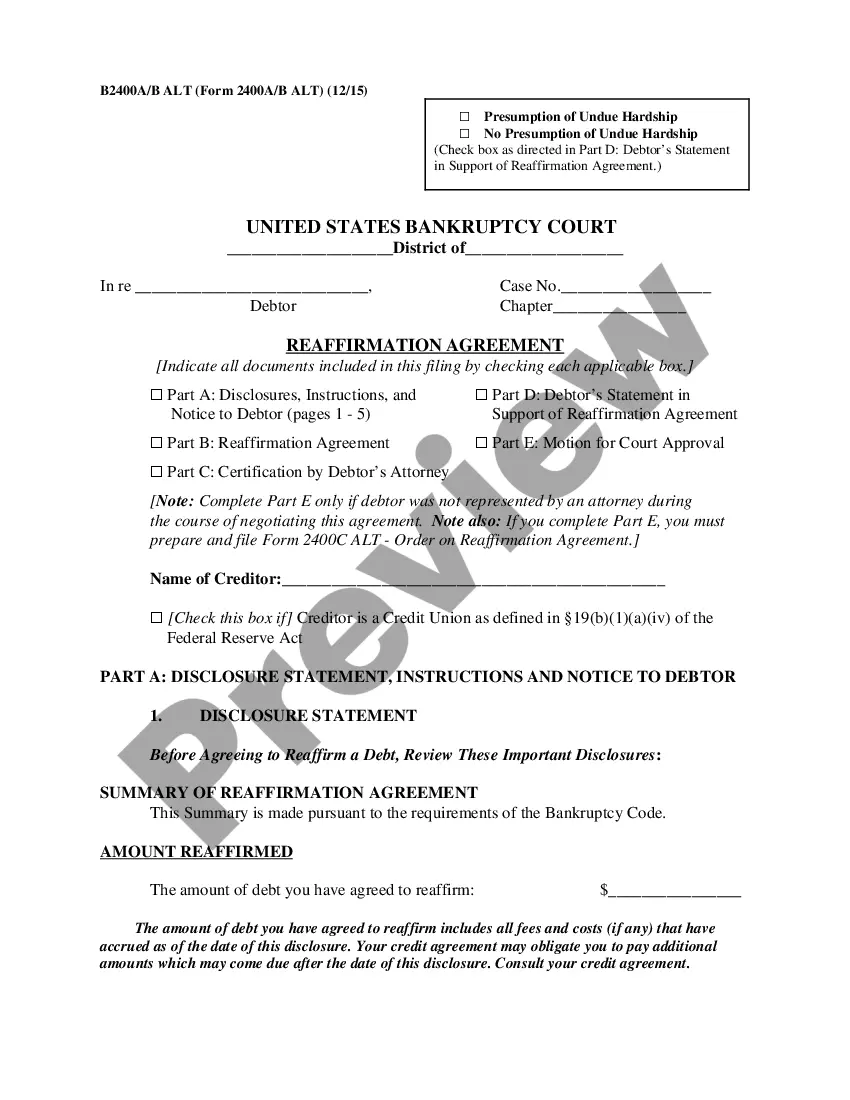

California Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

You may commit hours on the web looking for the authorized papers design which fits the federal and state needs you will need. US Legal Forms supplies a huge number of authorized kinds which are examined by experts. It is possible to down load or printing the California Reaffirmation Agreement, Motion and Order from our service.

If you currently have a US Legal Forms profile, you may log in and then click the Obtain option. Next, you may total, edit, printing, or sign the California Reaffirmation Agreement, Motion and Order. Each authorized papers design you purchase is the one you have for a long time. To get yet another duplicate associated with a bought type, check out the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms site for the first time, stick to the basic guidelines beneath:

- Initially, ensure that you have chosen the best papers design for that area/town of your choosing. Read the type information to ensure you have picked out the proper type. If available, utilize the Review option to search throughout the papers design too.

- In order to get yet another model from the type, utilize the Research industry to find the design that fits your needs and needs.

- After you have discovered the design you need, simply click Buy now to continue.

