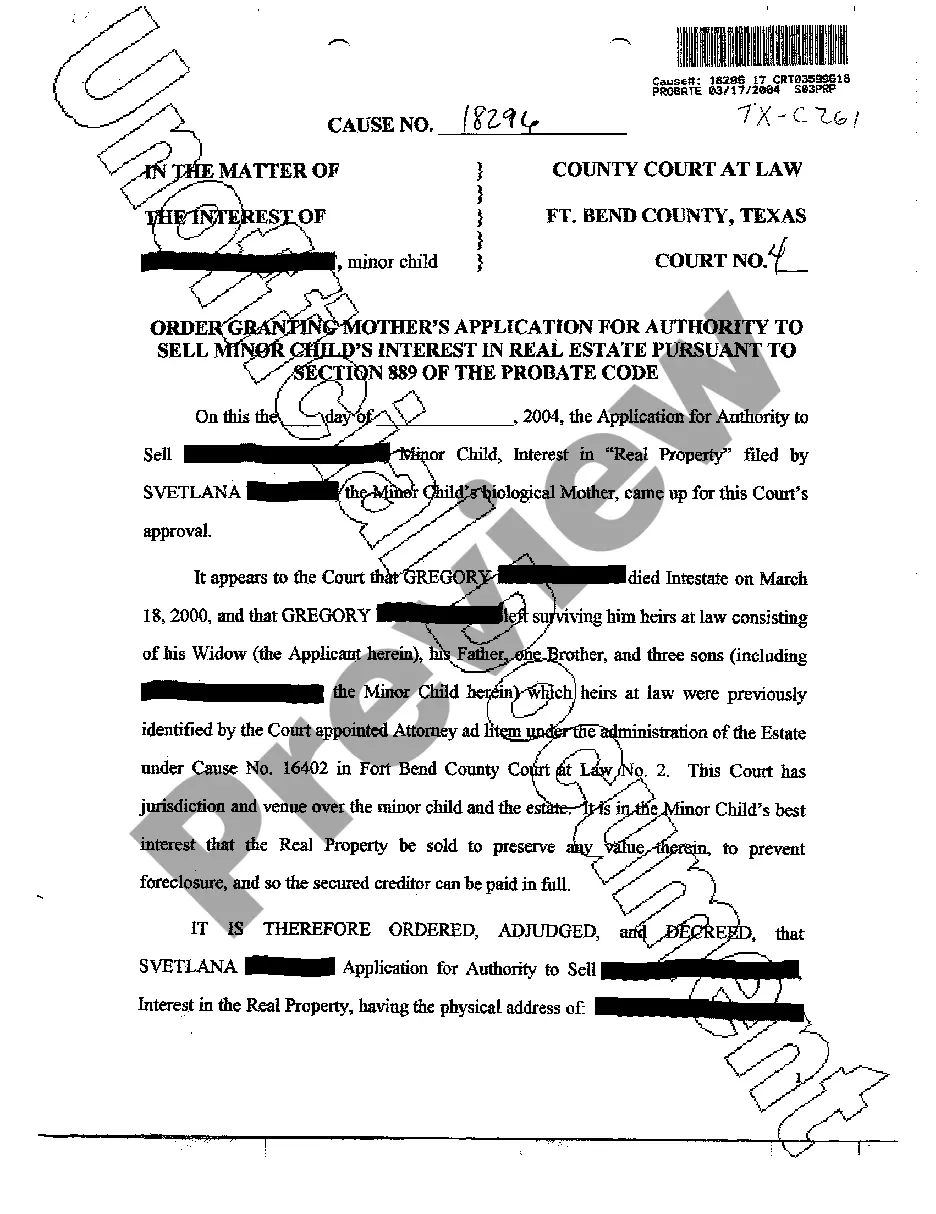

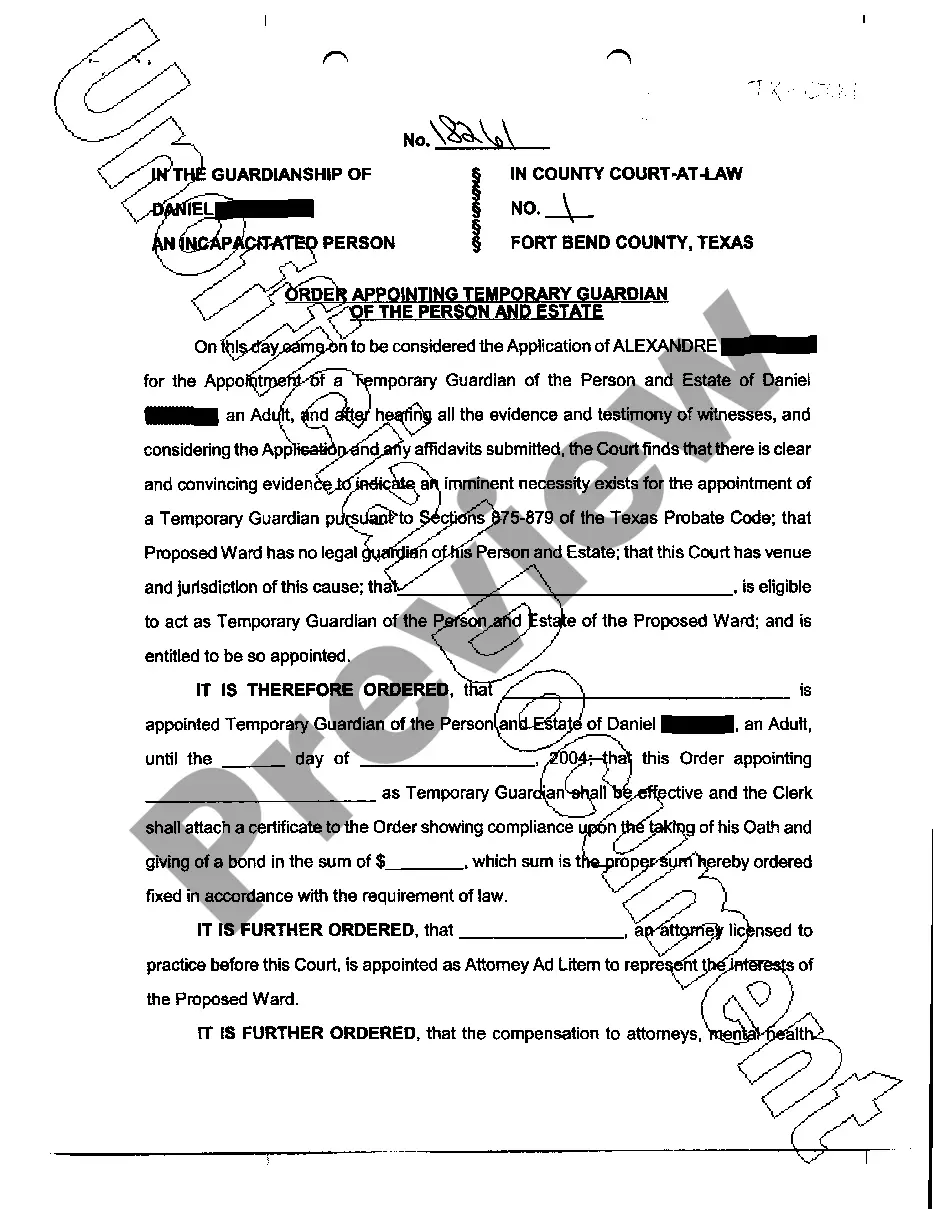

California Worksheet Analyzing a Self-Employed Independent Contractor is a comprehensive tool designed to assess the employment status and factors influencing the classification of an individual as an independent contractor in the state of California. This worksheet is especially crucial for businesses and individuals engaging in independent contracting arrangements to ensure compliance with California labor laws. Keywords: California, worksheet, analyzing, self-employed, independent contractor. The California Worksheet Analyzing a Self-Employed Independent Contractor helps businesses and individuals navigate the nuanced guidelines provided by the California Labor Code and various court cases in determining whether an individual should be classified as an independent contractor or an employee. It is important to understand that misclassification can lead to significant legal and financial consequences, such as employment tax liabilities, wage and hour violations, and denial of worker protections. The worksheet examines several factors that are considered when determining an individual's employment status, including but not limited to: 1. Control: Assessing the level of control the hiring entity has over the worker's activities, such as the ability to dictate work hours, methods, and key job responsibilities. 2. Financial arrangement: Evaluating how the compensation structure is set up, including whether the worker is paid a fixed fee, hourly rate, or project-based payment. 3. Tools and equipment: Considering who provides the necessary tools, equipment, and supplies needed to perform the work. 4. Independence: Assessing whether the worker operates an independent business, has the freedom to provide services to multiple clients, and bears the risk of profit or loss. 5. Integration: Examining how closely the worker's services are integrated into the hiring entity's core business operations. By analyzing these factors and providing detailed responses to questions in the worksheet, businesses and self-employed individuals can evaluate the likelihood of the worker being classified as an independent contractor in California. It also gives insights into potential areas of concern or factors that may prompt the reclassification of an independent contractor as an employee. Different types of California Worksheet Analyzing a Self-Employed Independent Contractor may include variations based on the specific