California Equipment Lease with Lessor to Purchase Equipment Specified by Lessee is a legal agreement that allows individuals or businesses in California to lease equipment from a lessor with the option to purchase the equipment at the end of the lease term. This type of lease provides lessees with the flexibility to acquire necessary equipment for their operations without making significant upfront investments. In a California Equipment Lease with Lessor to Purchase Equipment Specified by Lessee, the lessee specifies the particular equipment they require for their business. The lessor then procures the equipment and leases it to the lessee for a predetermined period, typically ranging from months to years. During the lease term, the lessee pays regular lease payments to the lessor, which are often fixed but can also include variable components such as maintenance costs or insurance. At the end of the lease term, the lessee has the option to purchase the equipment from the lessor at a predetermined price, usually based on fair market value or a predetermined residual value. This buyout option allows lessees to test and evaluate the equipment during the lease term before committing to its permanent ownership. There are different types of California Equipment Lease with Lessor to Purchase Equipment Specified by Lessee based on various factors such as duration, buyout options, and specific equipment requirements. Some common variations include: 1. Short-Term Equipment Lease: This type of lease typically spans a few months to a year and is suitable for businesses with temporary equipment needs or projects. At the end of the lease, the lessee can choose to return the equipment or negotiate its purchase. 2. Long-Term Equipment Lease: This lease agreement extends over several years and is suitable for businesses that require equipment for extended periods, such as construction companies or manufacturing firms. Lessees usually have a buyout option at the end of the lease term. 3. Fixed-Purchase Option Lease: In this type of lease, the lessee has a predetermined buyout price specified in the agreement. This provides certainty regarding the equipment's purchase cost at the end of the lease and allows lessees to plan their finances accordingly. 4. Fair Market Value Lease: Unlike the fixed-purchase option lease, this type of lease bases the buyout price on the fair market value of the equipment at the end of the lease term. This option is suitable for lessees who anticipate fluctuations in equipment value or intend to upgrade to newer models at the end of the lease. California Equipment Lease with Lessor to Purchase Equipment Specified by Lessee provides flexibility, cost control, and access to necessary equipment without major capital outlays. It is important for both lessors and lessees to carefully review and negotiate the terms and conditions of the lease agreement to ensure that their rights and obligations are protected throughout the lease term.

