California Model Asset Purchase and Sale Agreement

Description

How to fill out Model Asset Purchase And Sale Agreement?

Are you currently in the place that you need paperwork for either business or personal reasons almost every day time? There are plenty of lawful document web templates available online, but finding ones you can rely on is not simple. US Legal Forms provides a huge number of develop web templates, just like the California Model Asset Purchase and Sale Agreement, that are created in order to meet state and federal demands.

Should you be presently familiar with US Legal Forms internet site and get an account, merely log in. After that, you may obtain the California Model Asset Purchase and Sale Agreement web template.

Should you not provide an accounts and need to start using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is to the appropriate city/region.

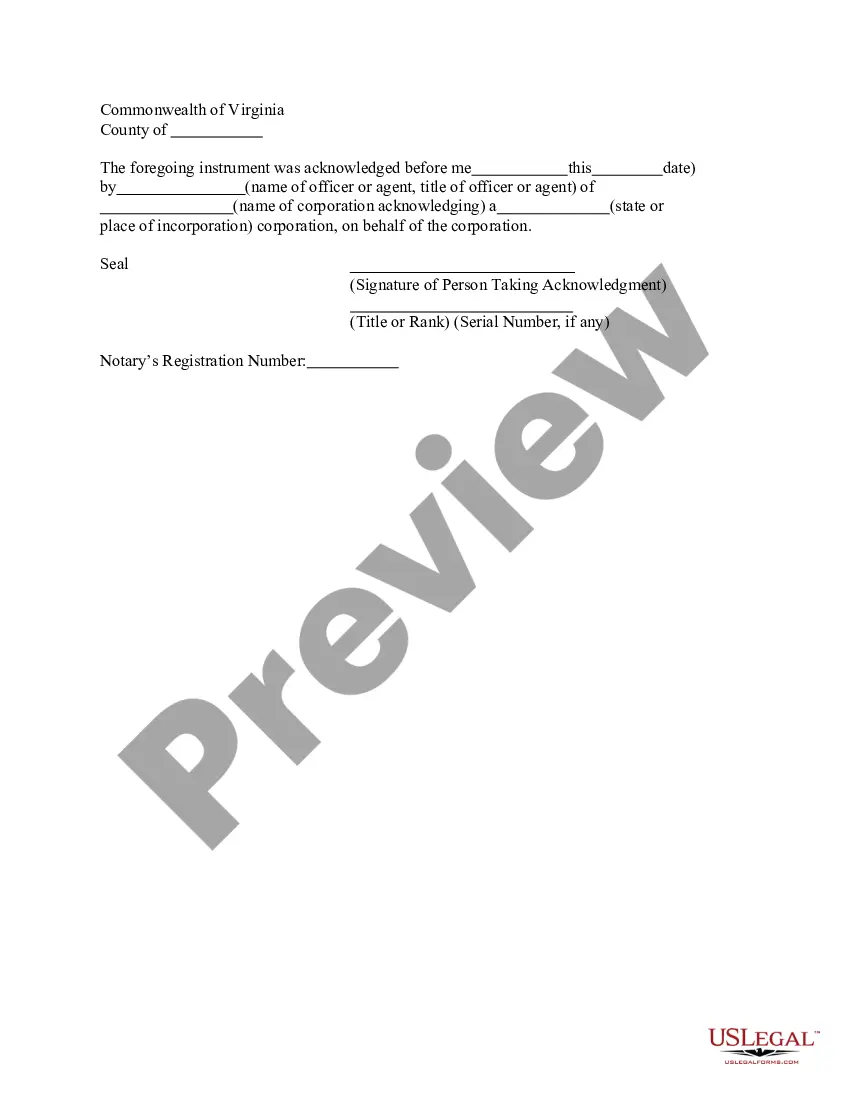

- Take advantage of the Review option to examine the shape.

- Read the outline to ensure that you have chosen the appropriate develop.

- When the develop is not what you are searching for, make use of the Look for industry to discover the develop that fits your needs and demands.

- Whenever you get the appropriate develop, just click Get now.

- Pick the rates strategy you want, fill in the required details to produce your account, and pay money for your order utilizing your PayPal or bank card.

- Select a handy data file structure and obtain your backup.

Discover all the document web templates you possess purchased in the My Forms food selection. You can aquire a extra backup of California Model Asset Purchase and Sale Agreement whenever, if possible. Just go through the essential develop to obtain or printing the document web template.

Use US Legal Forms, the most extensive assortment of lawful varieties, in order to save efforts and prevent blunders. The assistance provides appropriately produced lawful document web templates that you can use for a variety of reasons. Make an account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

Asset Sale Checklist List of Assumed Contracts. List of Liabilities Assumed. Promissory Note. Security Agreement. Escrow Agreement. Disclosure of Claims, Liens, and Security Interests. List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names. Disclosure of Licenses and Permits.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any.

A standard sales contract should include: Names and contact information for all involved parties. Description of the equipment. Payment terms. Delivery terms. Warranties and guarantees.

How to record disposal of assets Calculate the asset's depreciation amount. The first step is to ensure you have the accurate value of the asset recorded at the time of its disposal. ... Record the sale amount of the asset. ... Credit the asset. ... Remove all instances of the asset from other books. ... Confirm the accuracy of your work. How To Record Disposal of Assets in 5 Steps (With Examples) | Indeed.com indeed.com ? career-development ? how-to-... indeed.com ? career-development ? how-to-...

Once the intent to sell has been announced, interested buyers can submit bids for the assets. The seller then reviews and evaluates all bids before selecting a buyer. The next step is for the seller and buyer to negotiate and agree on a purchase price and other details of the deal. What Are The Steps Involved In A sale Of assets - FasterCapital fastercapital.com ? content ? What-Are-The-Steps... fastercapital.com ? content ? What-Are-The-Steps...

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory. Asset Sale vs. Stock Sale: What's The Difference? - Mariner Capital Advisors marinercapitaladvisors.com ? resources ? asset-sal... marinercapitaladvisors.com ? resources ? asset-sal...

Follow these steps to calculate the net results of any asset sales and record them ingly in your accounting: Determine the initial value of the assets. ... Calculate depreciation. ... Negotiate the sale price. ... Calculate loss or gain. ... Record your loss or gain. Guide to the Sale of Assets (Plus How To Record It) | Indeed.com indeed.com ? career-advice ? sale-of-asset indeed.com ? career-advice ? sale-of-asset