California Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death is a legal agreement that outlines the terms and conditions for the sale and purchase of a partner's interest in a partnership in the event of their death, retirement, or withdrawal. This agreement includes provisions for the use of life insurance to fund the purchase of the partner's interest. In California, there are different types of Partnership Buy-Sell Agreements with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. These variations include: 1. Cross-Purchase Agreement: This type of agreement is entered into by the partners themselves. Each partner agrees to purchase the interests of the other partners in the event of their death, retirement, or withdrawal. Life insurance policies are taken out on each partner's life, and the proceeds are used to fund the purchase of their interests. 2. Entity-Purchase Agreement: In this case, the partnership itself agrees to purchase the interest of a partner in the event of their death, retirement, or withdrawal. Life insurance policies are taken out on each partner's life, and the partnership pays the premiums. When a partner leaves, the partnership uses the life insurance proceeds to buy out their interest. 3. Wait-and-See Agreement: This type of agreement allows the partners to postpone the decision on whether to use a cross-purchase or entity-purchase arrangement until the triggering event actually occurs. Each partner takes out a life insurance policy on their own life, but it is not decided which option to use until the partner dies, retires, or withdraws. 4. Hybrid Agreement: A hybrid agreement combines elements of both the cross-purchase and entity-purchase agreements. Partners agree to use a cross-purchase arrangement for some partners and an entity-purchase arrangement for others, depending on specific circumstances. Life insurance policies are taken out accordingly. These Partnership Buy-Sell Agreements with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death are essential for protecting the interests of all partners in a California partnership. By outlining the procedures for the sale and purchase of a partner's interest, these agreements ensure the smooth transition and continuity of the partnership in the face of unexpected events. Consulting with legal professionals who specialize in partnership agreements is crucial to drafting a comprehensive and tailored agreement.

California Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

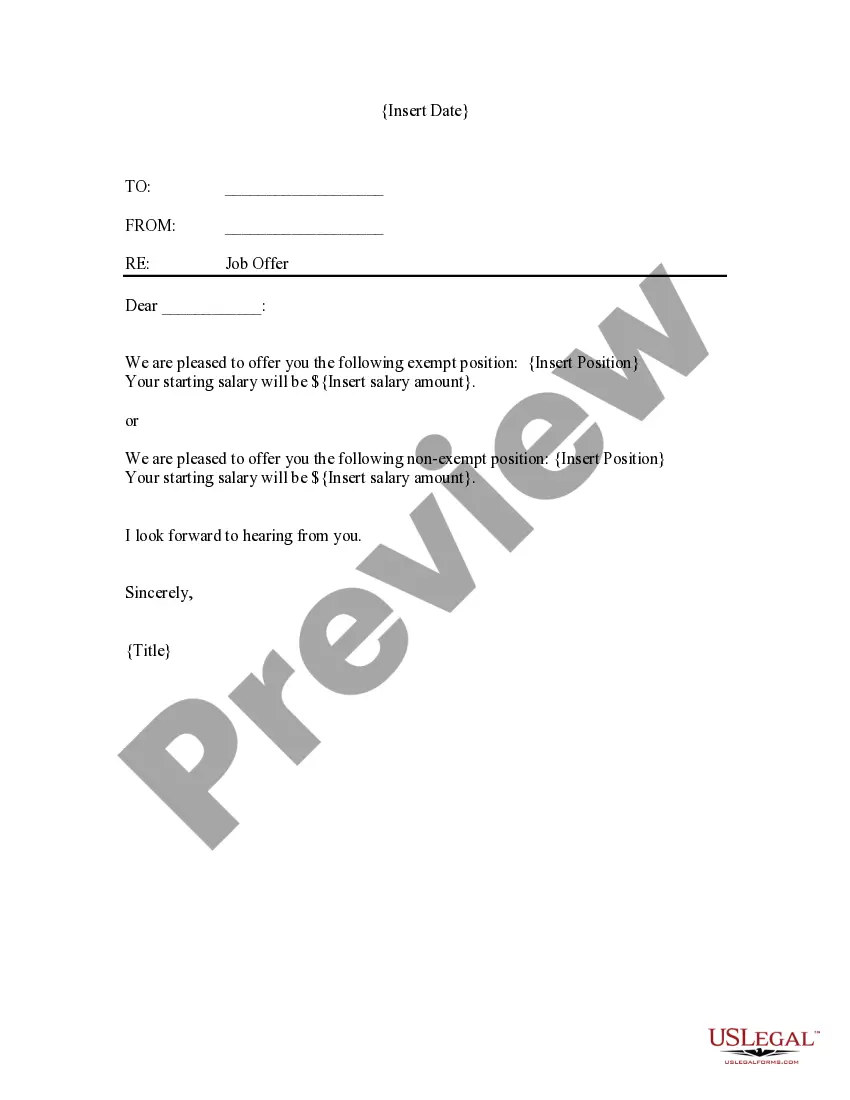

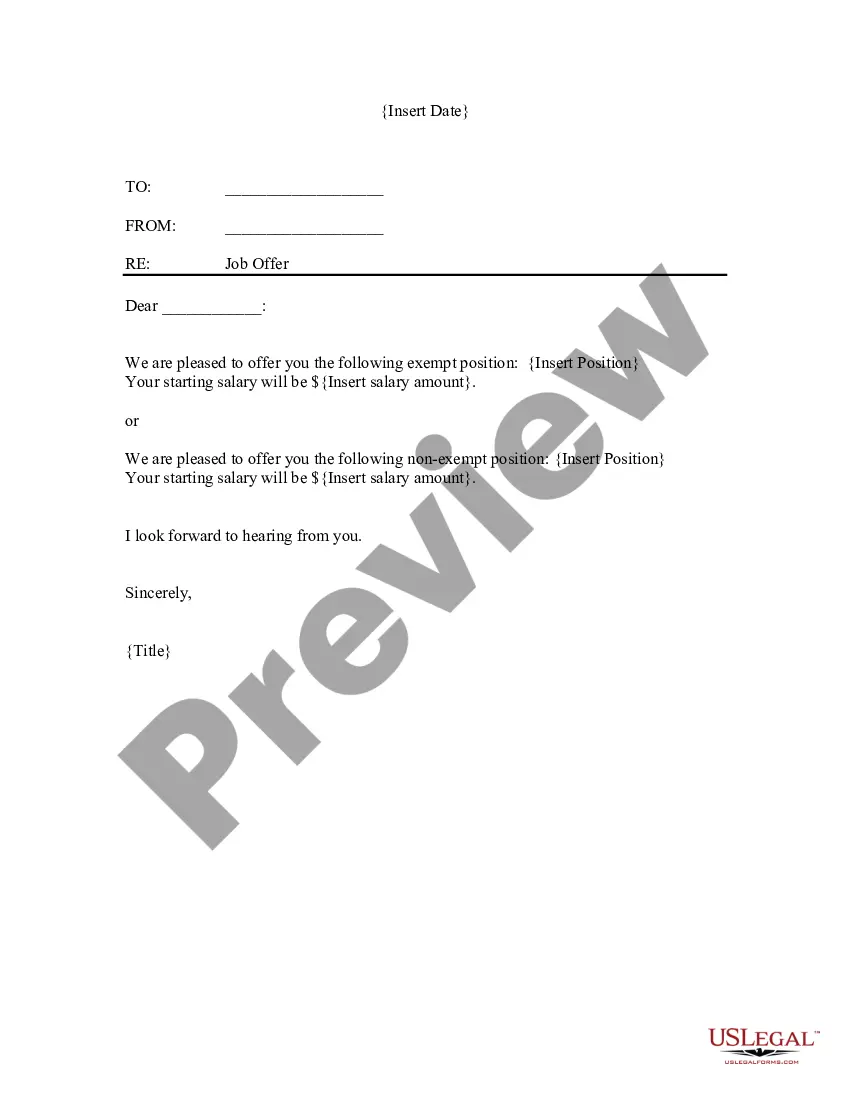

How to fill out California Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

Choosing the best authorized file format can be a have a problem. Naturally, there are a lot of themes available on the Internet, but how will you get the authorized develop you want? Take advantage of the US Legal Forms internet site. The service provides a large number of themes, such as the California Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, that you can use for enterprise and private demands. All the types are checked by experts and fulfill federal and state specifications.

When you are previously signed up, log in for your accounts and then click the Down load switch to obtain the California Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. Utilize your accounts to check throughout the authorized types you might have bought earlier. Proceed to the My Forms tab of your respective accounts and acquire one more version of your file you want.

When you are a whole new consumer of US Legal Forms, here are straightforward instructions that you can adhere to:

- Very first, make certain you have selected the correct develop for your metropolis/county. You are able to examine the form utilizing the Review switch and browse the form description to ensure this is the right one for you.

- If the develop fails to fulfill your preferences, use the Seach discipline to find the appropriate develop.

- When you are certain the form would work, click on the Purchase now switch to obtain the develop.

- Opt for the costs prepare you would like and enter the essential details. Design your accounts and buy the order utilizing your PayPal accounts or bank card.

- Choose the submit format and acquire the authorized file format for your product.

- Complete, revise and produce and indication the acquired California Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death.

US Legal Forms will be the greatest library of authorized types in which you can find different file themes. Take advantage of the company to acquire appropriately-made files that adhere to state specifications.

Form popularity

FAQ

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.09-Oct-2013

Each owner would pay the premiums and be the beneficiary of the policy. The face amount of the insurance would be calculated based on the other's ownership interest. Upon the death of one owner, the insurance proceeds would be used to purchase the ownership interests from the deceased owner's estate or family.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

A wait and see buy-sell agreement is a legal document drafted by an attorney that controls the sale of a business interest upon various triggering events (e.g., disability, death, etc.). In a cross- purchase buy-sell agreement, the remaining owners have the obligation to buy a departing owner's interest.

How a buy-sell funded with life insurance works. In a cross-purchase plan, each business owner purchases a life insurance policy on each of the other owners. Each business owner will pay the premium and will be the owner and beneficiary of the policy written on the partner's life.

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

What is the structure and purpose of a cross-purchase buy-sell agreement? A cross-purchase buy-sell agreement is an arrangement between individuals who agree to purchase the business interest of a deceased owner.

So what is not allowable in a 1035 exchange? Single Premium Immediate Annuities (SPIAs), Deferred Income Annuities (DIAs), and Qualified Longevity Annuity Contracts (QLACs) are not allowed because these are irrevocable income contracts.