A California Self-Employed Independent Contractor Employment Agreement — commission for new business is a legal contract outlining the terms and conditions of the working relationship between a self-employed individual and a company. This agreement specifically focuses on the payment structure based on commissions earned from bringing in new business. Under the terms of this agreement, the contractor agrees to work independently and assumes full responsibility for their own business expenses, taxes, and liability insurance. The contractor receives compensation through commissions, which are a percentage or flat fee based on the value of the new business they generate for the company. There are several types of California Self-Employed Independent Contractor Employment Agreements — commission for new business, each designed to address various business models and industries: 1. Sales Commission Agreement: This agreement is commonly used in sales-driven industries where the primary responsibility of the contractor is to generate new business, increase sales, and earn commission based on the value of the products or services sold. 2. Affiliate Commission Agreement: In this type of agreement, the contractor is responsible for referring new customers or clients to the company's products or services. They receive commissions for each successful sale made as a result of their referrals. 3. Lead Generation Commission Agreement: This agreement is typically used in businesses that heavily rely on lead generation. Contractors are responsible for identifying and qualifying potential leads, and they earn commissions based on the successful conversion of those leads into paying customers. 4. Business Development Commission Agreement: This type of agreement is often used in professional service industries, such as consulting or marketing, where contractors are tasked with expanding the company's client base and generating new business through various activities like networking, partnerships, and strategic alliances. Regardless of the specific type, a California Self-Employed Independent Contractor Employment Agreement — commission for new business should include essential clauses such as the duration of the agreement, termination provisions, non-disclosure and non-compete clauses, as well as clarity on how commissions will be calculated, invoiced, and paid. Adhering to such an agreement ensures a transparent and fair working relationship between the self-employed contractor and the company, protecting the interests of both parties and promoting a mutually beneficial partnership.

California Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

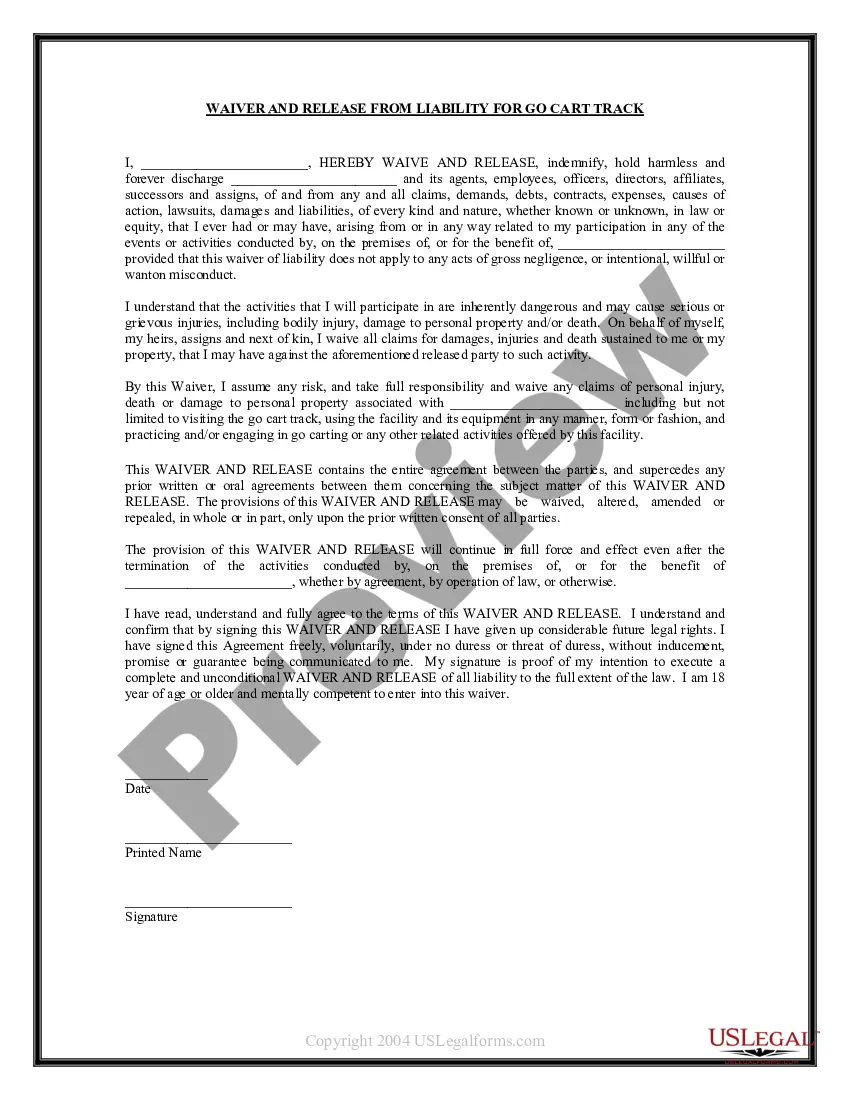

How to fill out California Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

US Legal Forms - among the biggest libraries of authorized types in the United States - delivers a wide range of authorized document themes it is possible to acquire or print. While using website, you can get thousands of types for company and individual reasons, sorted by categories, claims, or keywords and phrases.You can find the newest versions of types such as the California Self-Employed Independent Contractor Employment Agreement - commission for new business within minutes.

If you already have a subscription, log in and acquire California Self-Employed Independent Contractor Employment Agreement - commission for new business through the US Legal Forms catalogue. The Acquire key will appear on every single form you view. You gain access to all earlier delivered electronically types inside the My Forms tab of your profile.

If you want to use US Legal Forms the very first time, listed here are straightforward instructions to get you started out:

- Be sure to have selected the proper form to your town/region. Click on the Review key to analyze the form`s information. Look at the form information to actually have chosen the proper form.

- When the form doesn`t suit your specifications, utilize the Research industry on top of the screen to find the one that does.

- In case you are happy with the shape, affirm your decision by clicking on the Buy now key. Then, opt for the pricing prepare you prefer and provide your references to register for the profile.

- Process the deal. Make use of your charge card or PayPal profile to finish the deal.

- Select the file format and acquire the shape on your own gadget.

- Make alterations. Fill up, edit and print and indication the delivered electronically California Self-Employed Independent Contractor Employment Agreement - commission for new business.

Every web template you added to your account does not have an expiration date and it is yours for a long time. So, if you wish to acquire or print another version, just check out the My Forms section and then click in the form you want.

Gain access to the California Self-Employed Independent Contractor Employment Agreement - commission for new business with US Legal Forms, probably the most extensive catalogue of authorized document themes. Use thousands of expert and condition-specific themes that satisfy your small business or individual requirements and specifications.