A California Amendment to Articles of Incorporation refers to the process of making changes or modifications to the existing articles of incorporation of a company registered in the state of California. This legal document plays a crucial role in updating and altering various aspects of the original articles in order to reflect the company's evolving structure, purpose, or other important details. Companies may need to pursue California Amendment to Articles of Incorporation for several reasons, such as changing the business name, adding or removing directors/shareholders/officers, updating the company's address, modifying the stated business purpose, extending the duration of the corporation, increasing/decreasing the authorized stock, or making any other significant changes to the initial articles. By filing an amendment, a corporation ensures that its legal document accurately reflects its current operations, goals, and structure. This process provides transparency and compliance with the Corporation Code of the state. Moreover, amendments help protect the company and its stakeholders by ensuring clear and accurate documentation of all modifications. There are different types of California Amendment to Articles of Incorporation based on the specific changes being made. Some commonly encountered types include: 1. Name Change Amendment: This type of amendment is pursued when a company wishes to change its legal name. The process requires the submission of a new name for approval, following which the articles of incorporation are modified to reflect the change. 2. Director/Officer/Shareholder Amendment: In cases where there is a change in the members of the corporation's board of directors, officers, or shareholders, an amendment is filed to reflect these changes accurately. 3. Address Change Amendment: When a company's principal office address or registered agent address changes, it is necessary to file an amendment to reflect the updated information. 4. Purpose Amendment: If a company wants to modify its stated business purpose or engage in an additional line of business, it must file a purpose amendment to update the articles of incorporation. 5. Stock Amendment: Companies that intend to increase or decrease the amount of authorized capital stock can file an amendment to reflect the revised stock figures. 6. Duration Amendment: An amendment may be filed to extend or reduce the duration of the corporation if specified in the original articles. It is important to note that pursuing a California Amendment to Articles of Incorporation necessitates following the specific guidelines and procedures outlined by the California Secretary of State. These requirements ensure that the amendment process is carried out in a legal and transparent manner, promoting accurate representation and compliance for the corporation.