industry or occupation involved. For example, there may be unique considerations for independent contractors in fields such as construction, trucking, or software development. Customized worksheets might incorporate additional factors relevant to those industries to ensure a comprehensive analysis. Overall, the California Worksheet Analyzing a Self-Employed Independent Contractor is a valuable tool for businesses and individuals alike to evaluate the proper classification of workers in accordance with California labor laws. It enables them to make informed decisions and take necessary actions to ensure compliance, mitigate risks, and maintain a fair and legally compliant working relationship with independent contractors.

California Worksheet Analyzing a Self-Employed Independent Contractor

Description

How to fill out California Worksheet Analyzing A Self-Employed Independent Contractor?

US Legal Forms - one of several greatest libraries of legitimate forms in the USA - provides an array of legitimate record layouts you can obtain or print. While using site, you may get thousands of forms for business and individual purposes, categorized by groups, says, or search phrases.You can find the most up-to-date types of forms such as the California Worksheet Analyzing a Self-Employed Independent Contractor within minutes.

If you already possess a monthly subscription, log in and obtain California Worksheet Analyzing a Self-Employed Independent Contractor in the US Legal Forms library. The Obtain key will show up on every form you look at. You gain access to all earlier delivered electronically forms inside the My Forms tab of your respective accounts.

In order to use US Legal Forms the first time, here are easy recommendations to obtain started:

- Be sure you have picked the correct form for your town/state. Click on the Review key to analyze the form`s articles. Look at the form description to ensure that you have chosen the right form.

- If the form doesn`t suit your requirements, utilize the Lookup area at the top of the display screen to discover the one who does.

- In case you are satisfied with the shape, verify your choice by clicking on the Acquire now key. Then, opt for the pricing plan you want and provide your credentials to register on an accounts.

- Procedure the financial transaction. Make use of bank card or PayPal accounts to finish the financial transaction.

- Select the file format and obtain the shape on your own system.

