Title: California Information Sheet — When are Entertainment Expenses Deductible and Reimbursable Introduction: In California, understanding the rules and regulations surrounding deductible and reimbursable entertainment expenses is crucial for individuals and businesses alike. This information sheet serves as a comprehensive guide to help you navigate the tax implications and determine when you can deduct or seek reimbursement for such expenses. Overview of Deductible Entertainment Expenses: 1. Business Entertainment: — Networking events and company parties: Learn when these expenses can be fully or partially deductible. — Client meetings and entertainment: Explore the criteria that make these expenses deductible and how to substantiate them. — Business meals: Discover when meals become deductible and what documentation is required. 2. Travel and Entertainment Expenses: — Traveling for business purposes: Understand the deductible expenses associated with lodging, transportation, and meals while away from home. — Conferences and seminars: Determine when registration fees, accommodation, and related expenses are deductible. — Industry-related entertainment: Learn about reducibility when attending trade shows, conventions, or industry-related events. 3. Employee Entertainment Expenses: — Employer-provided parties or events: Explore the conditions which make these expenses fully or partially deductible. — Employee meals: Discover under what circumstances meals provided to employees are deductible. Reimbursable Entertainment Expenses: 1. Policies and Guidelines: — Identifying reimbursable entertainment expenses: Understand the criteria and documentation required to seek reimbursement. — Reimbursement limits: Learn about the maximum amounts or percentage caps on reimbursable expenses. 2. Record-Keeping Requirements: — Documentation for reimbursement: Discover the types of records necessary to support your claim for reimbursement. — Timeframe for reimbursement: Understand the timeline and procedures involved in claiming reimbursement. 3. Tax Implications: — Tax treatment of reimbursed expenses: Learn how reimbursed entertainment expenses are treated for tax purposes. — Reporting and withholding obligations: Understand the reporting responsibilities of employers when reimbursing entertainment expenses. Conclusion: This California Information Sheet provides vital information on the reducibility and reimbursement of entertainment expenses. By following the guidelines presented above, individuals and businesses can ensure compliance with California tax laws while making the most of deductible entertainment expenses and seeking reimbursement when applicable. Note: Different versions or categories of this information sheet can be created based on specific target audiences such as business owners, employees, or tax professionals seeking detailed guidance.

California Information Sheet - When are Entertainment Expenses Deductible and Reimbursable

