California Assignment of Leases and Rents as Collateral Security for a Commercial Loan

Description

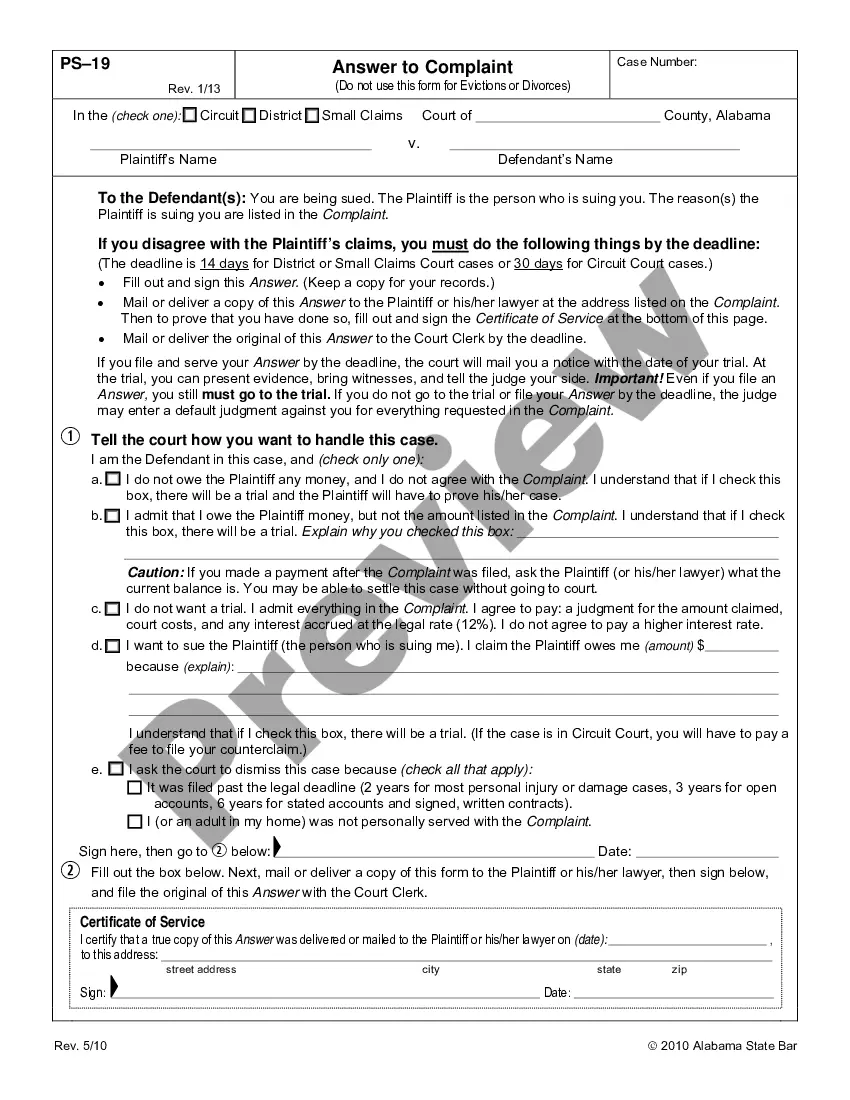

How to fill out Assignment Of Leases And Rents As Collateral Security For A Commercial Loan?

US Legal Forms - among the largest libraries of authorized forms in the States - provides a variety of authorized document themes it is possible to acquire or print out. While using web site, you can find thousands of forms for enterprise and specific reasons, sorted by groups, claims, or keywords.You can find the latest versions of forms much like the California Assignment of Leases and Rents as Collateral Security for a Commercial Loan in seconds.

If you already have a monthly subscription, log in and acquire California Assignment of Leases and Rents as Collateral Security for a Commercial Loan in the US Legal Forms library. The Obtain button can look on every single form you look at. You have accessibility to all formerly acquired forms in the My Forms tab of your bank account.

If you wish to use US Legal Forms initially, here are simple recommendations to help you started off:

- Ensure you have selected the correct form for your metropolis/area. Go through the Review button to check the form`s content. Browse the form outline to actually have chosen the correct form.

- When the form does not match your needs, take advantage of the Research discipline at the top of the monitor to find the one who does.

- If you are content with the shape, verify your decision by clicking the Acquire now button. Then, choose the prices strategy you favor and provide your qualifications to sign up to have an bank account.

- Approach the deal. Make use of Visa or Mastercard or PayPal bank account to perform the deal.

- Select the structure and acquire the shape on your product.

- Make alterations. Fill out, modify and print out and indicator the acquired California Assignment of Leases and Rents as Collateral Security for a Commercial Loan.

Every single template you included with your bank account does not have an expiration particular date and is your own eternally. So, if you would like acquire or print out an additional version, just go to the My Forms segment and click on about the form you will need.

Get access to the California Assignment of Leases and Rents as Collateral Security for a Commercial Loan with US Legal Forms, probably the most considerable library of authorized document themes. Use thousands of specialist and state-specific themes that meet your business or specific requirements and needs.