California Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

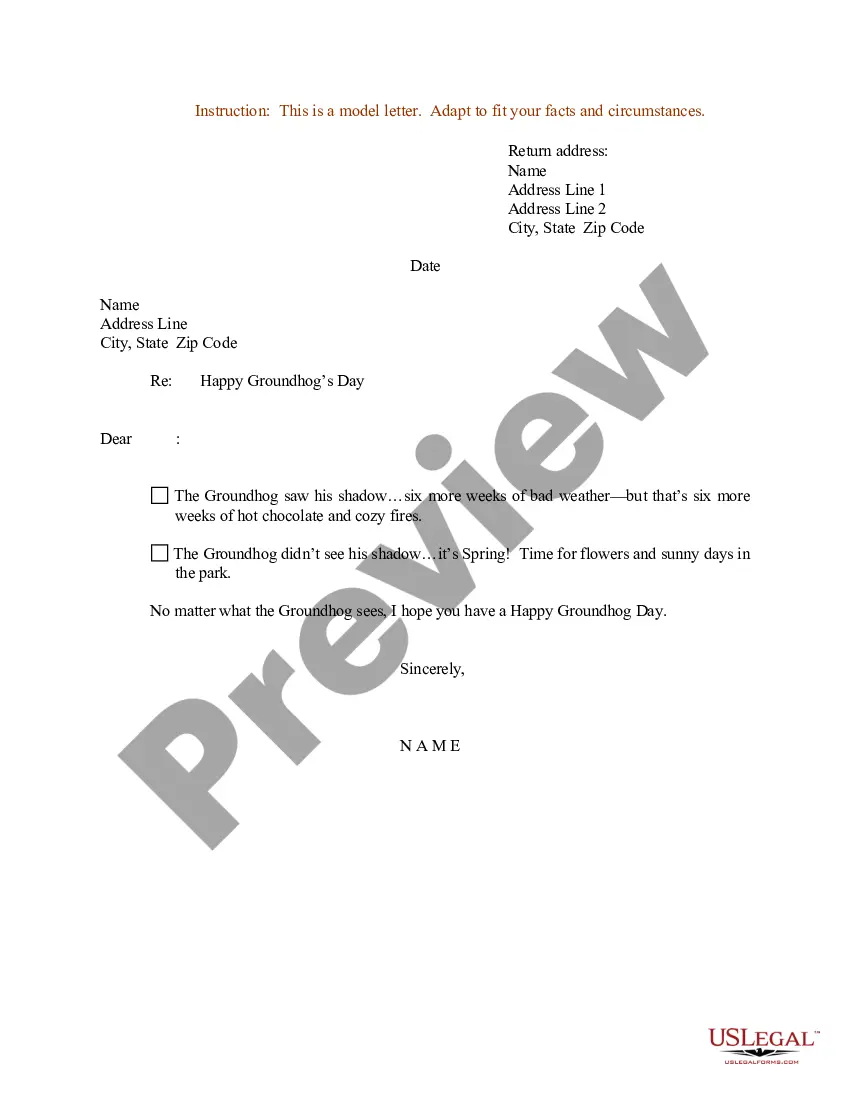

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump Sum Payment?

You can spend hours online searching for the legal document template that meets the federal and state specifications you require.

US Legal Forms offers a vast array of legal forms that have been reviewed by professionals.

You can download or print the California Agreement to Dissolve and Wind Up Partnership with Settlement and Lump Sum Payment from their service.

To find another version of the form, use the Search field to locate the template that fits your needs and criteria. Once you have found the template you want, click Get Now to continue. Select the pricing plan you prefer, enter your details, and create your account on US Legal Forms. Complete the payment process. You may use your credit card or PayPal account to purchase the legal form. Choose the file format of the document and download it to your device. Make changes to the document if necessary. You can fill, edit, sign, and print the California Agreement to Dissolve and Wind Up Partnership with Settlement and Lump Sum Payment. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and press the Download button.

- After that, you can fill out, edit, print, or sign the California Agreement to Dissolve and Wind Up Partnership with Settlement and Lump Sum Payment.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of an acquired form, go to the My documents tab and press the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/city that you choose.

- Review the form description to confirm you have chosen the right form.

- If available, use the Preview button to look over the document template as well.

Form popularity

FAQ

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Settlement of accounts on dissolutionPayment of the debts of the firm to the third parties.Payment of advances and loans given by the partners.Payment of capital contributed by the partners.The surplus, if any, will be divided among the partners in their profit-sharing ratio.

How to Dissolve a California Business PartnershipReview the Partnership Agreement.Vote or Take Action to Dissolve.Pay Remaining Debts & Distribute Remaining Assets.File a Dissolution Form with the State.Notify Concerned Parties.Resolve Remaining Tax Issues.Complete Any Out-of-State Regulations.

There is no filing fee. Under California law, other people generally are considered to have notice of the partnership's dissolution ninety (90) days after filing the Statement of Dissolution.

Under RUPA, California allows at-will partnerships to dissolve at the express (or written) will of at least half the partners, including those who may have left the partnership within the preceding 90 days. If approved, those remaining can then continue the partnership without those that want to leave.

Settlement of accounts on dissolution Losses including deficiencies of capital shall be first paid out from the profits, next from the capital, and if necessary, by the personal contribution of partners in their profit-sharing ratio.

It has a precise legal definition, given in UPA Section 29: The dissolution of a partnership is the change in the relation of the partners caused by any partner ceasing to be associated in the carrying on as distinguished from the winding up of the business. The partnership is not necessarily terminated on

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

These include:The expiration of a partnership's term.A partner serving notice of intention to leave.The court deeming the partnership as illegal.A partner's death or bankruptcy.The partnership becoming insolvent.A court-order dissolution due to incapacity or unsoundness of mind in one of the partners.More items...?