Description

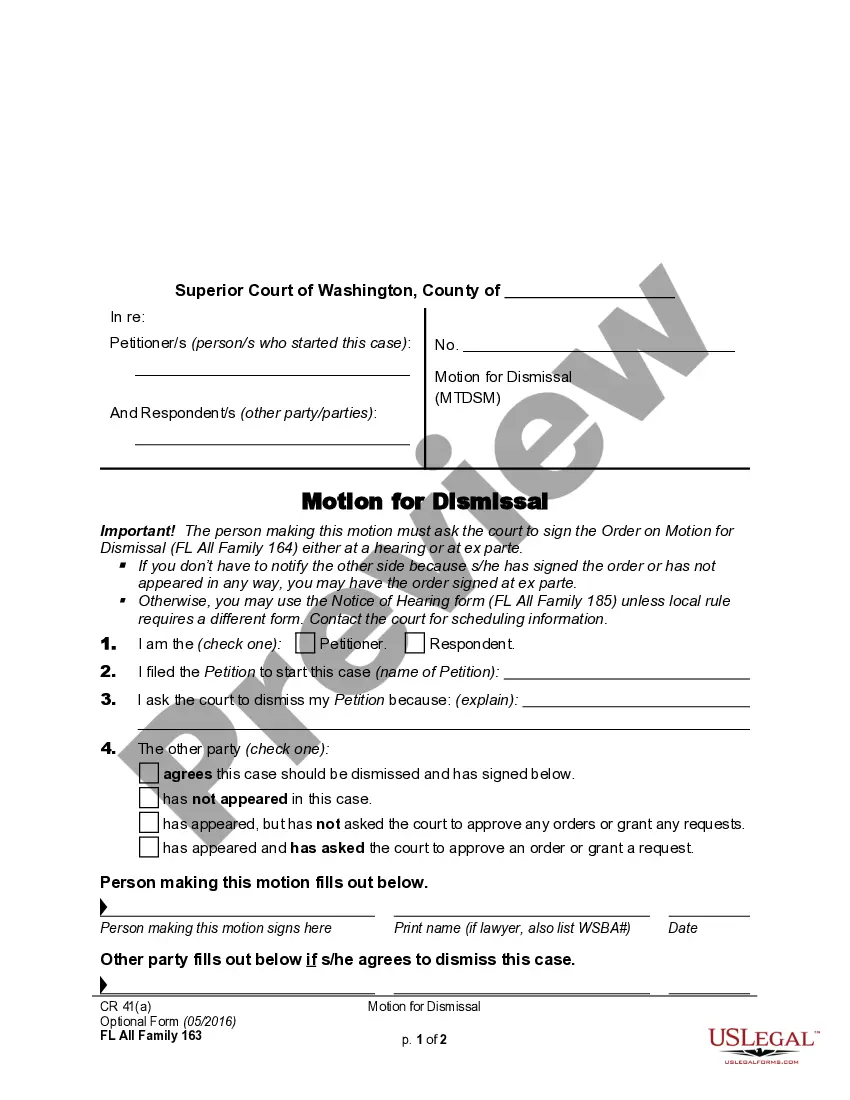

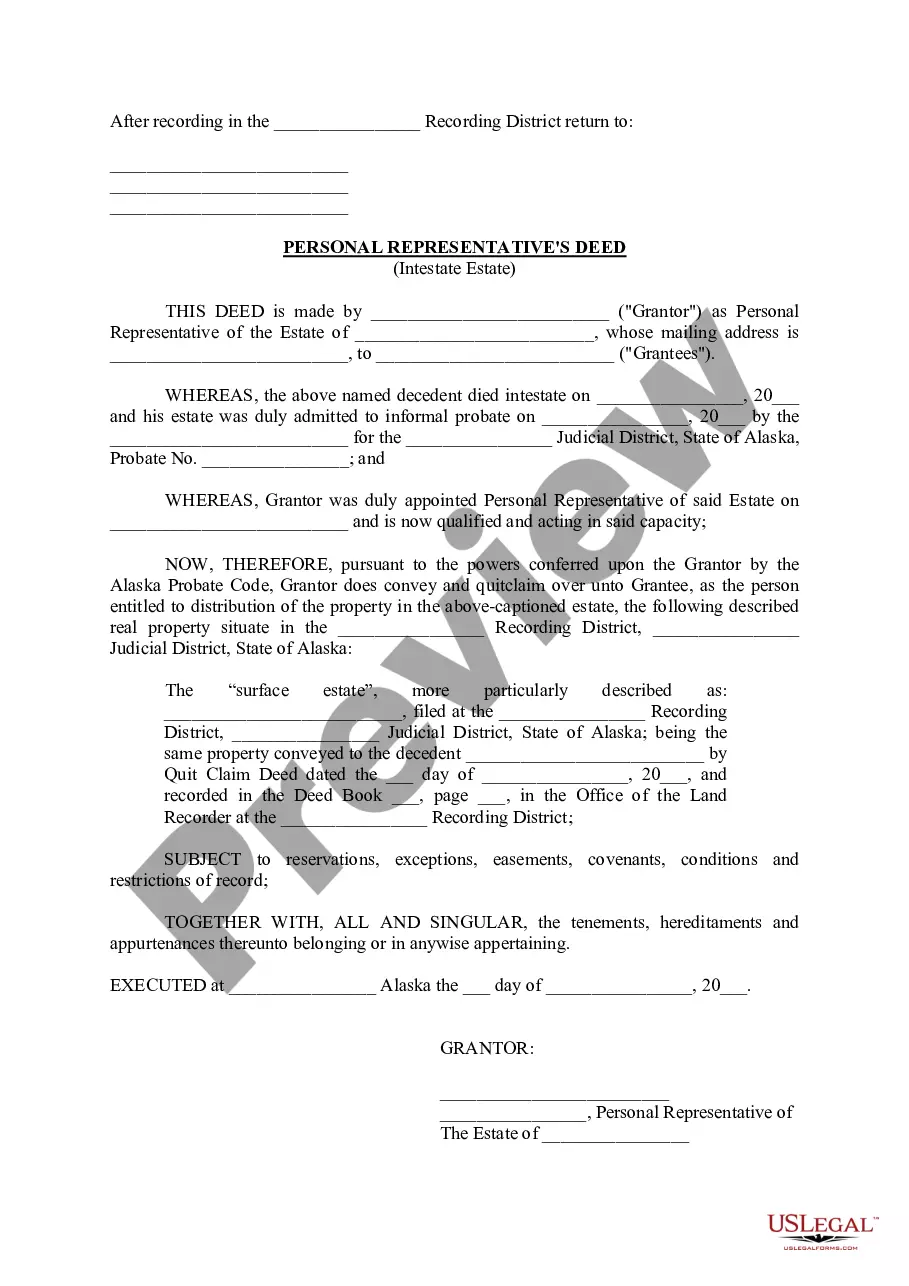

How to fill out California Information Sheet - When Are Entertainment Expenses Deductible And Reimbursable?

You may commit time online trying to find the legal file template that meets the federal and state demands you require. US Legal Forms offers 1000s of legal types which can be examined by pros. You can actually download or print out the California Information Sheet - When are Entertainment Expenses Deductible and Reimbursable from the support.

If you already have a US Legal Forms accounts, you can log in and click on the Down load key. After that, you can comprehensive, modify, print out, or signal the California Information Sheet - When are Entertainment Expenses Deductible and Reimbursable. Each and every legal file template you get is the one you have eternally. To get one more duplicate for any acquired type, proceed to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms site the first time, follow the straightforward instructions under:

- Initial, ensure that you have chosen the proper file template to the region/area of your liking. Look at the type information to ensure you have picked out the appropriate type. If accessible, utilize the Preview key to check through the file template at the same time.

- In order to get one more version from the type, utilize the Search industry to get the template that fits your needs and demands.

- Upon having identified the template you would like, click Purchase now to carry on.

- Find the prices program you would like, type in your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal accounts to cover the legal type.

- Find the file format from the file and download it in your gadget.

- Make alterations in your file if required. You may comprehensive, modify and signal and print out California Information Sheet - When are Entertainment Expenses Deductible and Reimbursable.

Down load and print out 1000s of file layouts while using US Legal Forms web site, that provides the most important selection of legal types. Use expert and express-certain layouts to take on your small business or individual demands.

Form popularity

FAQ

