California Resolution of Meeting of LLC Members to Set Attendance Allowance is a crucial document that outlines the rules and guidelines regarding attendance allowances for members attending meetings of a Limited Liability Company (LLC) in California. This resolution ensures that all members have a fair and consistent allocation of attendance allowances, promoting transparency and accountability within the LLC. Here are some key points to consider when drafting this resolution: 1. Purpose: The purpose of the California Resolution of Meeting of LLC Members to Set Attendance Allowance is to establish and define the attendance allowance policy for LLC members attending meetings. The resolution aims to establish a fair and efficient system that motivates active participation while accounting for members' various responsibilities and availability. 2. Types of Attendance Allowances: There are several types of California Resolution of Meeting of LLC Members to Set Attendance Allowance, including: a) Flat Rate Allowance: Under this resolution, all members are granted an equal fixed allowance for attending LLC meetings. This type of allowance ensures that each member is compensated equally for their participation, irrespective of their role or contribution. b) Tiered Allowance: In this resolution, attendance allowances are distributed based on tiers or categories. Members belonging to higher tiers, such as managers or executives, receive a higher attendance allowance compared to members in lower tiers, such as non-executive employees or consultants. This type of allowance considers hierarchies and roles within the LLC. c) Performance-based Allowance: Under this resolution, attendance allowances are based on individual performance and contribution. Members who actively engage, provide valuable insights, and contribute significantly to the meetings receive a higher attendance allowance. This type of allowance aims to encourage active participation and recognize outstanding performance. 3. Determining Attendance Allowance: When drafting the California Resolution of Meeting of LLC Members to Set Attendance Allowance, certain factors must be considered, including: a) Frequency of Meetings: The resolution should clearly state the frequency of LLC meetings that are eligible for attendance allowances. It could range from monthly, quarterly, or on a need-basis, depending on the nature of the LLC's operations. b) Calculation Method: The resolution should outline how the attendance allowances will be calculated. It can be a fixed amount per meeting, a percentage of profits, or an hourly rate. The calculation method should be transparent and easily understood by all LLC members. c) Eligibility Criteria: The resolution should specify the eligibility criteria for receiving attendance allowances, such as minimum attendance requirements or active participation requirements during the meetings. This ensures that attendance allowances are distributed fairly and only to members fulfilling their obligations. d) Review and Modification: The resolution should establish a process for reviewing and modifying the attendance allowance policy. This allows for future adjustments to accommodate changing circumstances or improvements to the policy. In conclusion, the California Resolution of Meeting of LLC Members to Set Attendance Allowance is a vital document for LCS in California. It ensures fairness, transparency, and accountability among members attending LLC meetings. Implementing an attendance allowance system can incentivize active participation, foster collaboration, and ultimately contribute to the success of the LLC.

