California Certificate of Borrower regarding Commercial Loan is a legal document that provides proof of a borrower's authority to obtain a commercial loan in the state of California. This certificate is required by lenders and financial institutions to ensure compliance with state regulations and protect their interests in the loan transaction. The California Certificate of Borrower is a comprehensive document that includes important information regarding the borrower's identity, financial standing, and legal capacity to enter into the loan agreement. It serves as a declaration by the borrower, attesting to their authenticity and credibility as a borrower in the commercial loan process. Keyword: California Certificate of Borrower, Commercial Loan, legal document, borrower's authority, state regulations, loan transaction, financial institutions, borrower's identity, financial standing, legal capacity, declaration, authenticity, credibility. Types of California Certificate of Borrower regarding Commercial Loan: 1. Standard California Certificate of Borrower: This is the most common type of certificate required by lenders for commercial loans. It includes basic information about the borrower's identity, finances, and capacity to enter into the loan agreement. 2. Simplified California Certificate of Borrower: Some lenders may offer a simplified version of the certificate for borrowers with lower loan amounts or less complex financial profiles. This certificate may require fewer supporting documents or detailed information. 3. Enhanced California Certificate of Borrower: For borrowers with higher loan amounts, more complex financial profiles, or unique circumstances, lenders may request an enhanced version of the certificate. This may involve additional documentation, such as tax returns, financial statements, or legal opinions. 4. California Certificate of Borrower for Specific Industries: Certain industries may require specialized certificates tailored to their unique needs. For example, real estate developers or construction companies may need to provide additional information, such as project timelines, permits, or feasibility studies. 5. Exempt California Certificate of Borrower: In specific cases where the borrower is exempt from certain requirements or regulations, an exempt certificate may be issued. This certificate provides proof of the borrower's eligibility for exemption, allowing them to proceed with the commercial loan process without fulfilling certain obligations. It is important for borrowers to carefully review the specific requirements of their lenders regarding the California Certificate of Borrower. Providing accurate and complete information in the certificate helps establish trust and facilitates the loan approval process.

California Certificate of Borrower regarding Commercial Loan

Description

How to fill out Certificate Of Borrower Regarding Commercial Loan?

US Legal Forms - one of the largest libraries of legal forms in the United States - offers a variety of legal record templates it is possible to acquire or printing. Utilizing the website, you can find thousands of forms for organization and specific purposes, categorized by categories, states, or key phrases.You will find the most recent types of forms such as the California Certificate of Borrower regarding Commercial Loan within minutes.

If you currently have a membership, log in and acquire California Certificate of Borrower regarding Commercial Loan through the US Legal Forms collection. The Down load option will appear on every develop you see. You get access to all previously acquired forms inside the My Forms tab of the bank account.

If you wish to use US Legal Forms for the first time, listed here are easy directions to help you started out:

