California Stop Annuity Request is a legal process used by individuals in California to halt or cease annuity payments. Annuities are financial contracts that provide periodic payments to an individual over a specific period of time or for their lifetime. However, there may be situations where annuity recipients need to stop these payments, which is where the California Stop Annuity Request comes into play. There are several types of California Stop Annuity Requests that individuals can make, depending on their specific circumstances. These requests can include: 1. Temporary Stop Annuity Request: This type of request is made when an annuity recipient needs to temporarily halt the annuity payments for a specific period. Some common reasons for a temporary stop request could be medical emergencies, unexpected financial hardships, or temporary changes in personal circumstances. 2. Permanent Stop Annuity Request: When annuity recipients wish to permanently stop receiving annuity payments, they can file a Permanent Stop Annuity Request. This may occur when they have found a better investment opportunity, inherited a substantial amount of money, or no longer require the annuity income. 3. Death Benefit Stop Annuity Request: In the unfortunate event of the annuity recipient's death, their beneficiaries or estate executors can submit a Death Benefit Stop Annuity Request. This stops the annuity payments and initiates the process of disbursing the remaining balance and benefits to the designated beneficiaries or estate. To initiate a California Stop Annuity Request, annuity owners must contact the insurance company or financial institution responsible for managing the annuity. They will be required to fill out specific forms and provide necessary documentation to support their request. Some essential information typically requested includes the annuity contract number, personal identification details, reason for the request, and any supporting documents. It's crucial to note that the process and requirements for a California Stop Annuity Request may vary depending on the insurance company or financial institution involved, as each may have its own specific procedures and forms. It is recommended to consult the annuity contract or seek professional legal advice to ensure compliance with the appropriate requirements and ensure a smooth and successful stop annuity request process in California.

