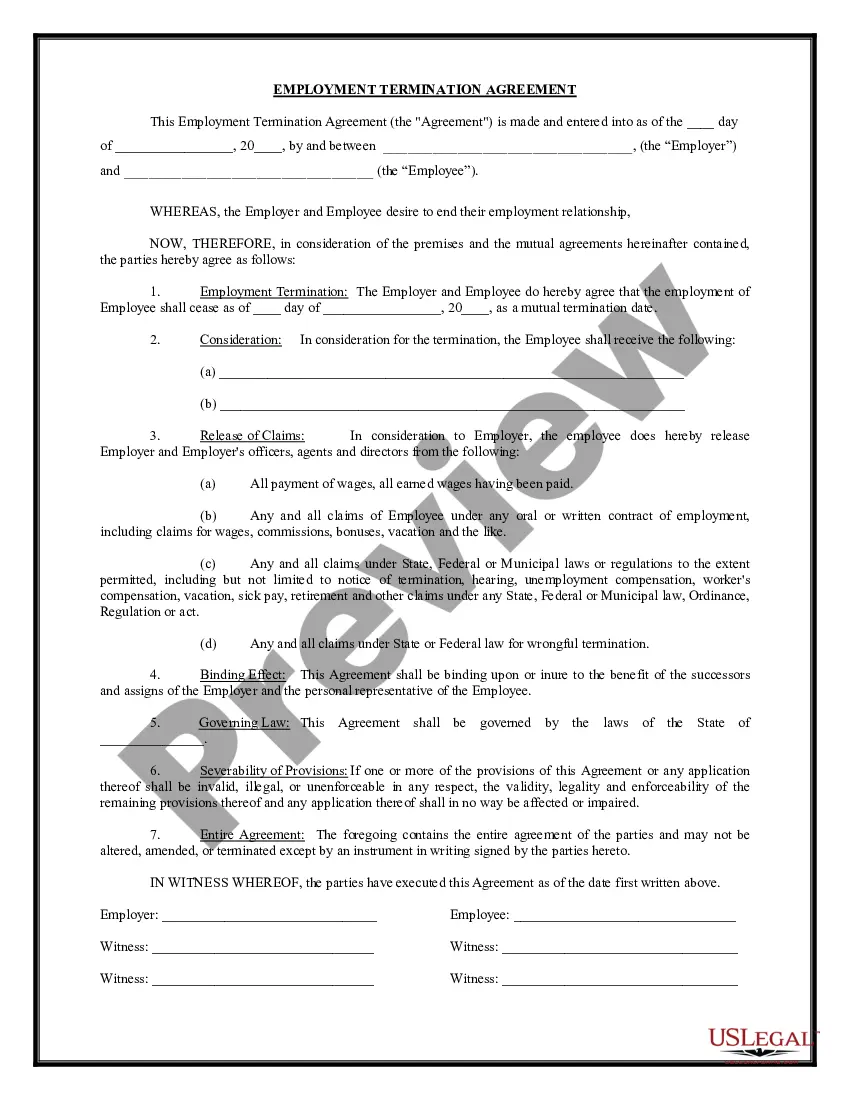

- Step 2. Use the Preview option to review the document's content. Don't forget to read through the details.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the page to find alternative versions of the legal document template.

Form popularity

FAQ

California RequirementsNo written notice is required if it is a voluntary quit, promotion or demotion, change in work assignment or location (some changes in location require a WARN notice), or if work stopped due to a trade dispute.

The UI contribution rate for new employers is 3.4 percent for up to three years. The contribution rate for all other tax-rated employers is based on one of seven contribution rate schedules established by the California UI Code, including a surtax of 15 percent when the UI Trust Fund is insolvent or near insolvency.

After receiving this information, the EDD will determine if the base period employer's reserve account should be charged for the employee's claim for unemployment benefits. If the base period employer fails to respond within 15 days, the base period employer's reserve account will likely be charged.

