California Leave of Absence Salary Clarification refers to the process of obtaining clear and concise information regarding salary entitlements during a leave of absence in the state of California. This clarification helps employers, employees, and human resources professionals ensure accuracy and compliance with the applicable leave laws. California provides several types of leave of absence policies that employees may be eligible for, each with their own specific salary entitlements. These include: 1. Family and Medical Leave Act (FMLA): Under the FMLA, eligible employees can take up to 12 weeks of unpaid leave in a 12-month period for various reasons, including their health condition, the birth or adoption of a child, or to care for a family member with a serious health condition. 2. California Family Rights Act (CFA): The CFA provides similar provisions to the FMLA but applies specifically to employers with 50 or more employees. It allows eligible employees to take unpaid leave for the same reasons as the FMLA. 3. Pregnancy Disability Leave (PDL): California law mandates that employers with five or more employees must provide pregnancy disability leave for up to four months. During this time, pregnant employees are entitled to full pay if their employer provides other non-pregnancy-related short-term disability benefits. 4. Paid Family Leave (PFL): California offers a paid family leave program through the State Disability Insurance (SDI) program. Eligible employees can receive wage replacement benefits for up to eight weeks when taking time off to bond with a new child or to care for a seriously ill family member. 5. California Paid Sick Leave: Employees in California are entitled to accrue paid sick leave at a rate of one hour per every 30 hours worked, up to a maximum of 24 hours or three days per year. This leave can be used for personal illness, preventive care, or to care for a family member's illness. When an employee takes a leave of absence under any of these policies, it is important for both the employer and the employee to clarify the salary entitlements. Details to be clarified may include whether the leave will be paid or unpaid, the employee's rights to use accrued paid time off, calculation methods for salary continuation, and any supplemental benefits offered by the employer. By understanding the specific provisions of California leave of absence policies, employers can ensure compliance with the law and provide employees with accurate information and expectations regarding their salary during their time away from work. Clear communication and proper clarification of salary entitlements contribute to a smoother leave process and help maintain positive employee relations.

