California Creditors Holding Unsecured Nonpriority Claims — Schedule — - Form 6F - Post 2005 is a document used in bankruptcy cases in California. This form allows creditors to list their unsecured nonpriority claims against the debtor. In bankruptcy proceedings, creditors holding unsecured nonpriority claims refer to individuals or entities that have loaned money or extended credit to the debtor without any collateral. These claims do not have a higher priority compared to other debts, such as taxes or secured loans. Therefore, they are treated equally in the distribution of assets during the bankruptcy process. The Schedule F form is an important tool for creditors to assert their claims and participate in the bankruptcy case. It requires detailed information about the creditor, debtor, and the nature of the debt. This information helps the court and the trustee understand the scope of the creditor's claim and determine how it should be treated in the bankruptcy proceedings. Post 2005 refers to claims filed after the adoption of the Bankruptcy Abuse Prevention and Consumer Protection Act (BAP CPA) in 2005. This act introduced various changes to the bankruptcy code, including stricter eligibility requirements and additional paperwork. The Schedule F form was revised to comply with these changes and ensure accurate reporting of unsecured nonpriority claims. Types of California Creditors Holding Unsecured Nonpriority Claims — Schedule — - Form 6F - Post 2005 may include: 1. Credit card companies: Credit card issuers who have provided credit to the debtor without any collateral security. 2. Personal loans: Individuals or entities that have lent money to the debtor for personal use or business purposes without any collateral. 3. Medical service providers: Healthcare professionals or institutions that have provided medical services to the debtor on credit. 4. Utility companies: Providers of essential services like electricity, water, or gas that have outstanding bills owed by the debtor. 5. Small businesses: Suppliers or vendors who have extended trade credit to the debtor for goods or services rendered. 6. Landlords: Property owners who are owed unpaid rent or lease payments by the debtor. It is crucial for creditors to accurately complete the Schedule F form by providing comprehensive details of their claims. Failure to do so may result in the creditor's claim being deemed invalid or receiving a lesser priority in the distribution of assets.

California Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005

Description

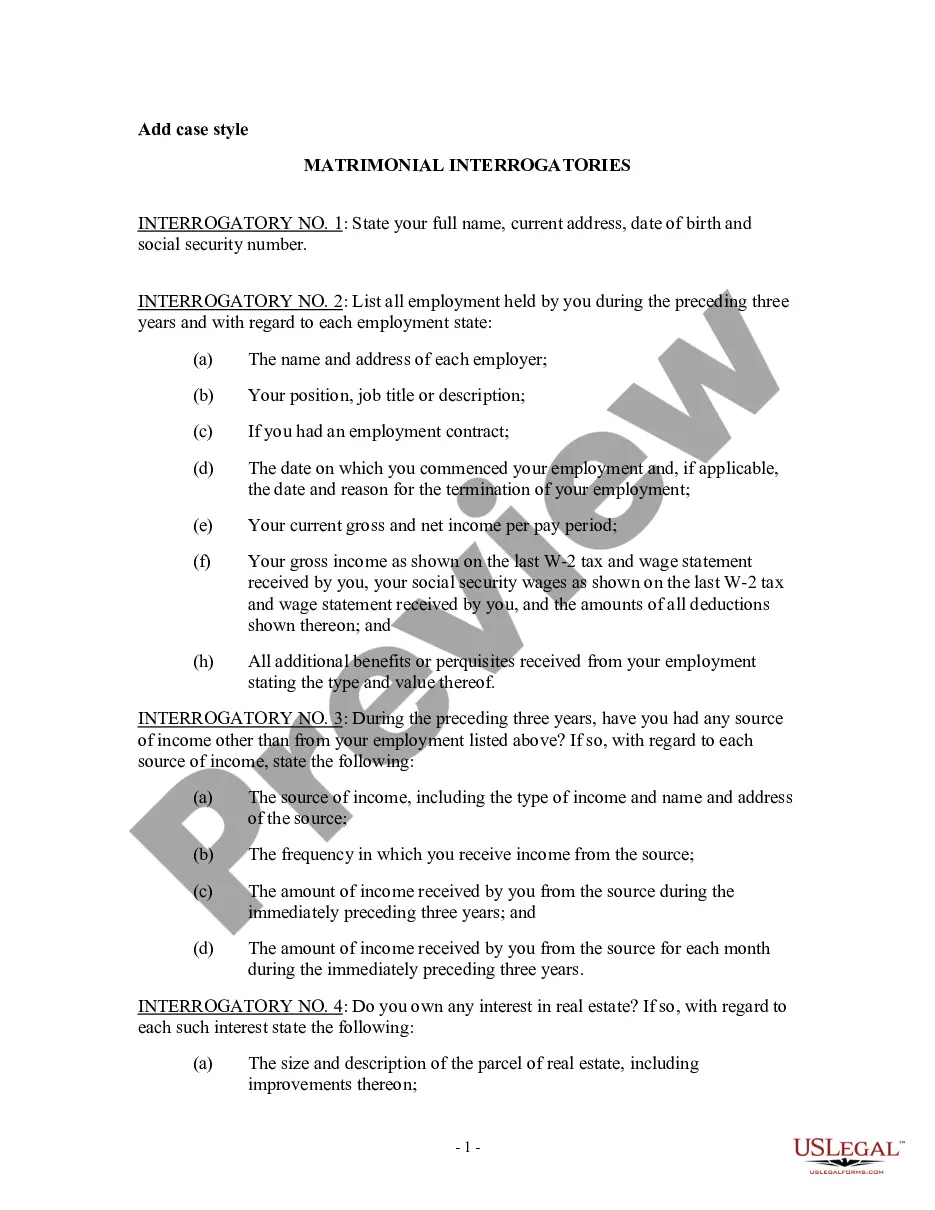

How to fill out California Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005?

You are able to invest hours online attempting to find the legitimate file format that meets the federal and state demands you need. US Legal Forms gives thousands of legitimate forms which can be evaluated by pros. You can easily obtain or printing the California Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005 from my support.

If you currently have a US Legal Forms accounts, you may log in and click on the Acquire key. After that, you may complete, edit, printing, or indicator the California Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005. Every single legitimate file format you buy is yours forever. To obtain an additional copy associated with a bought type, check out the My Forms tab and click on the related key.

Should you use the US Legal Forms internet site for the first time, follow the simple directions below:

- Initially, ensure that you have chosen the best file format for the region/area of your choosing. See the type outline to make sure you have picked out the appropriate type. If offered, make use of the Review key to appear with the file format too.

- If you want to locate an additional version of the type, make use of the Look for area to find the format that meets your needs and demands.

- Upon having discovered the format you want, click on Acquire now to continue.

- Find the pricing strategy you want, enter your references, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your bank card or PayPal accounts to fund the legitimate type.

- Find the format of the file and obtain it to your device.

- Make modifications to your file if possible. You are able to complete, edit and indicator and printing California Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005.

Acquire and printing thousands of file web templates while using US Legal Forms Internet site, which provides the biggest selection of legitimate forms. Use expert and status-particular web templates to take on your organization or individual requires.

Form popularity

FAQ

Priority unsecured claims include the following types of claims: the administrative expenses of the Chapter 11 case, wage claims of up to $10,950 per employee, wage benefit claims of employees up to certain limits, consumer deposit claims of up to $2,425 each, most divorce-related claims, and tax claims.

Unsecured creditors are generally placed into two categories: priority unsecured creditors and general unsecured creditors. As their name suggests, unsecured priority creditors are higher in the pecking order than general unsecured creditors when it comes to claims over any assets in a bankruptcy filing.

A creditor with an unsecured claim has a promise to pay from the borrower but doesn't have a lien. There are two types of unsecured claims: Priority unsecured claims. These debts aren't dischargeable in bankruptcy, and, if money is available, the claim will get paid before nonpriority unsecured claims.

Examples of unsecured debts include credit cards, medical expenses, utility bills, most taxes, and personal loans.

General unsecured claims have the lowest priority of all claims. After the bankruptcy estate pays administrative expenses, priority unsecured claims, and secured claims, general unsecured creditors will receive a pro rata (equal percentage) distribution of the remaining funds.

What is an Unsecured Claim? Unsecured claims are the opposite of secured claims: There is no property to seize, repossess, or foreclose upon. Examples of unsecured claims are child support debt, alimony debt, credit card debt, tax debts, and personal loans.

Under the priority system, certain unsecured creditors are entitled to full payment before other unsecured creditors receive anything at all. Whether a creditor filed a proof of claim form within the deadline also influences the order of payment.

Chapter 11 and Chapter 7 Creditor Recoveries Claims To begin, proceeds first get distributed to the most senior class of creditors until each class is paid in full before moving onto the next class and so forth, until there are no remaining proceeds left.

Non-Priority Unsecured Claims. Unsecured creditors do not have a lien, but for bankruptcy purposes, some unsecured debts, such as child support and alimony are ?priority debts,? and they cannot be discharged in bankruptcy. They are priorities above all other debts and will get paid before non-priority unsecured claims.

Priority Unsecured Debts Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims. In a Chapter 7 asset case, priority claims receive payment in full before any payments to general unsecured creditors. Priority debts are nondischargeable.