California Agreement to Form Limited Partnership is a legally binding document that outlines the terms and conditions under which a limited partnership is established in the state of California. This agreement enables individuals or entities to form a partnership for the purpose of conducting business while limiting personal liability and taking advantage of favorable tax treatment. Keywords: California Agreement, Form Limited Partnership, terms and conditions, limited partnership, business, personal liability, tax treatment. There are two main types of California Agreement to Form Limited Partnership: 1. General Partnership (GP): This type of partnership consists of at least two partners, where one assumes unlimited personal liability for the partnership's obligations while the others assume limited liability. The general partners manage the day-to-day operations and decision-making processes of the partnership. 2. Limited Partnership (LP): In this type of partnership, there must be at least one general partner who maintains unlimited personal liability, along with one or more limited partners who enjoy limited liability. The limited partners are typically passive investors who do not actively participate in the partnership's management or have decision-making authority. The California Agreement to Form Limited Partnership typically includes the following key provisions: 1. Identification of the partners: The agreement specifies the names and addresses of all partners involved in the formation of the limited partnership. 2. Business purpose: It outlines the specific objectives and activities the partnership intends to engage in. 3. Duration: The agreement specifies the duration for which the partnership will exist. By default, it is perpetual unless otherwise stated. 4. Contributions: It clarifies the amount and nature of capital contributions each partner will make to the partnership, including cash, property, or services. 5. Profit and loss allocation: The agreement outlines how profits and losses will be divided among the partners based on their respective ownership interests or other agreed-upon methods. 6. Management and authority: For general partnerships, the agreement defines the roles and responsibilities of each general partner regarding decision-making and management. In limited partnerships, these details are typically limited to the general partner(s), as limited partners have limited or no control over management decisions. 7. Dissolution and withdrawal: The circumstances under which the limited partnership may be dissolved or a partner may withdraw are outlined in this section. 8. Dispute resolution: The agreement includes provisions for how any disputes or disagreements among partners will be resolved, such as through mediation or arbitration. California Agreement to Form Limited Partnership is a crucial document that ensures clarity, transparency, and adherence to legal requirements for individuals or entities entering into a business partnership in California. It provides a solid foundation for the partnership's operations, protecting the rights and responsibilities of all parties involved and facilitating efficient decision-making and dispute resolution.

