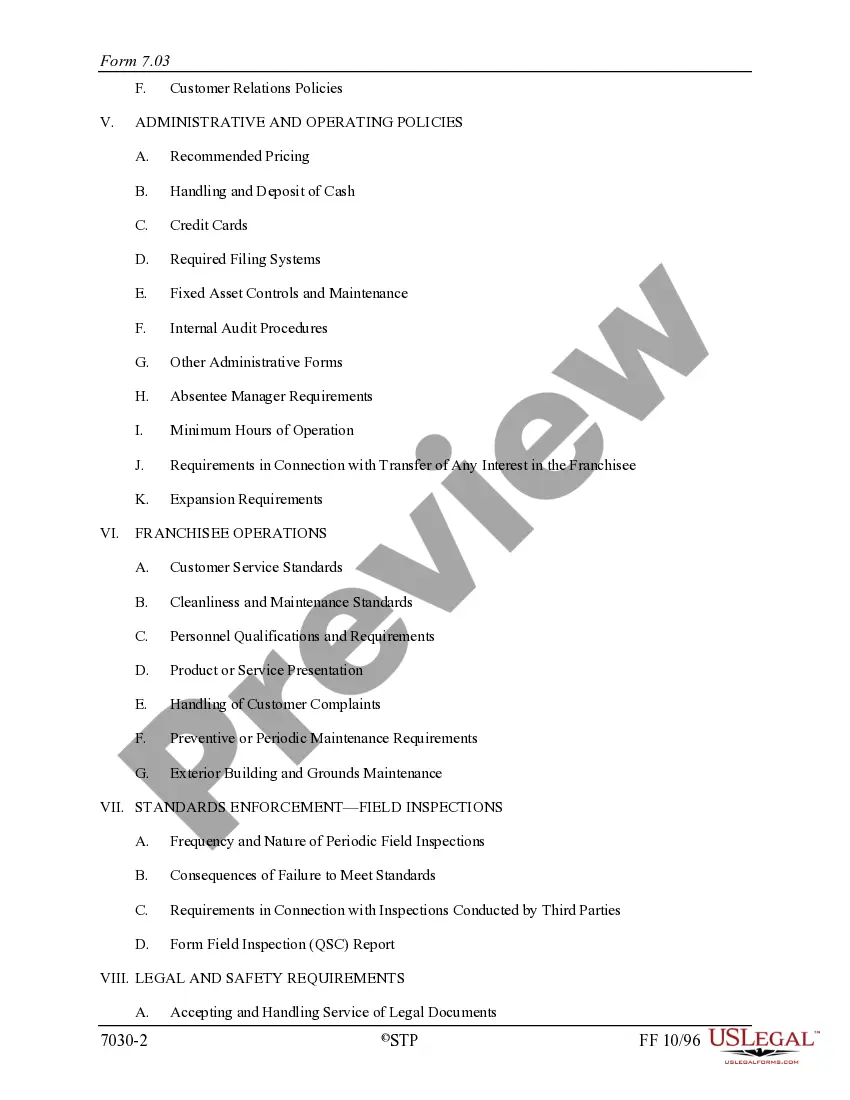

California Operations Manual Checklist is a comprehensive document designed to assist businesses and organizations operating in California in ensuring compliance with relevant laws, regulations, and industry standards. This checklist serves as a guide to identify areas where policies, procedures, and operational practices need to be reviewed and updated to align with legal requirements. The California Operations Manual Checklist covers various key areas that are essential for businesses to operate legally and ethically in the state. It includes sections that address: 1. Employment practices: This section focuses on California-specific labor laws, such as minimum wage requirements, employee benefits, wage and hour regulations, and anti-discrimination laws. 2. Workplace safety: It outlines safety measures that employers must implement to comply with California Occupational Safety and Health Administration (Cal/OSHA) standards, including hazard identification, safety training, and reporting of workplace injuries and illnesses. 3. Environmental compliance: This part of the checklist highlights regulations and permits relating to environmental sustainability, waste management, pollution control, air quality, and water conservation specific to California. 4. Data protection and privacy: California has strict data protection laws, including the California Consumer Privacy Act (CCPA). This section covers compliance requirements for businesses dealing with consumer data, data breach notifications, and the need for privacy policies. 5. Licensing and permits: California Operations Manual Checklist may include a section on licenses and permits that businesses need to obtain from specific state or local authorities. This may vary based on the industry, such as food establishment licenses, alcohol permits, or professional practice licenses. 6. Consumer protection: This section addresses regulations specific to consumer rights and protections, such as refund policies, warranty obligations, advertising standards, and product labeling requirements. 7. Tax regulations: California has its own set of tax laws that businesses must adhere to. The checklist may provide guidance on various tax obligations, including sales tax, income tax, payroll tax, and any specific industry-related taxes. Different types of California Operations Manual Checklists may exist based on specific industries or organizational needs. For example: 1. Healthcare sector: A California Operations Manual Checklist designed for healthcare facilities and organizations would focus on additional compliance areas, such as patient privacy (HIPAA), medical waste disposal, and accreditation requirements. 2. Food service industry: The checklist for restaurants, cafés, or any businesses involved in food preparation and service may include specific regulations related to food handling, hygiene, and health inspections. 3. Construction and contracting: This type of checklist would address construction-related permits, safety regulations, worker's compensation, and prevailing wage requirements set by California's Contractors State License Board (CSL). In conclusion, the California Operations Manual Checklist is an essential tool for businesses operating in California to ensure compliance with state laws and industry-specific regulations. It helps organizations review and update their policies, procedures, and operational practices to align with legal requirements, ultimately improving overall compliance and reducing the risk of regulatory penalties or lawsuits.

California Operations Manual Checklist

Description

How to fill out California Operations Manual Checklist?

Choosing the right authorized papers web template can be a have a problem. Naturally, there are a variety of templates available on the net, but how do you find the authorized develop you need? Make use of the US Legal Forms internet site. The service delivers 1000s of templates, for example the California Operations Manual Checklist, that you can use for business and personal needs. All of the forms are examined by professionals and satisfy state and federal requirements.

If you are already registered, log in to your profile and click on the Download switch to find the California Operations Manual Checklist. Make use of your profile to search throughout the authorized forms you possess acquired previously. Visit the My Forms tab of your profile and obtain one more backup of your papers you need.

If you are a whole new end user of US Legal Forms, listed below are easy recommendations for you to adhere to:

- Initially, make sure you have chosen the proper develop for your town/state. It is possible to check out the form utilizing the Preview switch and study the form outline to make certain this is basically the best for you.

- In case the develop fails to satisfy your preferences, make use of the Seach field to get the right develop.

- Once you are certain the form is suitable, select the Buy now switch to find the develop.

- Select the costs strategy you would like and enter the required details. Design your profile and purchase your order using your PayPal profile or credit card.

- Opt for the file structure and download the authorized papers web template to your device.

- Comprehensive, change and printing and signal the obtained California Operations Manual Checklist.

US Legal Forms is definitely the biggest library of authorized forms in which you can discover different papers templates. Make use of the service to download professionally-created files that adhere to express requirements.