California Personal Guaranty of Another Person's Agreement to Pay Consultant

Description

How to fill out Personal Guaranty Of Another Person's Agreement To Pay Consultant?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legitimate document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, including the California Personal Guaranty of Another Person's Agreement to Pay Consultant, designed to meet state and federal requirements.

Once you find the right form, click Acquire now.

Choose the pricing plan you want, provide the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Personal Guaranty of Another Person's Agreement to Pay Consultant template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the right city/area.

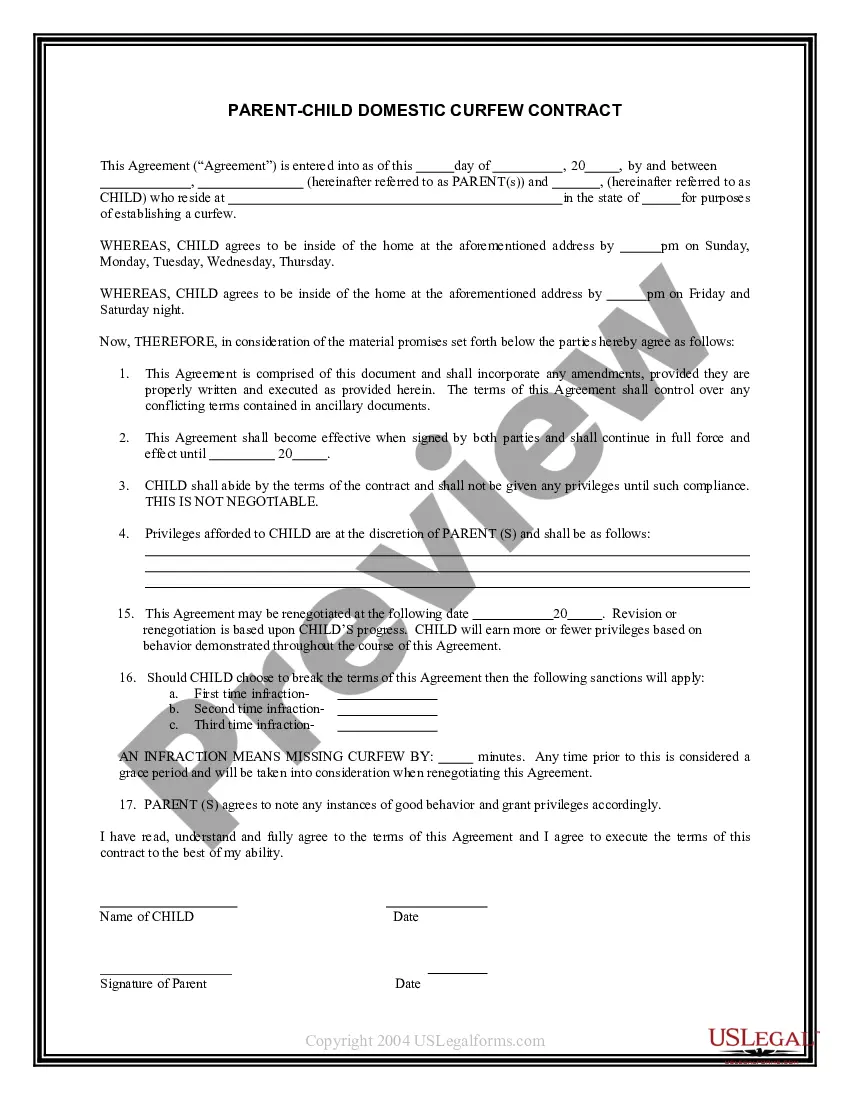

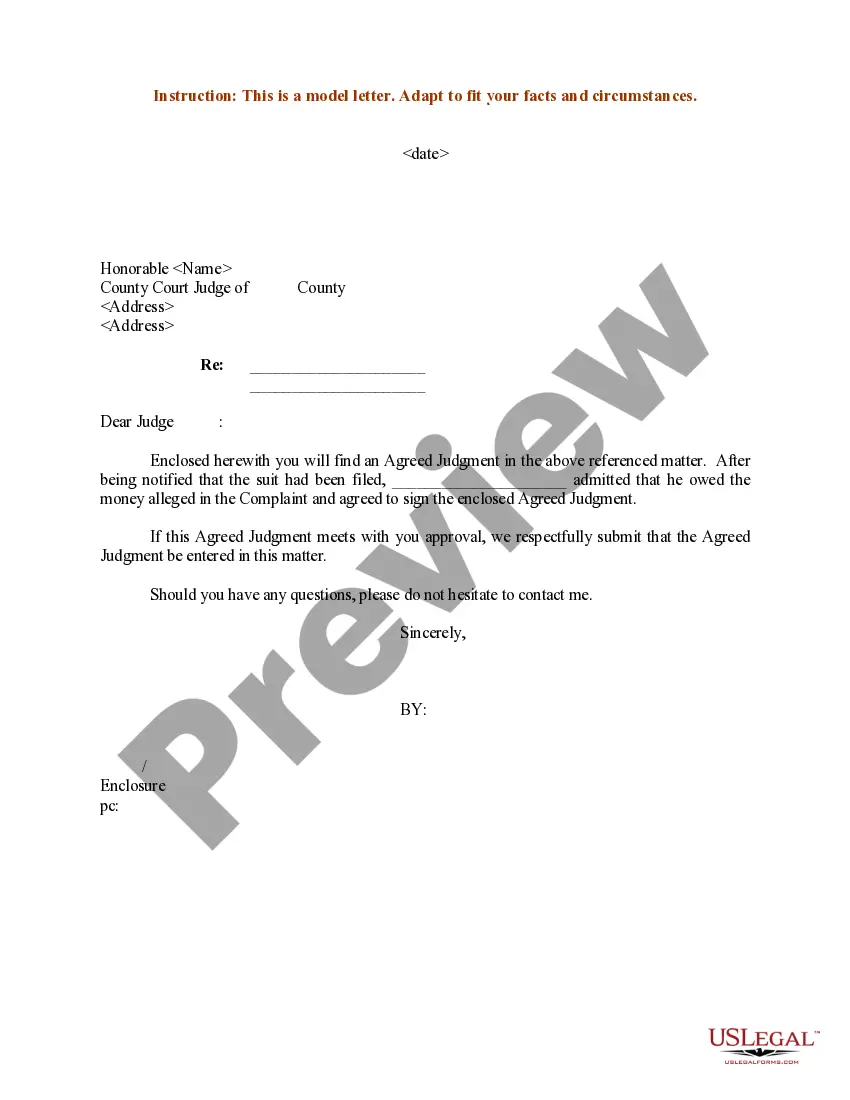

- Utilize the Review button to assess the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that suits your needs.

Form popularity

FAQ

If the guarantee is enforceable based on the points described in this guide, unfortunately, there is no way to get out of a personal guarantee. However, there are some steps you can take to protect yourself from the potentially damaging consequences of the guarantee being called in.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

The "guarantor" is the person guarantying the debt while the party who originally incurred the debt is the "principle" and the creditor is the "guaranteed party." Under California law, if properly drafted, a guaranty is a fully enforceable obligation which allows the guaranteed party to proceed directly against the

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

A guarantee is a contract and such instruments must be in writing by virtue of the Statue of Frauds Act 1677. If the guarantee is drafted as a contract then there is a requirement to evidence consideration (for example in consideration of providing credit to the borrower).

In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed. Secondary liability The document must establish that the guarantor has secondary liability for the debt.

A personal guaranty is not enforceable without consideration In fact, no contract is enforceable without consideration. A personal guaranty is a type of contract.