California Equipment Lease with Lessor to Purchase Equipment Specified by Lessee

Description

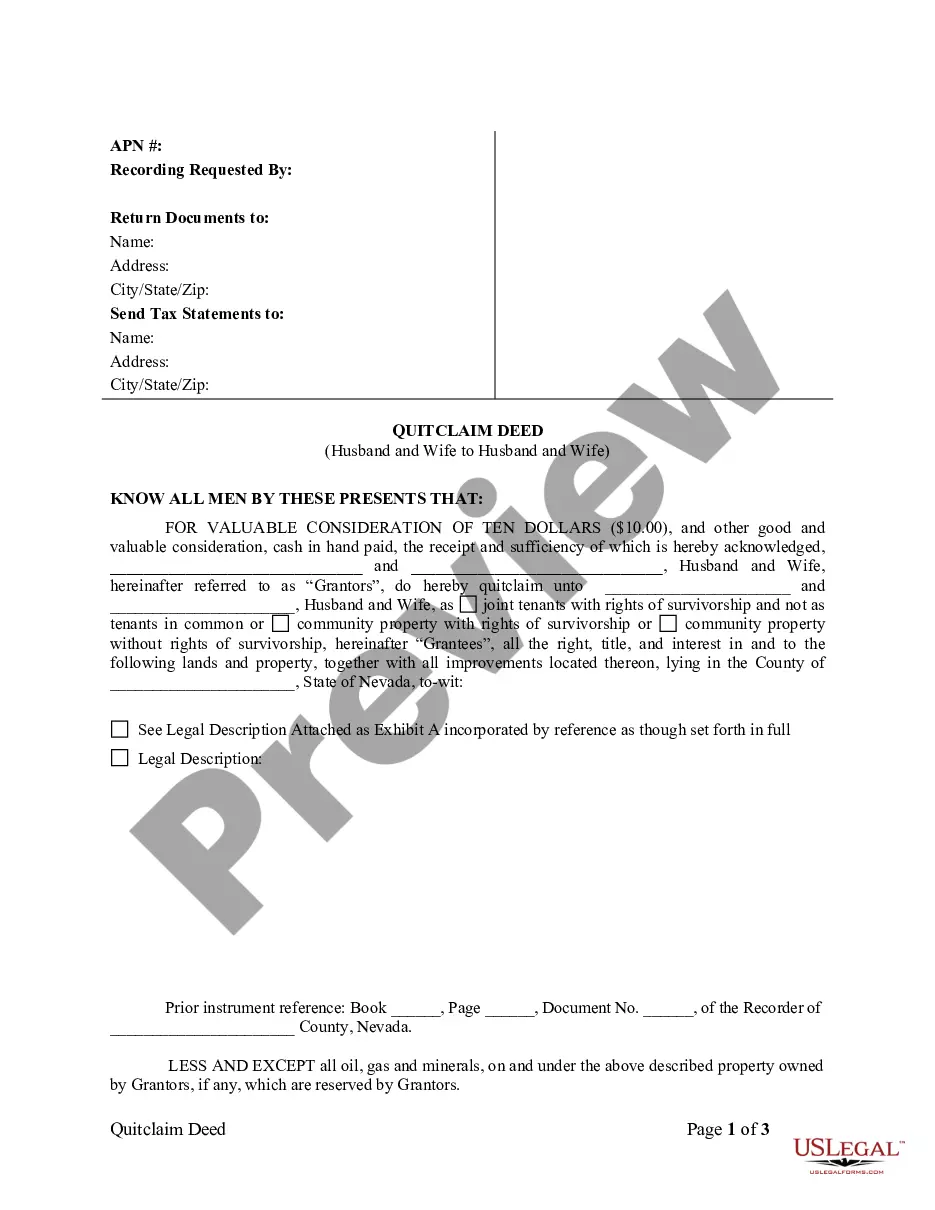

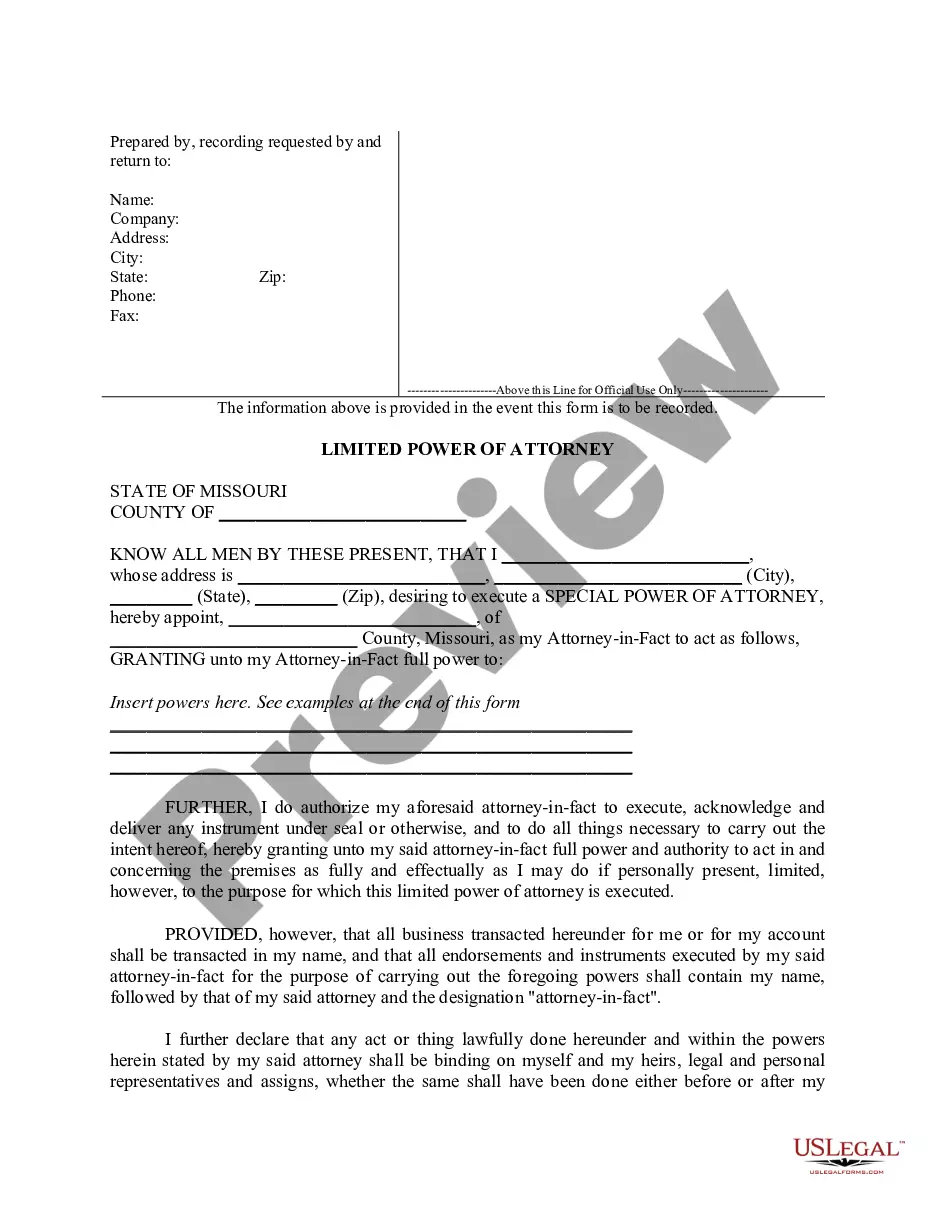

How to fill out California Equipment Lease With Lessor To Purchase Equipment Specified By Lessee?

Are you in the placement the place you need documents for possibly company or individual purposes almost every working day? There are a lot of legitimate file layouts available online, but finding types you can depend on isn`t effortless. US Legal Forms gives a huge number of kind layouts, like the California Equipment Lease with Lessor to Purchase Equipment Specified by Lessee, that happen to be published to satisfy state and federal demands.

In case you are already familiar with US Legal Forms internet site and possess an account, just log in. Next, it is possible to download the California Equipment Lease with Lessor to Purchase Equipment Specified by Lessee template.

Unless you offer an bank account and need to start using US Legal Forms, abide by these steps:

- Discover the kind you require and ensure it is for that correct town/region.

- Use the Review button to examine the form.

- Browse the information to ensure that you have chosen the proper kind.

- In case the kind isn`t what you`re searching for, take advantage of the Research field to obtain the kind that fits your needs and demands.

- Whenever you get the correct kind, simply click Acquire now.

- Pick the pricing plan you desire, submit the specified information to produce your bank account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Choose a practical document format and download your copy.

Discover every one of the file layouts you possess bought in the My Forms menu. You can obtain a more copy of California Equipment Lease with Lessor to Purchase Equipment Specified by Lessee whenever, if required. Just select the necessary kind to download or print out the file template.

Use US Legal Forms, by far the most considerable variety of legitimate types, to save time as well as stay away from errors. The assistance gives skillfully manufactured legitimate file layouts that can be used for a variety of purposes. Produce an account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Compared to a loan which typically requires 5-20% down, a TRAC lease does not require a large down payment. The TRAC lease has a lower barrier of entry. You get the equipment needed for your business and keep more money in your pocket.

A TRAC (Terminal Rental Adjustment Clause) is a lease on vehicles intended for commercial use more than half of the time. TRAC leases reduce the high cost of equipment to low monthly payments, thus allowing you to get access to the equipment you need at the lowest possible rate.

A $1 Buyout Lease, also called a capital lease, is similar to purchasing equipment with a loan. With this type of lease, there is a higher monthly payment compared with an FMV lease, but at the end of the lease term, the lessee purchases the equipment for $1.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Because they are both a form of lease, they have one thing in common. That is, the owner of the equipment (the lessor) provides to the user (the lessee) the authority to use the equipment and then returns it at the end of a set period.