As part of the 2018 tax reform created by the Tax Cuts and Jobs Act (TCJA), Congress made several significant changes to the deductions for meals, entertainment, and employee fringe benefits, including making business entertainment expenses entirely nondeductible and reducing the deduction for most meals to 50%.

The deduction for unreimbursed non-entertainment-related business meals is generally subject to a 50% limitation. You generally can't deduct meal expenses unless you (or your employee) are present at the furnishing of the food or beverages and such expense is not lavish or extravagant under the circumstances.

2022 meals and entertainment deduction As part of the Consolidated Appropriations Act signed into law on December 27, 2020, the deductibility of meals is changing. Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. Entertaining clients (concert tickets, golf games, etc.)

Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible. However, team-building activities for employees are deductible.

The IRS on Wednesday issued final regulations (T.D. 9925) implementing provisions of the law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, that disallow a business deduction for most entertainment expenses.

Generally, the answer is that you can deduct ordinary and necessary expenses to entertain a customer or client if:Your expenses are of a type that qualifies as meals or entertainment.Your expenses bear the necessary relationship to your business activities.You keep adequate records and can substantiate the expenses.

Taxable Allowances Entertainment Allowance: Employees are allowed the lowest of the declared amount one-fifth of basic salary, actual amount received as allowance or Rs. 5,000. This is an allowance provided to employees to reimburse the expenses incurred on the hospitality of customers.

Answer. In short, no. But that's provided your employer completes the pay stub accurately as part of their expense reimbursement process. If they incorrectly lump the reimbursed amount with your wages, it's taxed.

The 2018 Tax Cuts and Jobs Act brought a few big changes to meals and entertainment deductions. The biggest one: entertainment expenses are no longer deudctible.

Businesses will be permitted to fully deduct business meals that would normally be 50% deductible. Although this change will not affect your 2020 tax return, the savings will offer a 100% deduction in 2021 and 2022 for food and beverages provided by a restaurant.