- Make changes. Fill out, change and print and sign the delivered electronically California Worksheet Analyzing a Self-Employed Independent Contractor.

Each format you added to your money does not have an expiry date and it is your own property for a long time. So, if you want to obtain or print yet another version, just check out the My Forms area and click in the form you will need.

Obtain access to the California Worksheet Analyzing a Self-Employed Independent Contractor with US Legal Forms, probably the most extensive library of legitimate record layouts. Use thousands of professional and state-certain layouts that satisfy your small business or individual requirements and requirements.

Form popularity

FAQ

Independent contractor. n. a person or business which performs services for another person or entity under a contract between them, with the terms spelled out such as duties, pay, the amount and type of work and other matters.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Line 3 Federal tax classification This section defines how you, the independent contractor, is classified when it comes to federal taxes.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Some of the common characteristics of an independent contractor include:Furnishes equipment and has control over that equipment.Submits bids for jobs, contracts, or fixes the price in advance.Has the capacity to accept or refuse an assignment or work.Pay relates more to completion of a job.More items...

How do I know if I'm an independent contractor or an employee in California?You are paid by the hour.You work full-time for the company.You are closely supervised by the company.You received training from the company.You receive employee benefits.Your company provides the tools and equipment needed to work.More items...

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.07-Mar-2018

California's contractor laws state that an independent contractor is a person or business who provides a specific service to another company in exchange for compensation. It further says that the independent contractor is under managerial control for results and not how he or she accomplishes the work.

You are probably an independent contractor if:You are paid by the job.You set your own working hours.You provide the tools and equipment needed to do your job.You work for more than one company at a time.You pay your own business and traveling expenses.You hire and pay your own assistants.More items...

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.