The California Agreement for Sale of Assets of Corporation is a legal document that outlines the terms and conditions for the purchase and sale of assets belonging to a corporation based in California. This agreement is crucial in facilitating smooth transactions between the buyer and the corporation, ensuring the protection of both parties' interests. It serves as a binding contract and provides a framework for negotiating and finalizing the sale of assets. Key elements included in the agreement are the identification of the buyer and the corporation, detailed descriptions of the assets being sold, their value, and any appropriate representations and warranties regarding the assets' condition or title. The document also specifies the purchase price, payment terms, and any contingencies or conditions that must be met before the sale is finalized. There are several types of California Agreements for Sale of Assets of Corporation that may be tailored to different circumstances. For instance: 1. "California Agreement for Sale of Assets of Corporation — General": This type of agreement is used for standard asset sales, involving various business assets such as equipment, inventory, customer lists, intellectual property, or real estate owned by the corporation. 2. "California Agreement for Sale of Assets of Corporation — Intellectual Property Assets": This type of agreement specifically deals with the sale of intellectual property rights, patents, trademarks, copyrights, or licenses owned by the corporation. It includes provisions to ensure the proper transfer and protection of these assets. 3. "California Agreement for Sale of Assets of Corporation — Real Estate Assets": This agreement focuses on the sale of real estate properties owned by the corporation, whether it is land, buildings, or other structures. It typically includes additional provisions related to inspections, permits, and zoning compliance. 4. "California Agreement for Sale of Assets of Corporation — Going Concern": This type of agreement refers to the sale of the entire business operation, including its assets, liabilities, contracts, and obligations. It is commonly used when a corporation is looking to sell its entire business and transfer all related aspects to the buyer. In summary, the California Agreement for Sale of Assets of Corporation is a comprehensive legal document used to facilitate the purchase and sale of various assets owned by a corporation in California. These assets can include general business assets, intellectual property, real estate, or an entire business operation. It is crucial to customize the agreement to suit the specific circumstances and type of assets involved in the transaction.