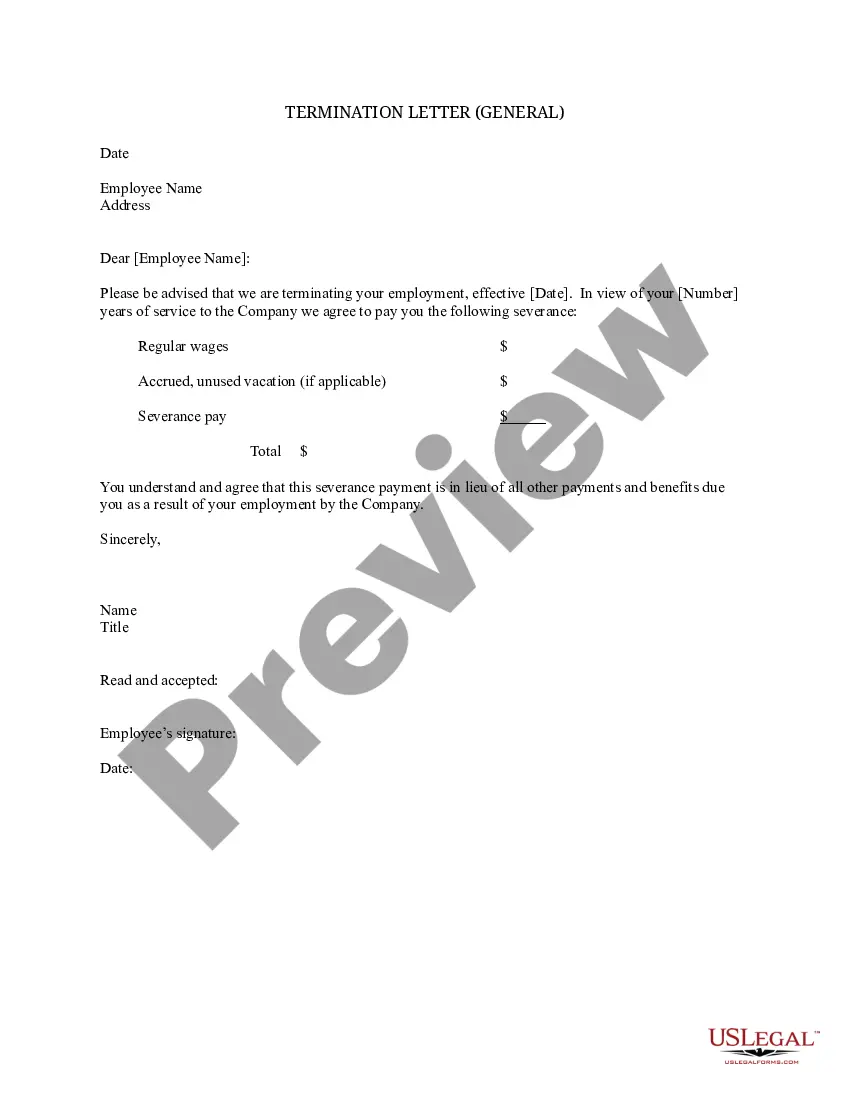

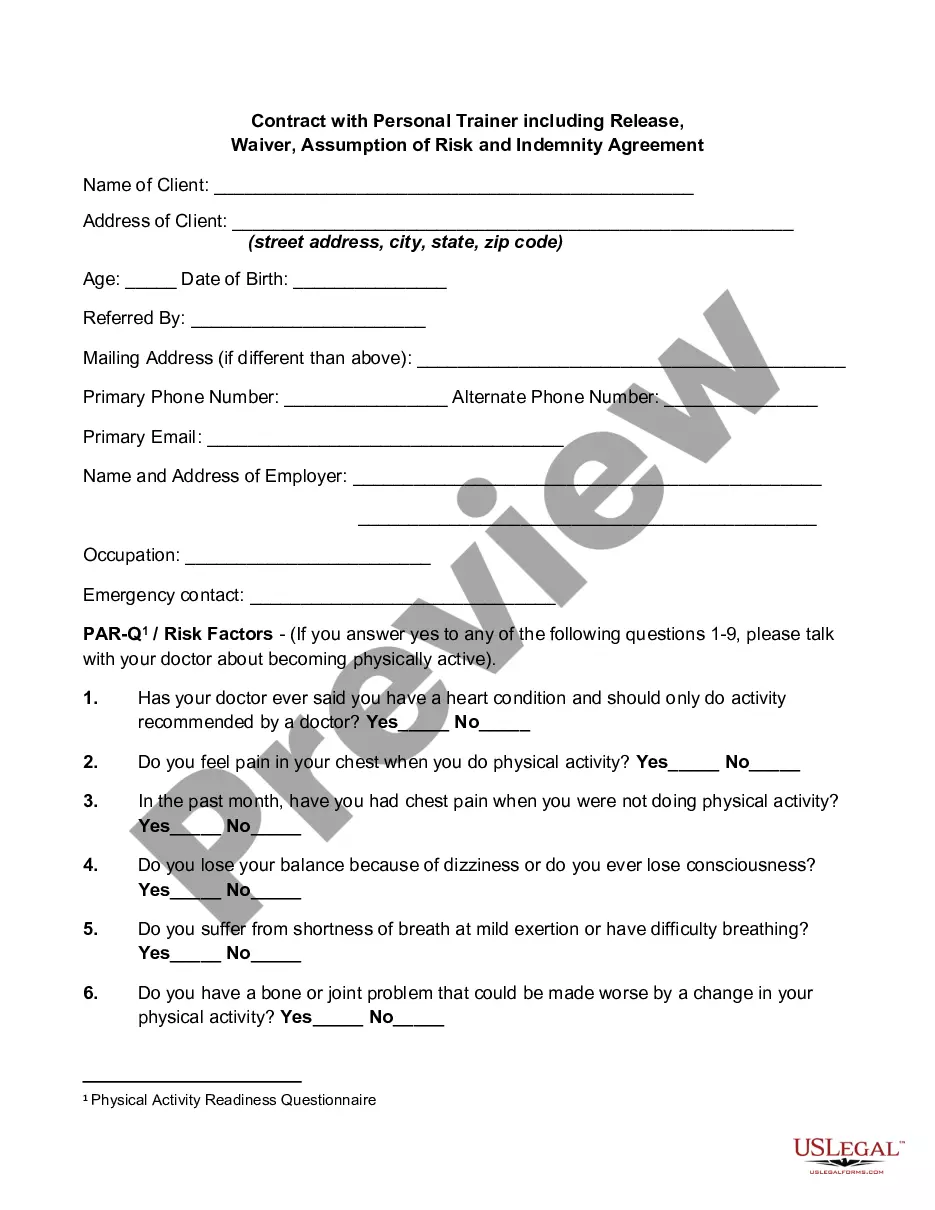

Employers must fulfill certain legal obligations and provide a terminated employee with information about their benefits, including COBRA, their last paycheck, unemployment options and transportability of other insurance.

Employers must notify any covered, terminated employees of their Cal-COBRA continuation rights.

All California employers must report all of their new or rehired employees who work in California to the New Employee Registry within 20 days of their start-of-work date, which is the first day of work. Any employee who is rehired after a separation of at least 60 consecutive days must also be reported within 20 days.

"An individual is disqualified for unemployment compensation benefits if the director finds that he or she left his or her most recent work voluntarily without good cause or that he or she has been discharged for misconduct connected with his or her most recent work."

In other words, firing is "the final step in a fair and transparent process," as outlined below.Identify and Document the Issues.Coach Employees to Rectify the Issue.Create a Performance Improvement Plan.Terminate the Employee.Have HR Conduct an Exit Interview.

After the termination, an employer have to clear all dues of a respective employee. One has to get the notice pay when the termination notice has not been issued. Salary for the working days, compensation of retrenchment and leave encashment.

When going through the termination process with an employee, make sure they are given these required documents:Final paycheck acknowledgment- Signed by the employee.For your benefit (Form 2320)COBRA notice.Health Insurance Premium (HIP) notice.