California Stop Annuity Request

Description

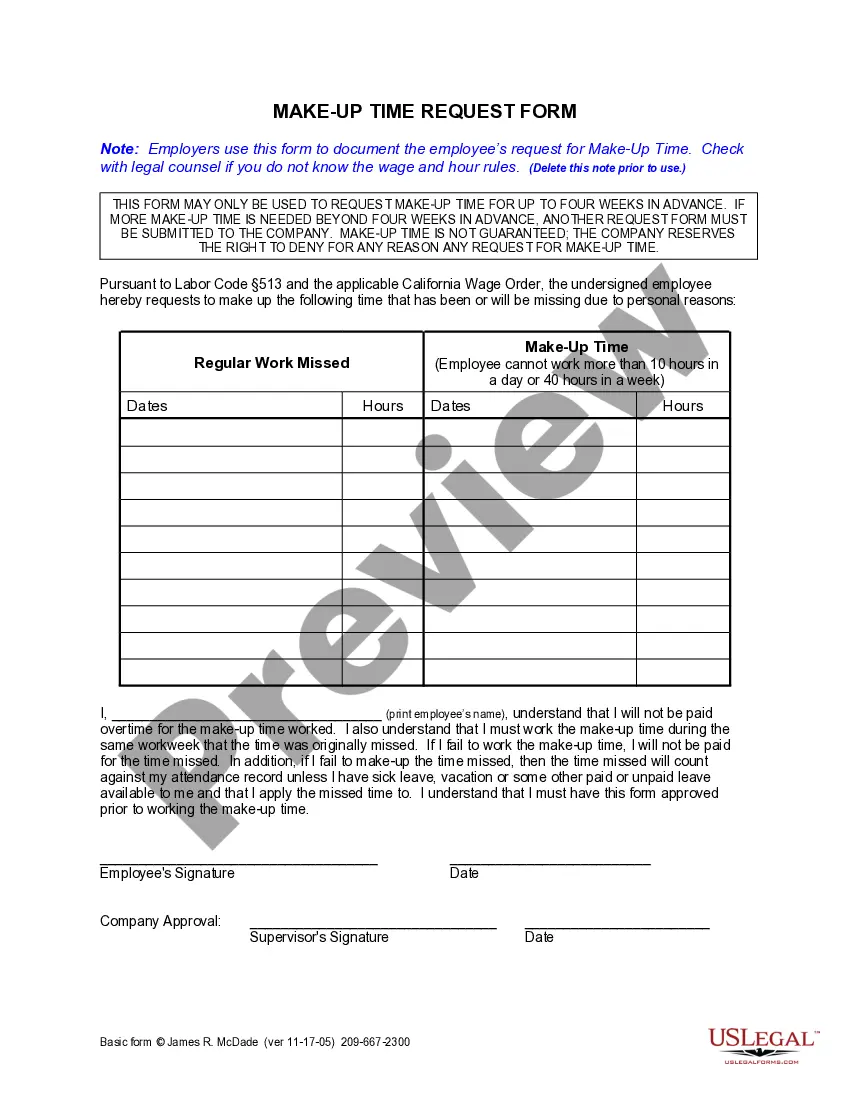

How to fill out California Stop Annuity Request?

US Legal Forms - one of several greatest libraries of lawful types in America - delivers an array of lawful papers web templates you are able to acquire or printing. Using the web site, you can find a large number of types for business and individual functions, categorized by categories, says, or keywords.You can get the latest versions of types like the California Stop Annuity Request in seconds.

If you have a subscription, log in and acquire California Stop Annuity Request from the US Legal Forms catalogue. The Obtain button will show up on each type you look at. You gain access to all earlier acquired types within the My Forms tab of your accounts.

If you wish to use US Legal Forms for the first time, here are basic guidelines to obtain started:

- Make sure you have selected the right type to your area/region. Select the Preview button to analyze the form`s articles. Read the type information to actually have chosen the appropriate type.

- If the type does not fit your requirements, take advantage of the Research field near the top of the monitor to obtain the the one that does.

- Should you be pleased with the shape, validate your decision by simply clicking the Purchase now button. Then, select the prices program you want and provide your references to register to have an accounts.

- Process the transaction. Utilize your bank card or PayPal accounts to complete the transaction.

- Choose the file format and acquire the shape on the product.

- Make adjustments. Fill up, change and printing and signal the acquired California Stop Annuity Request.

Each design you included with your bank account lacks an expiration time and is also yours for a long time. So, if you want to acquire or printing yet another copy, just check out the My Forms portion and click on on the type you want.

Gain access to the California Stop Annuity Request with US Legal Forms, one of the most comprehensive catalogue of lawful papers web templates. Use a large number of skilled and state-specific web templates that satisfy your organization or individual needs and requirements.

Form popularity

FAQ

On the downside, if you stop contributing to your retirement annuity, and make it paid-up, you may incur an early termination or surrender penalty. This is an accelerated recovery of upfront fees - you would have paid these fees anyway, but they would have been deducted over the life of your retirement annuity.

Are Annuities Protected From Creditors in California? California has asset protection laws in place to benefit residents. For unmatured life policies including annuities, the exempt amounts are $9,700 for an individual and $19,400 for a married couple. A money judgment can be enforced beyond these dollar amounts.

You typically have to pay surrender penalties if you cash in your contract before it reaches maturity with variable and indexed annuities. It can take up to 20 years for a contract to mature, and surrender penalties can amount to 25 percent of the contract's value.

Most annuities offer a surrender-free withdrawal option, available in each contract year. (Your contract year begins the day you sign the annuity contract and ends 364 days later.)

Life-Only Annuity Payments Life-only payments continue as long as you live. But they stop immediately upon your death. Even if you live for 40 or 50 years after you start receiving payments, the guaranteed payments will continue. This is true as long as the insurance company stays in business.

Almost every time you buy an annuity, you'll have at least 10 days to reconsider and back out if you change your mind. Annuity.org partners with outside experts to ensure we are providing accurate financial content.

Annuities are contracts sold by life insurance companies and are considered long-term investments that may be suitable for retirement. Income annuities (either immediate or deferred) have no cash value and once issued they can't be terminated (surrendered).

Most annuities allow you to cancel your contract before the term is up, but annuities are long-term contracts at the end of the day.

If you take money out of an annuity, you may face a penalty or a surrender fee, also known as a withdrawal, or surrender charge. Annuity contracts include surrender charges to make up for the insurance company's loss if you choose to withdraw before they can earn interest on your principal.

If you decide that you no longer want the annuity within the set time frame, then you can simply cancel the contract without incurring a surrender charge from the insurance company. Think of the free-look period as a get-out-of-jail-free card but with a crucial caveat.