California Agreement for Sale of Assets of Corporation

Description

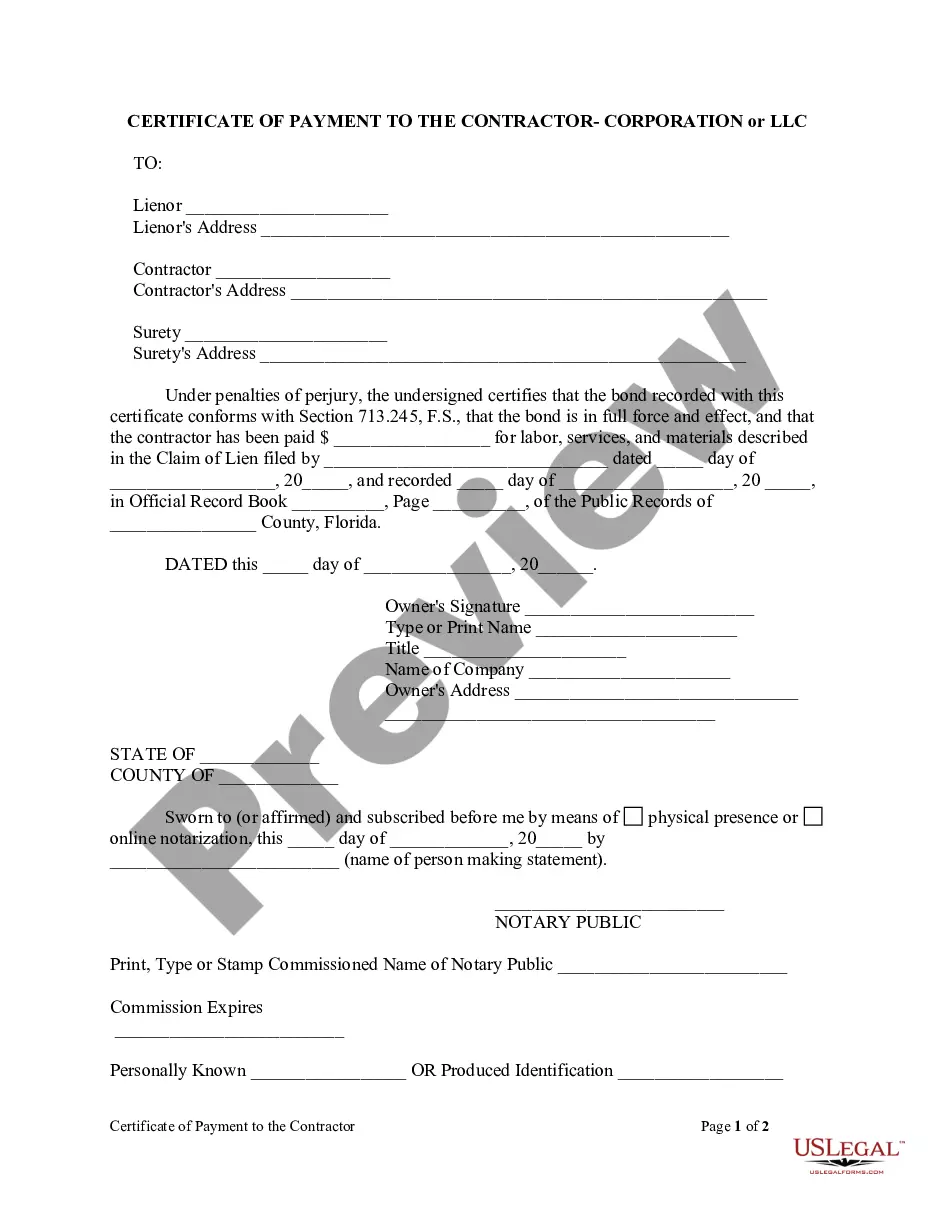

How to fill out California Agreement For Sale Of Assets Of Corporation?

You might spend time online trying to locate the proper legal document template that meets the state and federal standards you require.

US Legal Forms offers a vast array of legal forms that can be examined by experts.

You can obtain or print the California Agreement for Sale of Assets of Corporation from our platform.

If available, utilize the Examine button to review the document template as well.

- If you have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can fill out, edit, print, or sign the California Agreement for Sale of Assets of Corporation.

- Every legal document template you acquire is yours permanently.

- To obtain a duplicate of a purchased form, go to the My documents section and click the appropriate button.

- If you are visiting the US Legal Forms site for the first time, follow the simple guidelines below.

- First, ensure you have selected the correct document template for the county/area you prefer.

- Check the form outline to confirm you have chosen the right document.

Form popularity

FAQ

In an asset sale, shareholders do not directly sell their shares, but they may see changes in the value of their stocks depending on the outcome of the sale. The proceeds from the asset sale typically flow to the corporation first and are then distributed to shareholders, usually if there are remaining assets. It's important for shareholders to understand their rights and any implications of the sale. A California Agreement for Sale of Assets of Corporation provides a detailed framework to address these concerns and protect shareholder interests.

Selling all assets of a corporation typically requires approval from the board of directors and may also require shareholder consent depending on state laws. In California, the requirements can vary, so it is essential to consult with legal counsel to ensure compliance. Using a California Agreement for Sale of Assets of Corporation ensures that all stakeholder approvals are documented and conducted properly, streamlining the process.

An asset sale may present several disadvantages for sellers, including potential tax liabilities and the challenge of valuation. During an asset sale, sellers might face scrutiny over the fair market value of the assets, which can complicate negotiations. Furthermore, it often requires updating many contracts and licenses, leading to additional administrative headaches. A California Agreement for Sale of Assets of Corporation can help mitigate some of these issues by providing clarity and a structured approach to the transaction.

The decision between selling stock or assets largely depends on your specific situation and business goals. A stock sale generally enables a simpler transfer of ownership without the need to retitle individual assets. Conversely, an asset sale can give buyers the chance to selectively acquire only the desired assets, which can make it a better option in certain cases. Utilizing a California Agreement for Sale of Assets of Corporation can help clarify which method suits your needs best.

Many experts consider a share sale preferable because it usually allows for a smoother transition of ownership. It often avoids the need to reassign contracts and licenses tied to the business. Additionally, a share sale allows sellers to potentially benefit from more favorable tax treatment. Using a California Agreement for Sale of Assets of Corporation, stakeholders can clearly define the terms and ensure everyone understands their rights and responsibilities during the process.

Yes, the sale of a business asset can be taxable, especially if it involves tangible property. The extent of taxation relies on various factors, including the type of asset and the seller's tax situation. By utilizing a California Agreement for Sale of Assets of Corporation, you can address any taxable implications clearly and ensure compliance with tax laws. This step also helps you maintain transparency with the buyer regarding any taxes involved.

In California, the sale of certain business assets can be subject to sales tax, depending on the nature of the assets. For instance, tangible personal property typically attracts sales tax, while some intangible assets do not. When you create a California Agreement for Sale of Assets of Corporation, it is wise to assess whether sales tax applies to the specific assets being sold. Consulting with a tax advisor can provide clarity on your obligations and help you navigate these regulations.

When you sell a business asset, you transfer ownership to the buyer in exchange for payment. It is crucial to document this transaction correctly, often using a California Agreement for Sale of Assets of Corporation, to ensure a clear record of the sale. This agreement outlines the terms of the sale, including the assets involved, payment details, and any liabilities assumed by the buyer. Being thorough can help prevent disputes and clarify each party's rights.

The California Corporation Code provides specific regulations governing the sale of corporation assets. When engaged in a California Agreement for Sale of Assets of Corporation, it's crucial to adhere to these legal guidelines to avoid potential disputes. The code outlines requirements for obtaining shareholder approval and filing necessary documentation. By understanding these regulations, you can ensure a smoother transaction and reduce the risk of legal issues.

A bill of sale for a business in California serves as a legal document that records the transfer of ownership of business assets. In the context of a California Agreement for Sale of Assets of Corporation, this document outlines the assets being sold and the terms of the sale. It protects both the seller and the buyer by providing a clear record of the transaction. Utilizing a bill of sale can simplify the transfer process and ensure compliance with state laws.