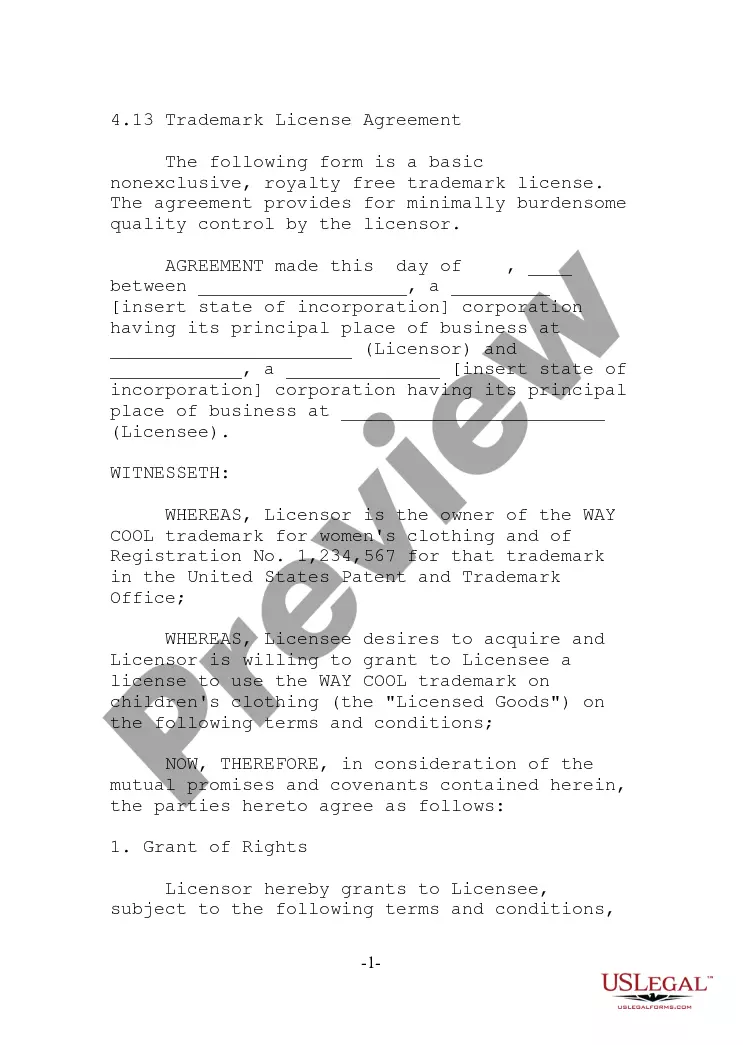

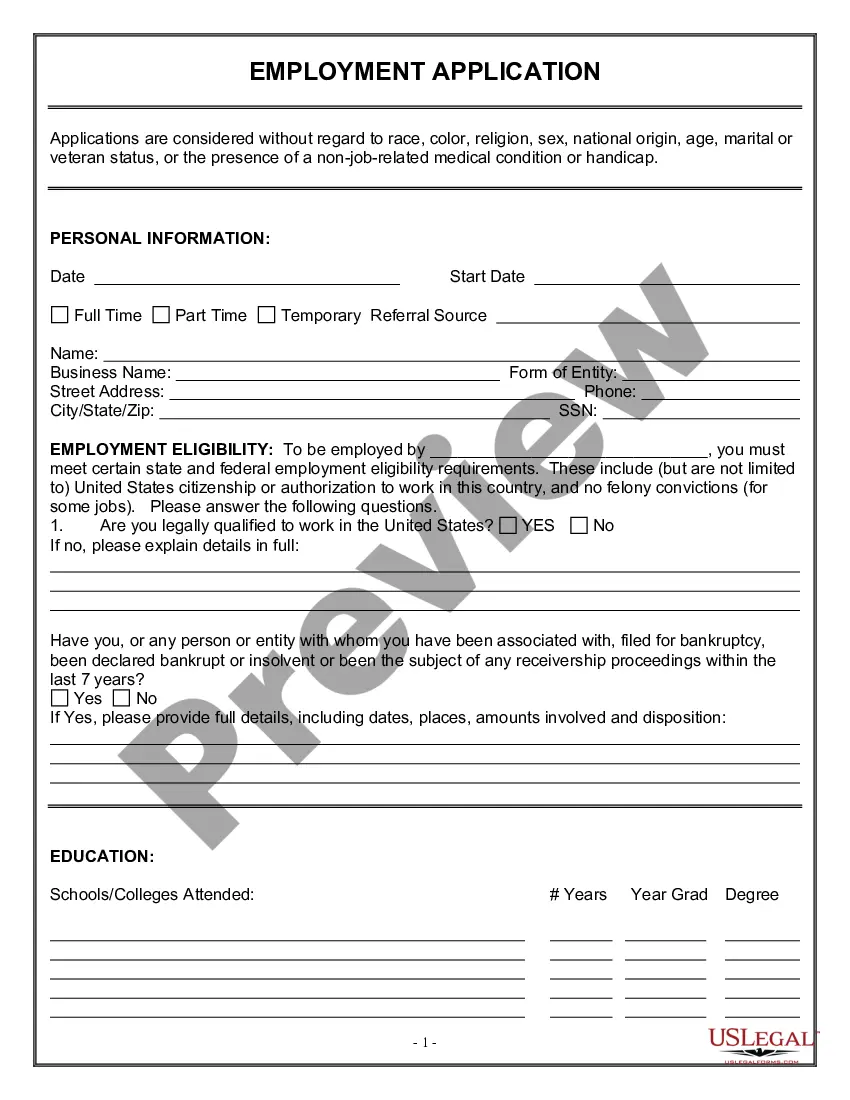

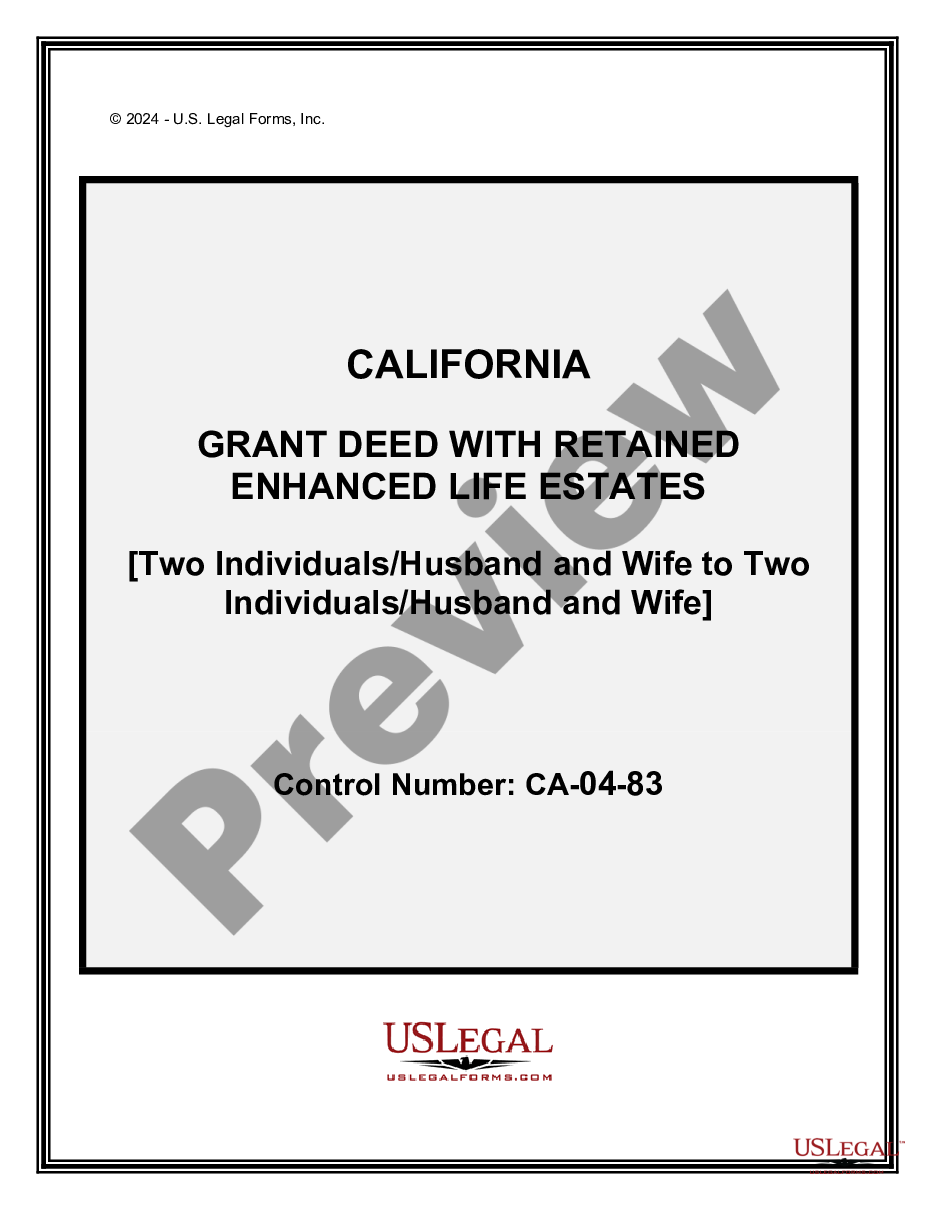

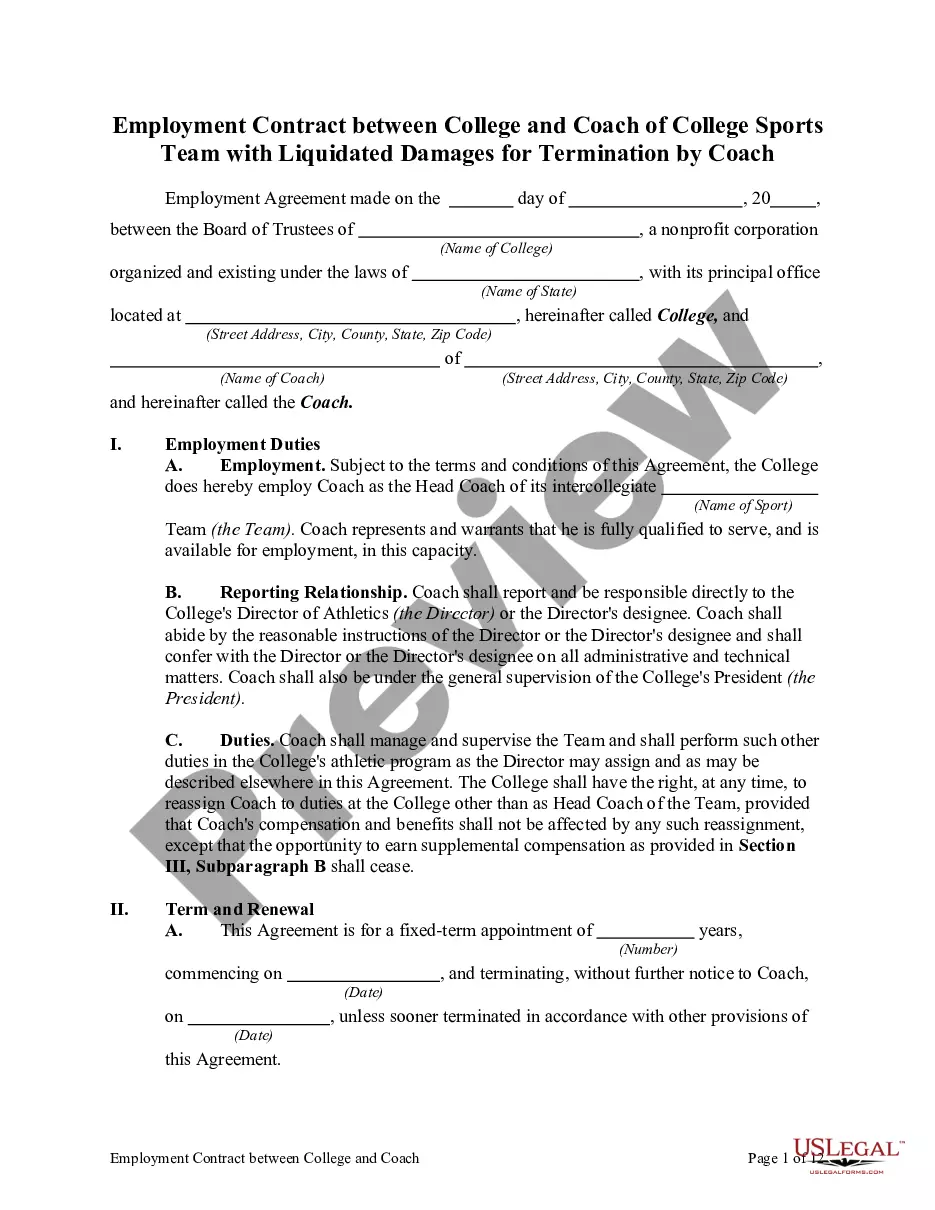

- Be sure to have picked out the proper develop for your area/state. Click on the Review option to check the form`s content. Look at the develop description to actually have selected the correct develop.

- In case the develop doesn`t suit your requirements, use the Research industry towards the top of the monitor to obtain the the one that does.

- In case you are content with the form, confirm your decision by visiting the Acquire now option. Then, select the costs plan you like and give your qualifications to register for an bank account.

- Procedure the transaction. Utilize your charge card or PayPal bank account to finish the transaction.

- Choose the file format and acquire the form on your own device.

- Make changes. Load, edit and printing and sign the acquired California Certificate of Borrower regarding Commercial Loan.

Each and every format you included with your bank account does not have an expiry time and is yours eternally. So, if you wish to acquire or printing an additional copy, just go to the My Forms area and click on about the develop you need.

