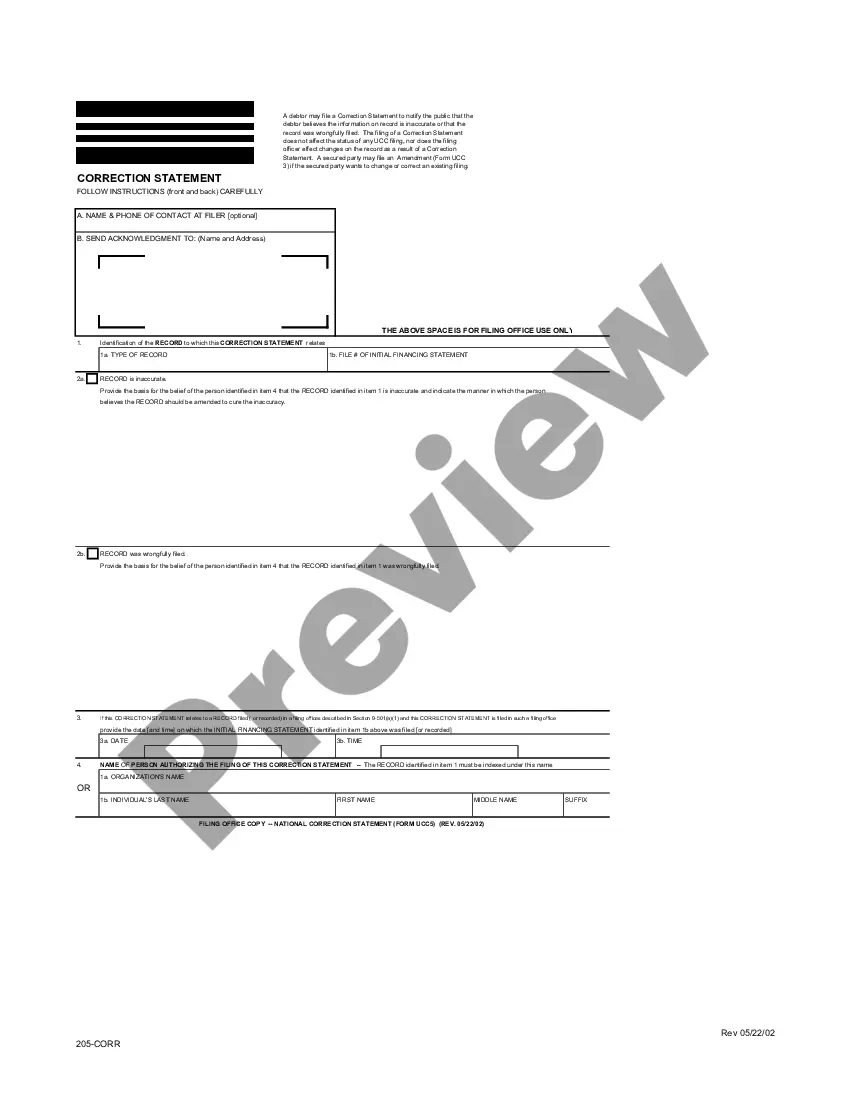

California Guaranty with Pledged Collateral

Description

How to fill out Guaranty With Pledged Collateral?

You can invest time on the Internet searching for the official document template that complies with the state and federal guidelines you will require.

US Legal Forms provides thousands of official templates that are reviewed by experts.

You can obtain or print the California Guaranty with Pledged Collateral from my service.

If available, utilize the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the California Guaranty with Pledged Collateral.

- Every official document template you purchase is your property for an extended period.

- To acquire another copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form details to ensure you have chosen the correct form.

Form popularity

FAQ

A bank guarantee serves as a promise from a commercial bank that it will assume liability for a particular debtor if its contractual obligations are not met. In other words, the bank offers to stand as the guarantor on behalf of a business customer in a transaction.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

Guarantee vs collateral what's the difference? A personal guarantee is a signed document that promises to repay back a loan in the event that your business defaults. Collateral is a good or an owned asset that you use toward loan security in the event that your business defaults.

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.

If the guarantee is enforceable based on the points described in this guide, unfortunately, there is no way to get out of a personal guarantee. However, there are some steps you can take to protect yourself from the potentially damaging consequences of the guarantee being called in.

Pledge TypesActive Pledge. Active pledge is defined as a pledge that is active, regardless if it has a payment schedule or not.Annual Fund Pledge.Conditional Pledge.Open Pledge.Pledge Intention.Straight Pledge.Will Commitment.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

A personal guaranty is not enforceable without consideration In fact, no contract is enforceable without consideration. A personal guaranty is a type of contract.

More Definitions of Collateral Guarantee Collateral Guarantee means a guarantee and indemnity to be executed by the Collateral Guarantor in favour of the Lender in form and substance acceptable to the Lender in all respects.

The "guarantor" is the person guarantying the debt while the party who originally incurred the debt is the "principle" and the creditor is the "guaranteed party." Under California law, if properly drafted, a guaranty is a fully enforceable obligation which allows the guaranteed party to proceed directly against the