California Amendment to Articles of Incorporation

Description

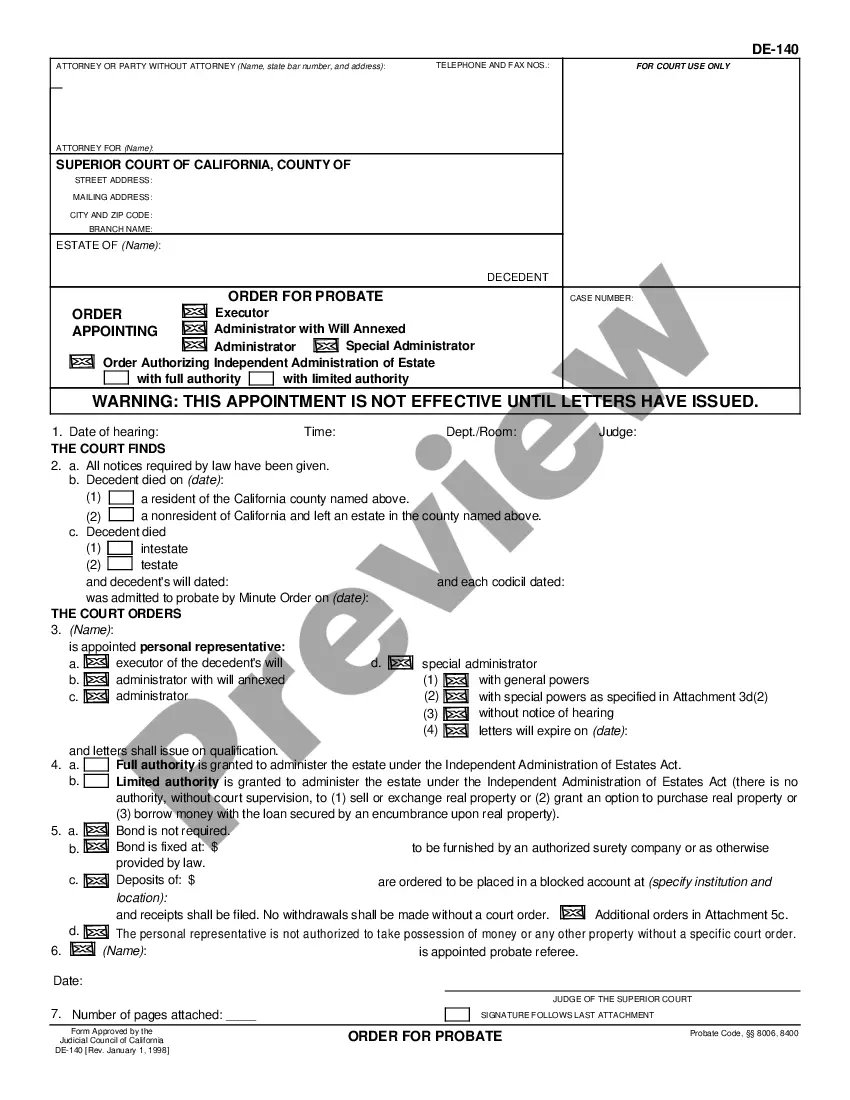

How to fill out California Amendment To Articles Of Incorporation?

Are you presently in the placement that you need to have documents for possibly business or specific uses virtually every day time? There are plenty of lawful papers layouts accessible on the Internet, but locating ones you can depend on is not easy. US Legal Forms gives thousands of form layouts, much like the California Amendment to Articles of Incorporation, which can be composed to fulfill state and federal specifications.

When you are already acquainted with US Legal Forms internet site and get a merchant account, merely log in. After that, you are able to down load the California Amendment to Articles of Incorporation template.

If you do not have an profile and would like to start using US Legal Forms, adopt these measures:

- Obtain the form you need and ensure it is for the appropriate metropolis/county.

- Make use of the Preview key to review the shape.

- Browse the description to actually have chosen the proper form.

- When the form is not what you`re searching for, utilize the Lookup field to get the form that fits your needs and specifications.

- When you obtain the appropriate form, click Purchase now.

- Opt for the prices program you desire, fill in the desired details to generate your account, and pay for an order with your PayPal or Visa or Mastercard.

- Pick a hassle-free paper structure and down load your duplicate.

Get all of the papers layouts you have bought in the My Forms food list. You can obtain a more duplicate of California Amendment to Articles of Incorporation whenever, if possible. Just select the necessary form to down load or print out the papers template.

Use US Legal Forms, probably the most substantial assortment of lawful kinds, to conserve time and stay away from faults. The assistance gives professionally produced lawful papers layouts which can be used for a selection of uses. Create a merchant account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

Within the articles of incorporation, you will need to list the name of your corporation, describe the operations of the business, include an agent for service, and mention if your corporation will issue stock.

Constitution and articles of association You'll need agreement from your shareholders before changing your company's articles of association - the rules about how your company is run. This can include changes to your company's 'objects' - what your company does as a business.

California Incorporation Filing Fee In addition, filing the California articles of incorporation including a filing carries a fee of $100, plus a $15 handling fee. You must also file an initial report giving detailed information about your company, which includes a fee of $25 and a $75 service fee.

The Certificate of Amendment can be mailed to Secretary of State, Document Filing Support Unit, 1500 11th Street, 3rd Floor, Sacramento, CA 95814 or delivered in person (drop off) to the Sacramento office. Certificates of Amendment are filed only in the Secretary of State's Sacramento office.

The Articles of Amendment, also sometimes called a Certificate of Amendment, is a document filed with your state of incorporation (or any states in which your company has foreign qualified to transact business), to enact a specific change to the information included in your company's incorporation or qualification ...

If you want to amend your California articles of incorporation, you must file a Certificate of Amendment of Articles of Incorporation form with the California Secretary of State (SOS) by mail or in person. Checks should be payable to the Secretary of State.

The voting requirements for membership approval of bylaw amendments and restatements are normally found in an association's bylaws. In the event the bylaws fail to include an amendment provision, they may be amended by a majority of those members voting once a quorum has been established. (Corp. Code § 7150(b).)