- Pick the prices prepare you need, enter your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can use your bank card or PayPal profile to pay for the authorized type.

- Pick the format from the papers and down load it to your product.

- Make adjustments to your papers if necessary. You may total, edit and sign and printing California Reaffirmation Agreement, Motion and Order.

Obtain and printing a huge number of papers themes using the US Legal Forms web site, which offers the biggest collection of authorized kinds. Use professional and status-specific themes to take on your small business or specific requires.

Form popularity

FAQ

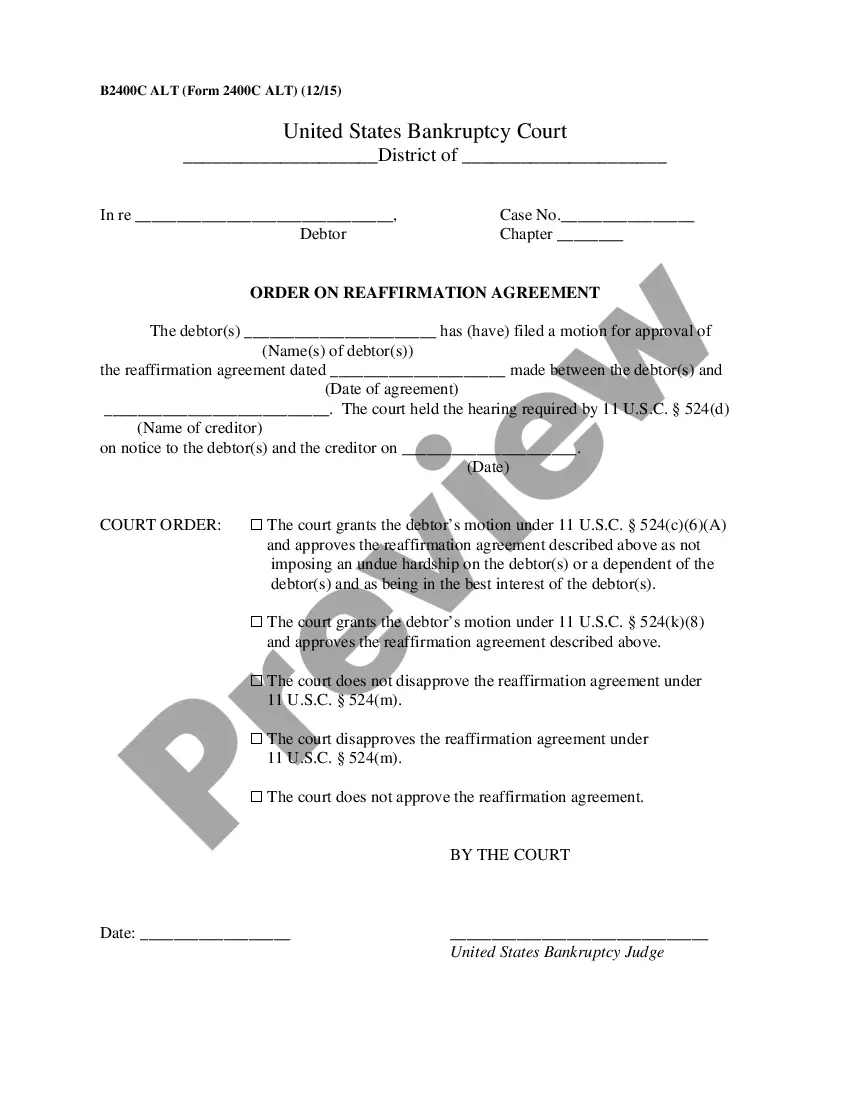

Reaffirmation agreements can be rescinded any time before the Court issues the discharge, or within 60 days after the agreement is filed with the Court, whichever is the later. Notice of the rescission must be given to the creditor.

Reaffirming a debt informs the lender that you intend to continue to pay the loan. Generally, the lender will continue to report the loan and all payments made on that loan to the credit reporting agencies, which may help improve your credit score after bankruptcy, provided timely payments are made on the loan.