Obtain access to the California Certificate of Borrower regarding Commercial Loan with US Legal Forms, probably the most comprehensive collection of legal record templates. Use thousands of skilled and status-distinct templates that meet up with your business or specific requirements and requirements.

Form popularity

FAQ

Hear this out loud PauseA third party authorization form says to your mortgage company that you allow a third party to receive information about you and your mortgage. It may allow the third party to take actions for you. There is no single form used by every mortgage company.

Hear this out loud PauseThe borrower's certification and authorization also authorizes the lender to share information in the loan application with other parties. It also gives the lender the right to verify information in the loan application, credit application, and employment history.

The Borrower Certification and Authorization Form - YouTube YouTube Start of suggested clip End of suggested clip Process is true and nothing was withheld the information this form refers to is the purpose of theMoreProcess is true and nothing was withheld the information this form refers to is the purpose of the loan. The amount and source of the down payment. Your employment. Information income and assets and

Consult the California Department of Financial Protection and Innovation (DFPI) before applying for this registration. This license is required for any company engaging in the business of making or brokering consumer or commercial loans, whether secured by real or personal property, or unsecured.

An application for a license under the California Financing Law must be filed through the Nationwide Multistate Licensing System (NMLS). A company must complete an NMLS Company Form (MU1) for a main license before applying for a branch license on the NMLS Branch Form (MU3).

Hear this out loud PauseSummary. This certificate of borrower (limited liability company) is a form of officer's certificate delivered by a borrower (that is organized as a limited liability company) to the lender at the closing of an acquisition loan transaction.

CFL Annual Report for Calendar Year 2022 The report must be completed online on the DFPI's website at . Licensees must log in to the self-service portal in order to complete the report. The 2022 Annual Report must be filed with the DFPI by March 15, 2023.

Borrower Certification means, with respect to any request for a Loan, a certification of the Borrower stating that (i) no Default or Event of Default will occur or be continuing after giving effect to such Loan, and (ii) the proceeds of such Loan will be used solely for Permitted Uses.