California Resolution of Meeting of LLC Members to Set Attendance Allowance

Description

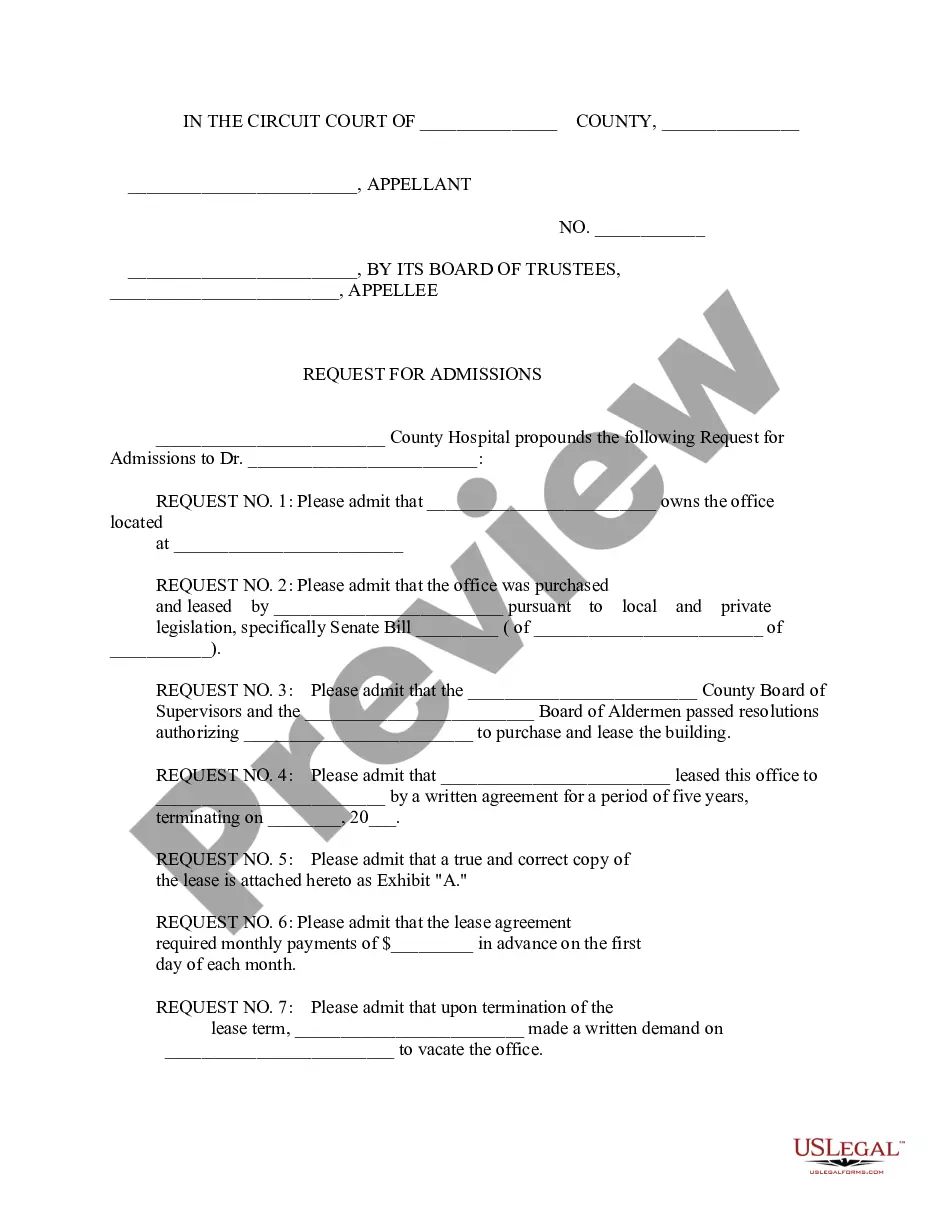

How to fill out California Resolution Of Meeting Of LLC Members To Set Attendance Allowance?

If you wish to full, acquire, or print authorized record web templates, use US Legal Forms, the greatest variety of authorized forms, which can be found on the web. Utilize the site`s easy and practical lookup to obtain the papers you will need. A variety of web templates for company and person purposes are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to obtain the California Resolution of Meeting of LLC Members to Set Attendance Allowance within a number of click throughs.

Should you be already a US Legal Forms consumer, log in to the bank account and click the Acquire option to find the California Resolution of Meeting of LLC Members to Set Attendance Allowance. You may also access forms you earlier downloaded within the My Forms tab of your bank account.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape to the correct town/country.

- Step 2. Use the Preview option to examine the form`s content material. Never neglect to see the description.

- Step 3. Should you be unsatisfied using the kind, use the Search area towards the top of the display to locate other versions of the authorized kind web template.

- Step 4. Upon having found the shape you will need, go through the Get now option. Select the rates strategy you prefer and include your credentials to register for an bank account.

- Step 5. Process the purchase. You can use your bank card or PayPal bank account to complete the purchase.

- Step 6. Find the file format of the authorized kind and acquire it on the device.

- Step 7. Complete, revise and print or indication the California Resolution of Meeting of LLC Members to Set Attendance Allowance.

Every single authorized record web template you get is your own property forever. You might have acces to every single kind you downloaded within your acccount. Click on the My Forms section and select a kind to print or acquire again.

Remain competitive and acquire, and print the California Resolution of Meeting of LLC Members to Set Attendance Allowance with US Legal Forms. There are millions of specialist and express-particular forms you can use to your company or person demands.