A reaffirmed debt remains your personal legal obligation to pay. Your reaffirmed debt is not discharged in your bankruptcy case. That means that if you default on your reaffirmed debt after your bankruptcy case is over, your creditor may be able to take your property or your wages.

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.

In this article, you'll learn that lenders sometimes agree to new terms when completing a reaffirmation agreement, including lowering the amount owed, interest rate, or monthly payment. A local bankruptcy lawyer can help you with the negotiation process.

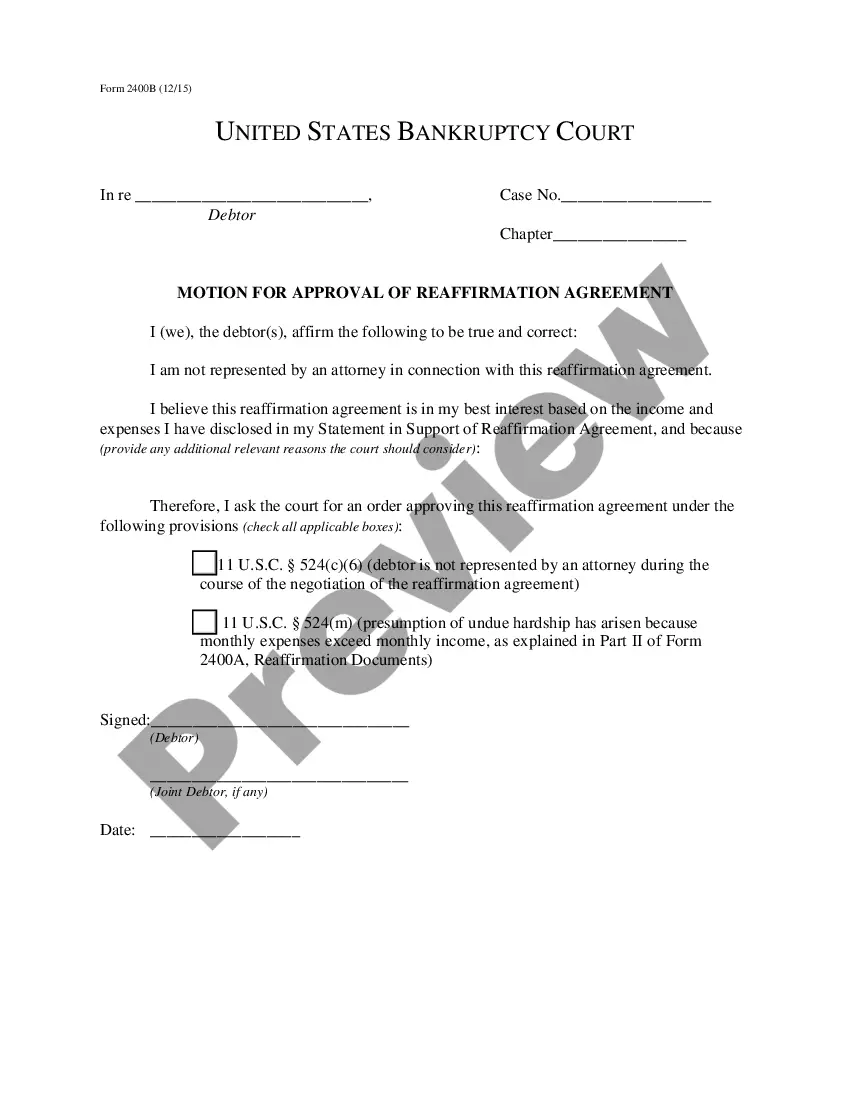

If I deny the motion to reaffirm the debt, you are under no legal responsibility to pay the creditor, but the creditor can seek to repossess the collateral (if there is any). However the creditor cannot obtain a judgment against you for the amount you owe on this debt.

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.

Agreeing to repay the excess loan amount in ance with the terms of the promissory note is called ?reaffirmation.? You can reaffirm an excess loan amount by signing a reaffirmation agreement with your loan servicer.