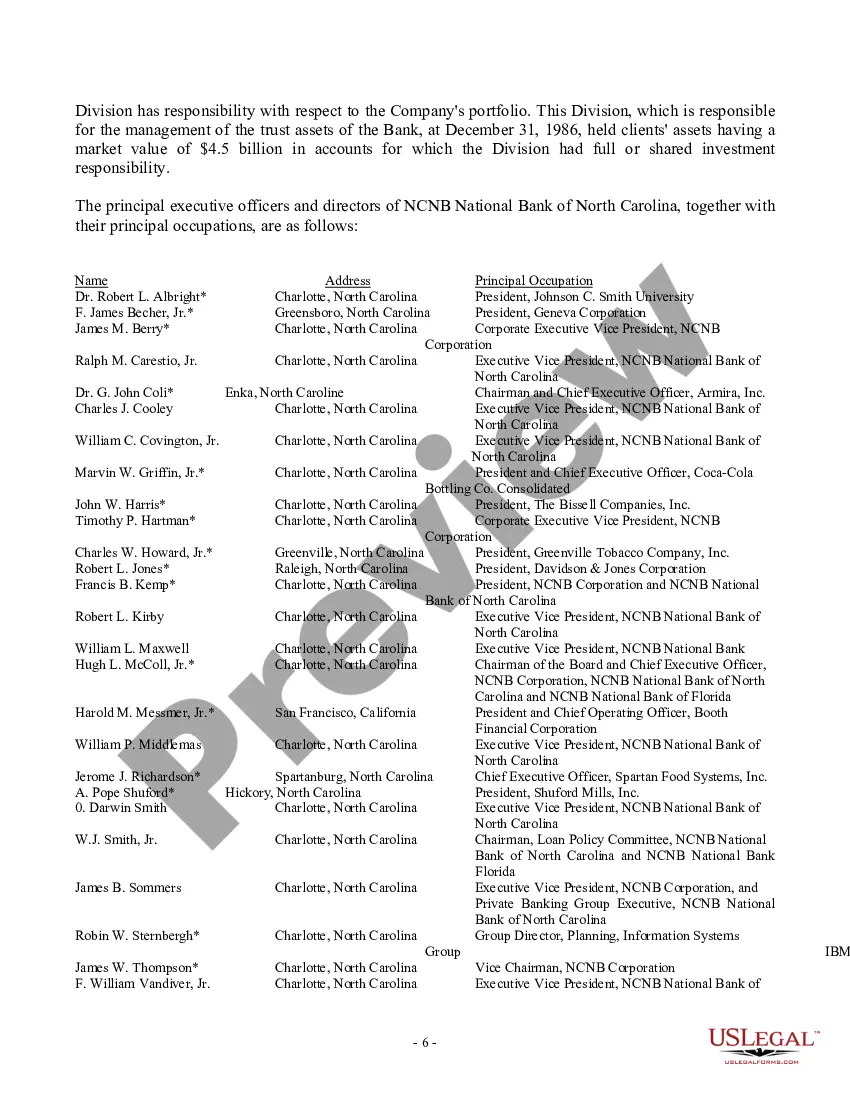

Title: California Proxy Statement — Hatteras Income Securities, Inc.: Exploring Its Types, Purpose, and the Copy of Advisory Agreement Introduction: The California Proxy Statement serves as a crucial document that holds significance for shareholders of Hatteras Income Securities, Inc. This article aims to provide a detailed description of what a California Proxy Statement is, shedding light on its various types, the purpose it serves, and its relation to the advisory agreement. 1. Understanding California Proxy Statement: A California Proxy Statement is a legal document filed by companies in the state to solicit votes from shareholders for matters requiring their consent or approval. It is often prepared in compliance with the regulations set forth by the California Corporations Code and the U.S. Securities and Exchange Commission (SEC). 2. Purpose of California Proxy Statement: The primary purpose of a California Proxy Statement is to provide shareholders with important information about matters to be voted on during an annual or special meeting. Through this document, companies like Hatteras Income Securities, Inc. can inform shareholders about important decisions, such as appointments, mergers, acquisitions, amendments to corporate documents, executive compensation, and other relevant matters. It allows shareholders to cast their votes even if they are unable to attend the meeting in person. 3. Types of California Proxy Statement: a. Annual Proxy Statement: Hatteras Income Securities, Inc. prepares an Annual Proxy Statement each year to present matters requiring shareholder approval. This includes voting for directors, discussing financial statements, and approving the compensation of executives. b. Special Meeting Proxy Statement: In case of any important matters that require immediate shareholder attention between annual meetings, Hatteras Income Securities, Inc. may prepare a Special Meeting Proxy Statement. These statements address extraordinary events, such as mergers, acquisitions, or significant changes to corporate policies. 4. Advisory Agreement and its Relation: Accompanying the California Proxy Statement, Hatteras Income Securities, Inc. typically includes a copy of the advisory agreement. This agreement outlines the terms and conditions under which the company employs an investment advisor to manage its investment operations. It provides insight into the roles, responsibilities, compensation, and any potential conflicts of interest between the company and the advisor. Conclusion: The California Proxy Statement — Hatteras Income Securities, Inc. with a copy of the advisory agreement serves as a crucial communication tool that enables shareholders to exercise their voting rights and stay informed about key corporate decisions. Understanding the purpose and different types of proxy statements will allow shareholders to actively participate in shaping the company's future.

California Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement

Description

How to fill out California Proxy Statement - Hatteras Income Securities, Inc. With Copy Of Advisory Agreement?

Are you currently in the situation the place you require files for either company or person purposes virtually every day? There are tons of authorized record templates accessible on the Internet, but getting versions you can depend on is not effortless. US Legal Forms gives thousands of develop templates, much like the California Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement, that are written to satisfy federal and state demands.

In case you are currently knowledgeable about US Legal Forms web site and get an account, basically log in. Next, you are able to down load the California Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement design.

Should you not have an account and would like to begin using US Legal Forms, follow these steps:

- Get the develop you will need and make sure it is for the proper area/area.

- Make use of the Preview key to analyze the form.

- Browse the information to actually have chosen the correct develop.

- When the develop is not what you`re looking for, utilize the Look for discipline to discover the develop that fits your needs and demands.

- If you obtain the proper develop, just click Get now.

- Opt for the rates strategy you desire, fill out the required details to produce your account, and buy the order utilizing your PayPal or Visa or Mastercard.

- Pick a handy data file structure and down load your backup.

Discover all the record templates you possess bought in the My Forms menus. You can obtain a additional backup of California Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement whenever, if necessary. Just select the required develop to down load or produce the record design.

Use US Legal Forms, one of the most substantial variety of authorized kinds, to save lots of time as well as steer clear of mistakes. The service gives expertly manufactured authorized record templates which can be used for a variety of purposes. Generate an account on US Legal Forms and start making your life a little easier.