California Agreement to Form Limited Partnership

Description

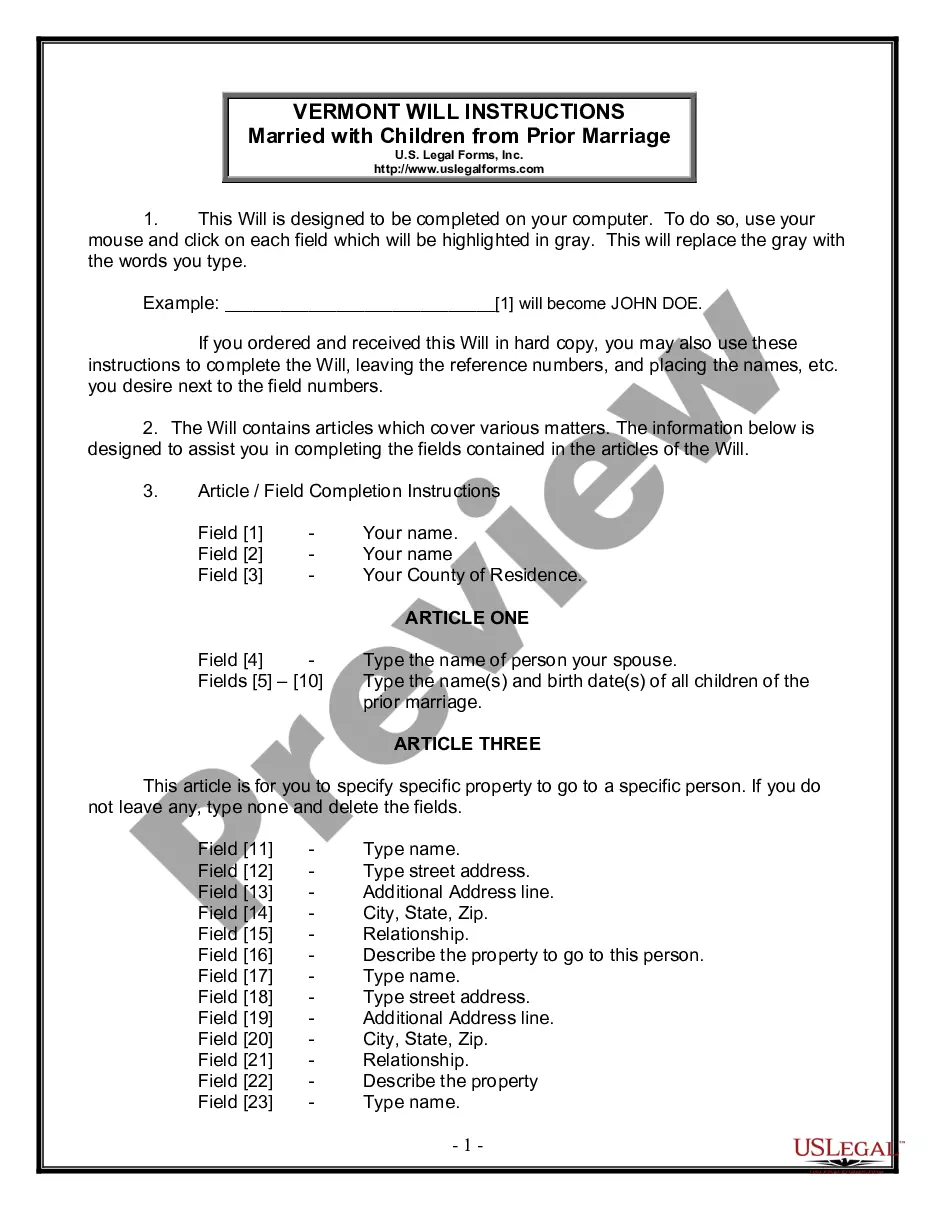

How to fill out California Agreement To Form Limited Partnership?

Are you in a situation where you require documents for both business or personal purposes almost every day? There are numerous legal document formats available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the California Agreement to Form Limited Partnership, which are designed to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the California Agreement to Form Limited Partnership template.

Select a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain another copy of the California Agreement to Form Limited Partnership anytime, if needed. Click the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally created legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct state/county.

- Use the Preview button to review the form.

- Read the description to confirm you have chosen the correct form.

- If the form is not what you need, use the Search field to find the form that suits your needs and requirements.

- When you find the right form, click Get now.

- Choose the pricing plan you prefer, enter the required information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

Yes, it is possible to have a partnership without a formal agreement in California. However, without a California Agreement to Form Limited Partnership, you risk encountering uncertainties regarding each partner’s rights and responsibilities. It is advisable to create a partnership agreement to protect everyone involved and ensure smooth operations.

A written agreement is not a legal requirement for partnerships in California, but it is a smart practice. A California Agreement to Form Limited Partnership helps to prevent misunderstandings and clearly defines each partner's roles. By having a formal document, partners can easily address issues that may arise and maintain a positive working relationship.

While you can form a partnership without a written agreement, having one can significantly benefit your business. A California Agreement to Form Limited Partnership can specify key details such as profit sharing, decision-making processes, and partner contributions. This clarity fosters healthy collaboration among partners, ensuring everyone is on the same page.

In California, a partnership agreement is not legally required to form a partnership. However, having a California Agreement to Form Limited Partnership is highly recommended. This written document outlines the responsibilities, duties, and expectations of each partner, providing clarity and reducing potential disputes in the future.

Writing a limited partnership agreement involves outlining the name and purpose of the partnership, specifying the contributions of each partner, and detailing how profits and losses will be shared. It is also important to include procedures for adding or removing partners and for resolving disputes. Utilizing a California Agreement to Form Limited Partnership can provide a solid framework, ensuring that all essential elements are covered.

In California, a limited partnership must have at least one general partner and one limited partner. You must file a California Agreement to Form Limited Partnership with the state, and it’s advisable to have a partnership agreement in place. This agreement should clearly define each partner's roles and responsibilities to avoid potential conflicts.

The greatest disadvantage of limited partnerships is that general partners have unlimited personal liability for the debts of the partnership. This means that their personal assets can be at risk if the business faces legal issues or financial troubles. Understanding this aspect is crucial when considering a California Agreement to Form Limited Partnership.

Filling out a partnership agreement involves specifying details such as the name of the partnership, the purpose of the business, and the roles of each partner. You should also include provisions for profit sharing and decision-making processes. A California Agreement to Form Limited Partnership can serve as a guideline for drafting this critical document.

To form a limited partnership in California, you need at least one general partner and one limited partner. You must file a California Agreement to Form Limited Partnership with the Secretary of State. Additionally, it is essential to create a partnership agreement that outlines the rights and responsibilities of each partner.

An LLP in California provides its partners with limited liability protection, safeguarding personal assets from business debts. Additionally, LLPs often benefit from a flexible management structure and pass-through taxation. Utilizing the California Agreement to Form Limited Partnership can enhance these advantages. By choosing an LLP, you create a business structure that balances protection and operational ease.

Interesting Questions

More info

Common Law Partnerships What is a Limited Larceny Partnership? Common Law Partnerships and LCS: What is a Limited Liability Partnership? LCS in the real estate business are required to file an annual report with the SEC. An LLC is typically formed by a “Partner” and a “Limited Partner” who have joined together to form a general partnership and that partnership is called the “Limited Liability Partnership”. A Limited Liability Partnership is not required to file with the SEC as a sole proprietorship, and it may have the same limited liability protection as a general partnership. LCS are generally required to file the Form 1065 by the first day of the 4th month after the end of the 3rd taxable year. The LLC may also need to file additional Forms 1065s or 1026Cs for each of its taxable years (except when the Partnership has less than 12 months of annual activity).