California Agreement Acquiring Share of Retiring Law Partner

Description

How to fill out Agreement Acquiring Share Of Retiring Law Partner?

Have you been in the place that you require documents for sometimes company or person uses just about every day? There are plenty of authorized file themes available on the Internet, but finding versions you can trust isn`t simple. US Legal Forms delivers a huge number of develop themes, just like the California Agreement Acquiring Share of Retiring Law Partner, that happen to be composed to satisfy state and federal requirements.

When you are currently informed about US Legal Forms internet site and get your account, merely log in. Afterward, you may acquire the California Agreement Acquiring Share of Retiring Law Partner design.

Unless you offer an account and want to begin to use US Legal Forms, abide by these steps:

- Obtain the develop you require and make sure it is to the appropriate town/area.

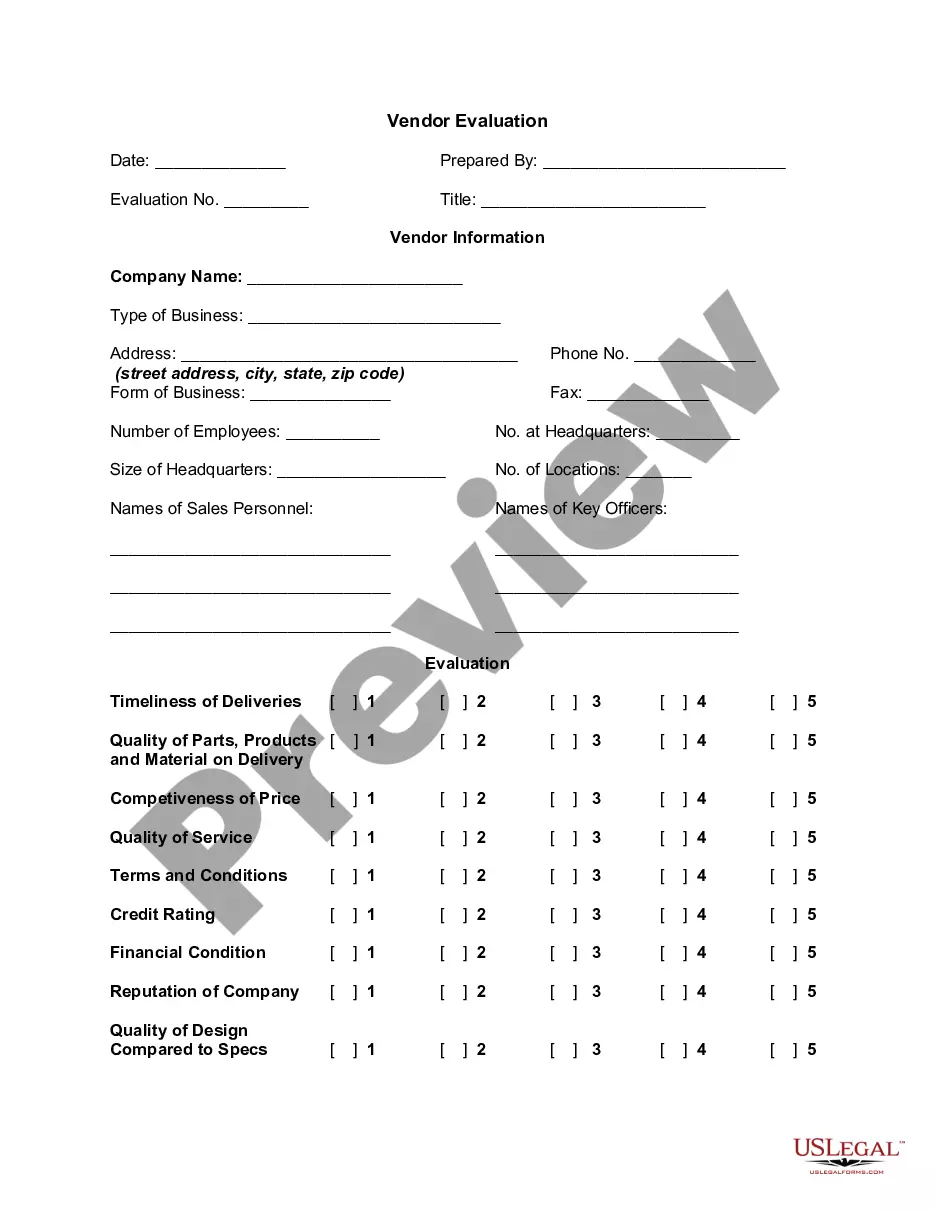

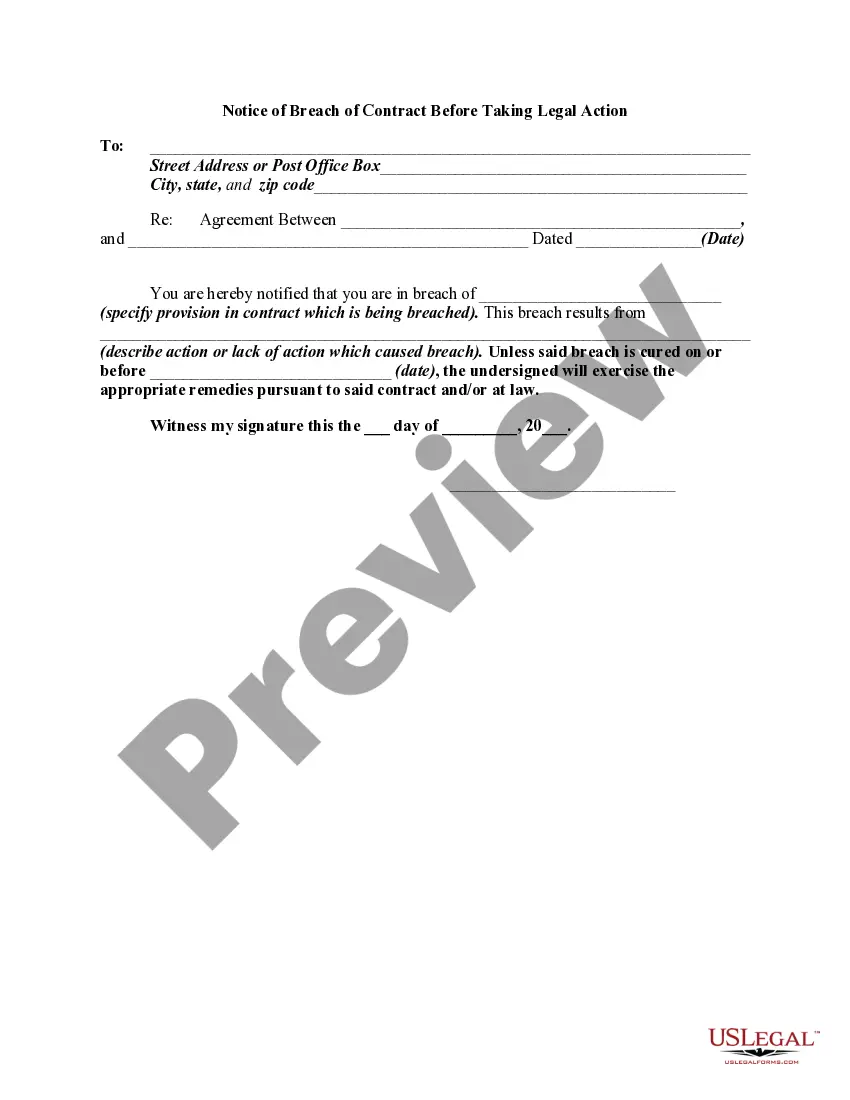

- Make use of the Review switch to check the form.

- Browse the explanation to actually have selected the right develop.

- In case the develop isn`t what you`re trying to find, use the Search area to discover the develop that suits you and requirements.

- When you get the appropriate develop, just click Get now.

- Choose the rates program you need, fill in the required info to make your money, and pay for the transaction with your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper format and acquire your duplicate.

Get each of the file themes you may have bought in the My Forms menu. You can obtain a more duplicate of California Agreement Acquiring Share of Retiring Law Partner at any time, if necessary. Just select the needed develop to acquire or print out the file design.

Use US Legal Forms, probably the most extensive collection of authorized varieties, to conserve time as well as steer clear of mistakes. The services delivers professionally made authorized file themes which you can use for a selection of uses. Produce your account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

