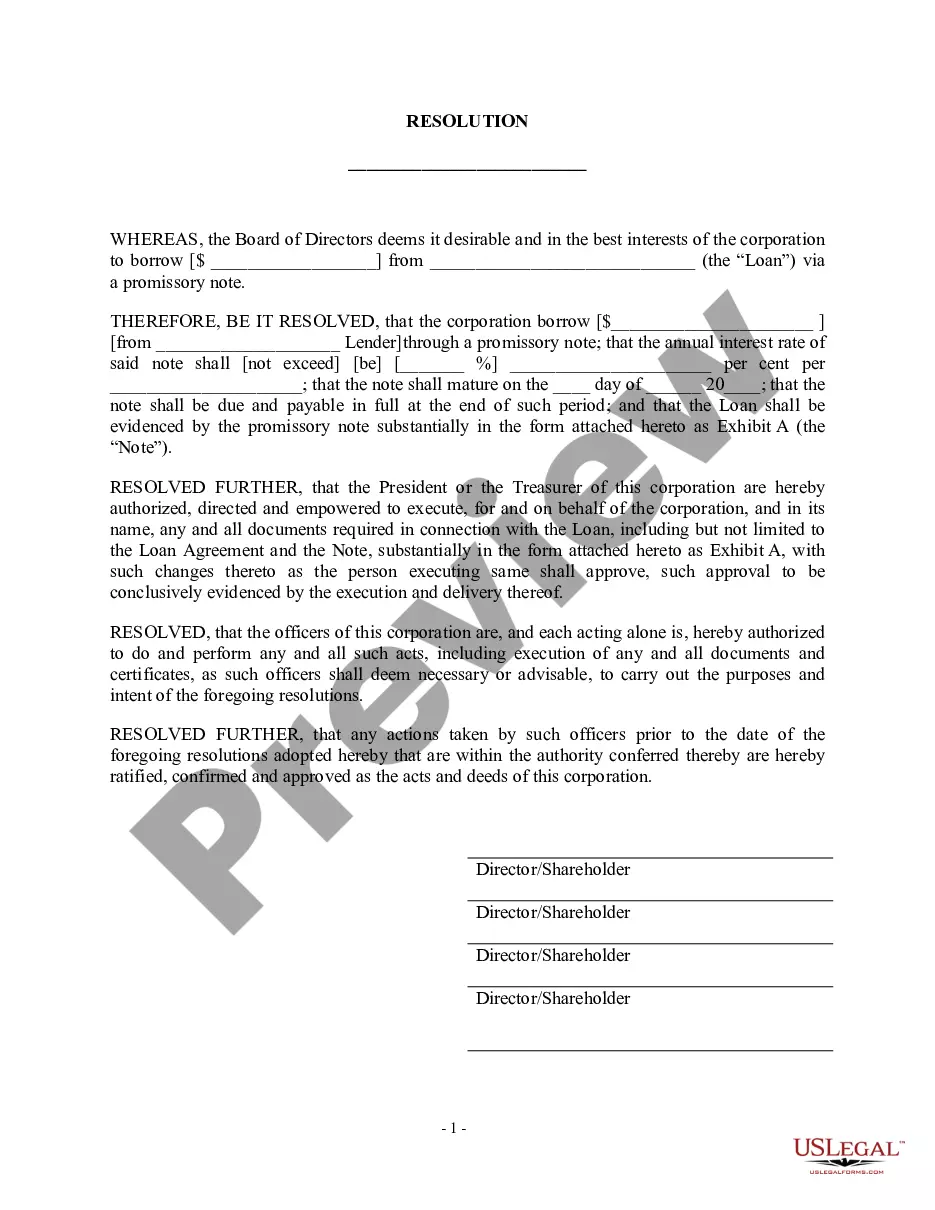

California Balance Sheet Notes Payable refer to the financial obligations owed by a company or organization in the state of California. These liabilities are typically documented on the balance sheet and represent the amounts borrowed from various sources to finance the operations, investments, or other financial activities of the entity. The notes payable provide insight into the short-term and long-term debts of the company and are crucial for evaluating its financial health and solvency. Keywords: California Balance Sheet, Notes Payable, liabilities, balance sheet, financial obligations, borrowed funds, short-term debts, long-term debts, financial health, solvency. There are different types of California Balance Sheet Notes Payable that can vary based on several factors, including the duration, interest rates, and collateral involved. Some common types include: 1. Short-term Notes Payable: These are obligations that are due within a year or less, typically used to finance day-to-day operations or meet immediate funding requirements. Examples include short-term bank loans or lines of credit used for working capital purposes. 2. Long-term Notes Payable: These are financial obligations with durations exceeding one year. They are often used to fund larger investments, such as purchasing fixed assets, acquiring property, or expanding operations. Long-term notes payable typically have defined repayment schedules and may involve collateral or security arrangements. 3. Convertible Notes Payable: These types of notes payable allow debt holders to convert their loan into equity (stocks or shares) of the company at predetermined terms and conditions. Convertible notes payable are commonly used in startup financing and provide flexibility to investors. 4. Secured Notes Payable: These are debts backed by specific assets or collateral, such as property, equipment, or inventory. If the borrower fails to repay the debt, the lender can claim the collateral as repayment. Secured notes payable often have lower interest rates compared to unsecured debts due to reduced risk for the lender. 5. Unsecured Notes Payable: These are debts that are not backed by specific collateral. Instead, they rely on the borrower's creditworthiness and overall financial strength. Unsecured notes payable generally carry higher interest rates to compensate for the increased risk borne by the lender. It is important for businesses and financial analysts to carefully monitor California Balance Sheet Notes Payable to assess the company's debt levels, repayment capacity, and overall financial stability.

California Balance Sheet Notes Payable

Description

How to fill out Balance Sheet Notes Payable?

US Legal Forms - one of several greatest libraries of legal forms in the United States - offers a wide range of legal document themes you can down load or print. Making use of the web site, you may get a large number of forms for company and person uses, categorized by classes, says, or search phrases.You can get the latest models of forms such as the California Balance Sheet Notes Payable within minutes.