California Leave of Absence Salary Clarification

Description

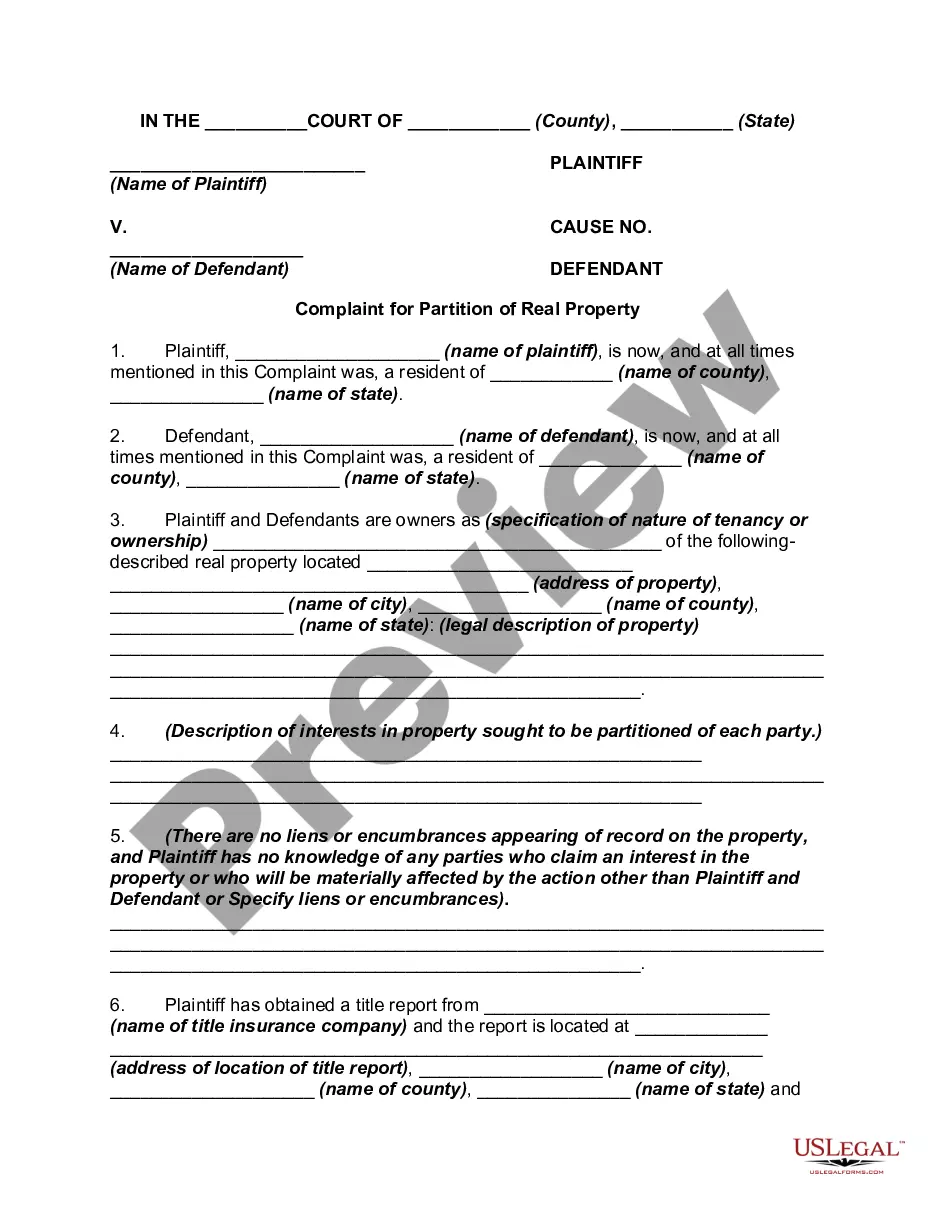

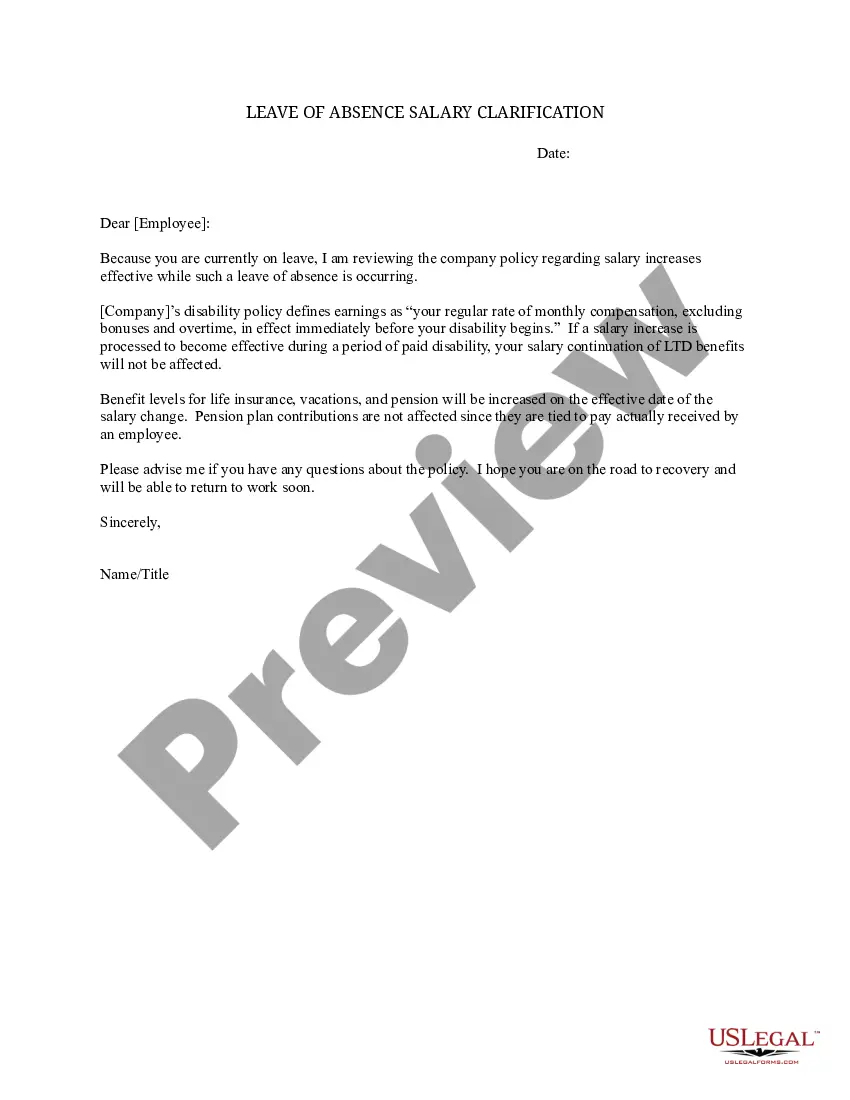

How to fill out California Leave Of Absence Salary Clarification?

Have you been in the situation the place you need files for either enterprise or person purposes almost every day time? There are a lot of authorized document web templates available on the net, but finding versions you can depend on isn`t effortless. US Legal Forms offers a large number of type web templates, like the California Leave of Absence Salary Clarification, which can be composed to meet state and federal needs.

If you are presently informed about US Legal Forms website and have an account, just log in. Following that, you can download the California Leave of Absence Salary Clarification web template.

If you do not provide an bank account and need to begin using US Legal Forms, abide by these steps:

- Get the type you want and ensure it is for your appropriate city/county.

- Utilize the Preview button to examine the shape.

- Browse the explanation to ensure that you have selected the proper type.

- In case the type isn`t what you`re trying to find, utilize the Lookup area to discover the type that meets your needs and needs.

- Whenever you get the appropriate type, simply click Buy now.

- Select the pricing strategy you desire, submit the necessary information to generate your money, and pay for the order making use of your PayPal or charge card.

- Choose a practical file format and download your backup.

Get all the document web templates you may have purchased in the My Forms menus. You can obtain a more backup of California Leave of Absence Salary Clarification anytime, if required. Just select the necessary type to download or produce the document web template.

Use US Legal Forms, by far the most substantial assortment of authorized kinds, to save time as well as stay away from blunders. The services offers expertly created authorized document web templates that can be used for a range of purposes. Generate an account on US Legal Forms and initiate generating your daily life a little easier.