California Guardianship Expenditures refer to the funds and expenses associated with the legal responsibility of a guardian who has been appointed to care for a minor or an incapacitated adult. It involves managing the financial affairs and ensuring the well-being of the individual under guardianship. The California Probate Code governs guardianship matters in the state. Various types of expenditures may arise during the guardianship process. Here are some key categories of California Guardianship Expenditures: 1. Necessities: Guardians are responsible for providing the ward with essential needs such as food, clothing, and shelter. This includes expenses related to housing, utilities, groceries, and clothing purchases. 2. Medical and Healthcare: Ensuring the ward's health and well-being is a crucial aspect of guardianship. Medical expenses including doctor visits, medications, hospital stays, therapy sessions, and health insurance premiums fall under this category. 3. Educational Costs: Guardianship often involve minor children, and it's important to prioritize their education. Expenses like tuition fees, school supplies, textbooks, uniforms, extracurricular activities, and tutoring services can be covered. 4. Legal Fees: Guardians may require legal representation for various matters, such as establishing or contesting guardianship, handling estate planning or immigration issues, or resolving any legal disputes related to the ward's well-being. Legal fees associated with these processes are considered as guardianship expenditures. 5. Caregiver Compensation: In some cases, professional caregivers or family members may be appointed as the guardian. They may be entitled to reasonable compensation for their time and effort spent in caregiving duties, which can include a stipend for their services. 6. Administrative Costs: Guardians are responsible for managing the ward's finances and may incur expenses for record-keeping, filing taxes, and handling financial accounts. Costs related to bookkeeping, accounting services, and document preparation fall under this category. 7. Professional Services: When necessary, guardians may need to hire professionals such as therapists, financial advisors, or consultants to provide expert guidance in specific areas, like mental health support or financial planning. These professional service fees are considered as guardianship expenditures. It is crucial for guardians to maintain detailed records of all expenditures incurred, including receipts and invoices. This documentation will help in accurately reporting and justifying the expenditures during the required court accounting procedures. Overall, California Guardianship Expenditures encompass a wide range of financial responsibilities involved in providing for and protecting the ward's best interests. Guardians must act diligently and transparently in managing these expenditures to ensure the welfare and financial stability of the individuals under their care.

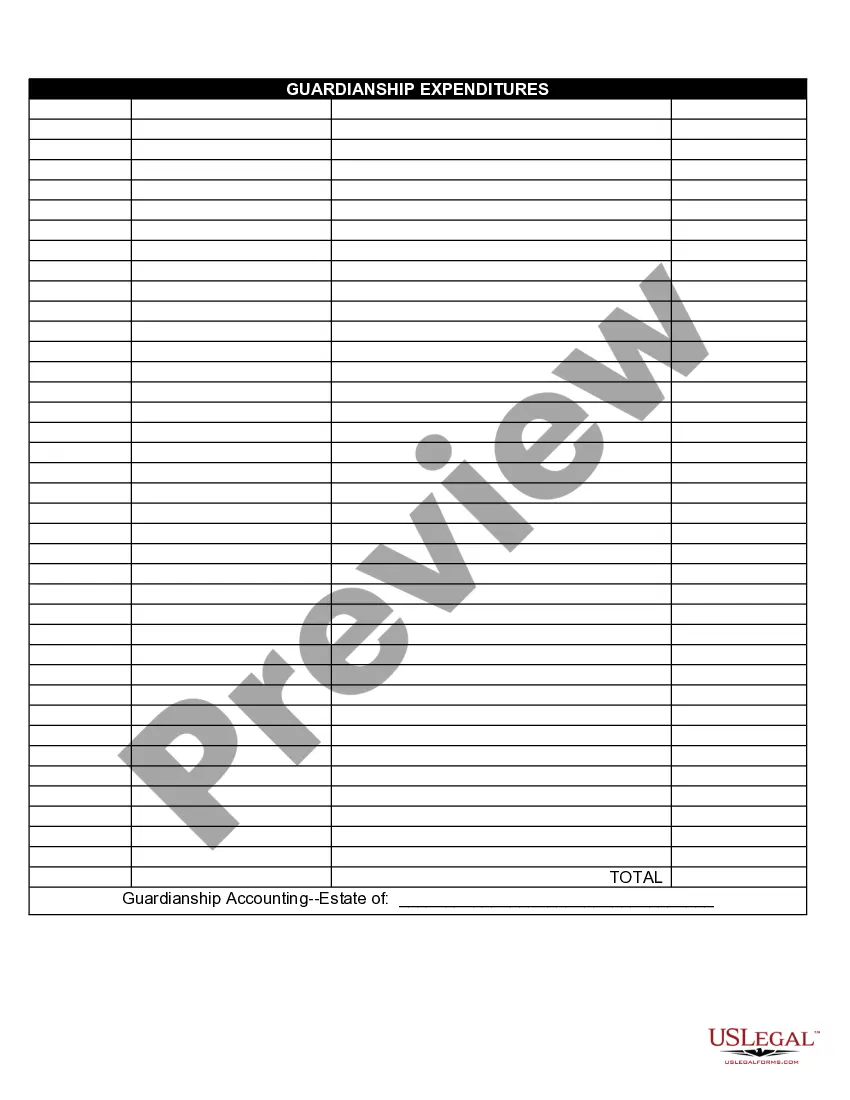

California Guardianship Expenditures

Description

How to fill out California Guardianship Expenditures?

US Legal Forms - among the most significant libraries of legal types in the States - provides a wide range of legal papers web templates you are able to down load or print. Making use of the web site, you may get a huge number of types for business and individual functions, sorted by classes, claims, or key phrases.You can find the newest models of types like the California Guardianship Expenditures within minutes.

If you have a subscription, log in and down load California Guardianship Expenditures in the US Legal Forms catalogue. The Down load button will show up on every develop you see. You have accessibility to all previously downloaded types inside the My Forms tab of your account.

If you wish to use US Legal Forms initially, listed below are basic recommendations to obtain started off:

- Be sure you have picked the proper develop for the area/county. Go through the Preview button to review the form`s articles. Read the develop description to ensure that you have selected the correct develop.

- When the develop does not satisfy your needs, use the Lookup industry towards the top of the display screen to discover the one that does.

- If you are pleased with the shape, affirm your choice by visiting the Buy now button. Then, pick the pricing plan you like and supply your qualifications to sign up for the account.

- Process the financial transaction. Use your bank card or PayPal account to complete the financial transaction.

- Find the structure and down load the shape on your own gadget.

- Make alterations. Complete, edit and print and indicator the downloaded California Guardianship Expenditures.

Every single template you included with your account lacks an expiration particular date which is your own for a long time. So, if you wish to down load or print an additional version, just go to the My Forms portion and click on around the develop you will need.

Obtain access to the California Guardianship Expenditures with US Legal Forms, by far the most extensive catalogue of legal papers web templates. Use a huge number of expert and status-distinct web templates that satisfy your organization or individual needs and needs.