California Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading

Description

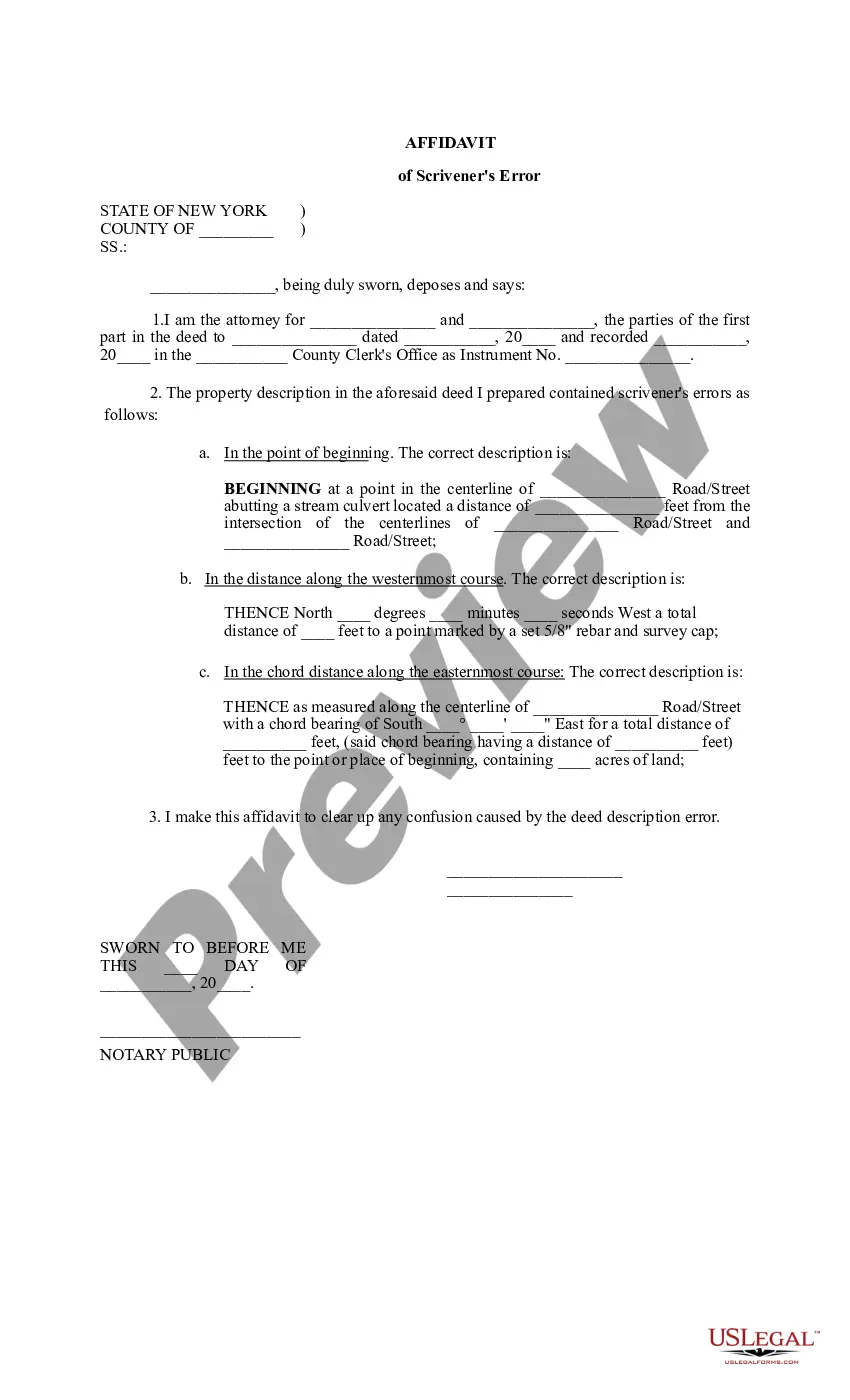

How to fill out Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading?

Are you in the place where you need to have documents for both business or specific reasons nearly every day? There are tons of legal file layouts accessible on the Internet, but finding ones you can rely isn`t effortless. US Legal Forms provides 1000s of kind layouts, much like the California Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading, which are published to meet federal and state specifications.

When you are presently acquainted with US Legal Forms web site and get a free account, simply log in. Following that, you may obtain the California Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading format.

Unless you have an bank account and wish to start using US Legal Forms, abide by these steps:

- Obtain the kind you need and ensure it is for your proper metropolis/area.

- Utilize the Preview switch to check the shape.

- Look at the description to ensure that you have chosen the correct kind.

- When the kind isn`t what you are trying to find, take advantage of the Search field to obtain the kind that suits you and specifications.

- If you obtain the proper kind, click Get now.

- Pick the pricing prepare you need, fill in the required information to make your account, and buy the order making use of your PayPal or Visa or Mastercard.

- Choose a convenient document format and obtain your copy.

Find all of the file layouts you might have purchased in the My Forms food list. You can get a further copy of California Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading whenever, if required. Just click on the needed kind to obtain or produce the file format.

Use US Legal Forms, the most substantial variety of legal forms, to save time as well as avoid errors. The service provides skillfully manufactured legal file layouts that you can use for an array of reasons. Produce a free account on US Legal Forms and commence making your way of life easier.