If you have a membership, log in and down load California Balance Sheet Notes Payable from your US Legal Forms library. The Obtain button can look on every single develop you view. You have access to all in the past saved forms in the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, allow me to share easy directions to get you started:

- Be sure to have picked out the proper develop for the metropolis/county. Go through the Review button to check the form`s articles. See the develop description to actually have chosen the appropriate develop.

- If the develop does not satisfy your requirements, utilize the Search discipline near the top of the monitor to get the one which does.

- Should you be content with the shape, affirm your selection by visiting the Buy now button. Then, pick the pricing prepare you prefer and offer your credentials to sign up on an account.

- Approach the transaction. Utilize your Visa or Mastercard or PayPal account to accomplish the transaction.

- Choose the structure and down load the shape in your device.

- Make adjustments. Fill up, revise and print and indicator the saved California Balance Sheet Notes Payable.

Every design you included with your bank account lacks an expiry date and it is your own property eternally. So, if you wish to down load or print one more backup, just visit the My Forms section and click on on the develop you need.

Gain access to the California Balance Sheet Notes Payable with US Legal Forms, probably the most comprehensive library of legal document themes. Use a large number of specialist and express-distinct themes that satisfy your organization or person demands and requirements.

Form popularity

FAQ

Presentation of Notes Payable A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months, or as a long-term liability if it is due at a later date.

Notes payable is a liability account that is maintained in an organization's general ledger. It is a written promise to pay a specific amount of money within a certain time period.

term note is classified as a current liability because it is wholly honored within a company's operating period. This payable account would appear on the balance sheet under Current Liabilities.

As you repay the loan, you'll record notes payable as a debit journal entry, while crediting the cash account. This is recorded on the balance sheet as a liability. But you must also work out the interest percentage after making a payment, recording this figure in the interest expense and interest payable accounts.

Accounts payable is listed on a company's balance sheet. Accounts payable is a liability since it is money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days.

Notes payable are written agreements (promissory notes) in which one party agrees to pay the other party a certain amount of cash. Alternatively put, a note payable is a loan between two parties. A note payable contains the following information: The amount to be paid.

Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed.

An extension of the normal credit period for paying amounts owed often requires that a company sign a note, resulting in a transfer of the liability from accounts payable to notes payable. Notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date.

Notes payable appear under liabilities on the balance sheet, separated into bank debt and other long-term notes payable. Payment details can be found in the notes to the financial statements.