Under California's community property law, your ex-spouse could be entitled to 50 percent of your pension in a divorce case.

You cannot claim divorced-spouse benefits tied to a living former mate if you are married. If you began drawing such ex-spousal benefits when you were single but then remarry, those payments will be terminated (except as noted below).

California Community Property Law: "The 10 Years Rule" In California, a marriage that lasts under 10 years will have a set duration of alimony, which is typically half the length of the marriage.

It depends on how the order was issued that granted her the pension benefits. Most likely, it was part of the property division in your divorce. If that is the case, then the payments cannot be stopped without her agreement.

The worker is eligible for the higher benefit, but he or she can't choose to take just the spousal benefits and allow his or her own benefits to keep increasing until age 70. If you remarry, you cannot receive benefits on your former spouse's record unless the new marriage ends (by death, divorce, or annulment).

A divorced ex-spouse who is at least 60 (50 if disabled) can also collect survivor benefits if he or she was married to the deceased for at least 10 years. Remarrying after turning 60 (50 if disabled) has no effect on survivor benefits.

Generally, no. As with other divided property, the ex-spouse's share of the pension remains his/her property. The pension is payable to an ex-spouse for as long as your pension is being paid to you or your qualified survivor.

Under California's community property law, your ex-spouse could be entitled to 50 percent of your pension in a divorce case.

In most instances, you must be married for at least one year prior to your retirement date for survivor benefits to be payable to your spouse. Review your beneficiary designation.

If you're getting Social Security retirement benefits, some members of your family may also qualify to receive benefits on your record. If they qualify, your ex-spouse, spouse, or child may receive a monthly payment of up to one-half of your retirement benefit amount.