California Investment Management Agreement between Fund, Asia Management and NICAM

Description

How to fill out Investment Management Agreement Between Fund, Asia Management And NICAM?

Are you within a placement that you need to have documents for possibly enterprise or individual uses nearly every day time? There are a lot of legitimate papers templates available on the net, but finding kinds you can depend on isn`t straightforward. US Legal Forms provides 1000s of type templates, such as the California Investment Management Agreement between Fund, Asia Management and NICAM, that happen to be composed to fulfill federal and state demands.

In case you are already informed about US Legal Forms web site and possess a free account, basically log in. Afterward, you can acquire the California Investment Management Agreement between Fund, Asia Management and NICAM format.

If you do not offer an accounts and want to begin to use US Legal Forms, follow these steps:

- Obtain the type you require and make sure it is for the appropriate metropolis/state.

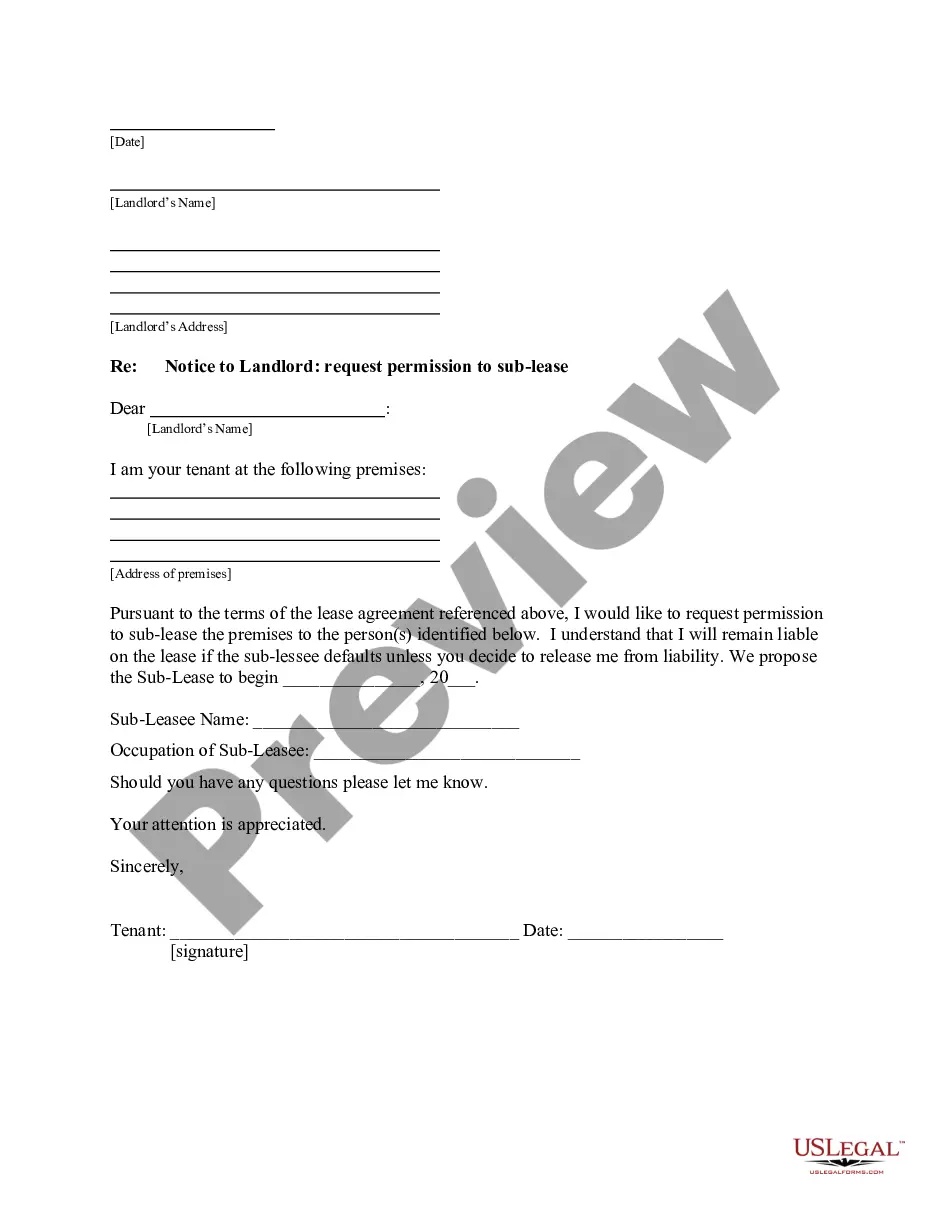

- Use the Preview switch to check the form.

- Browse the information to actually have chosen the appropriate type.

- In case the type isn`t what you`re looking for, make use of the Search discipline to get the type that meets your requirements and demands.

- When you find the appropriate type, click on Buy now.

- Choose the prices program you want, complete the required details to create your account, and pay money for your order with your PayPal or credit card.

- Decide on a hassle-free paper file format and acquire your duplicate.

Find all of the papers templates you may have purchased in the My Forms menu. You can obtain a extra duplicate of California Investment Management Agreement between Fund, Asia Management and NICAM at any time, if possible. Just click on the essential type to acquire or print out the papers format.

Use US Legal Forms, one of the most considerable variety of legitimate kinds, to conserve time and prevent mistakes. The services provides skillfully made legitimate papers templates that can be used for a range of uses. Create a free account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

An investment management agreement to be used in connection with a private equity fund's appointment of an investment manager. This agreement sets out the terms and conditions by which a fund vehicle agrees to pay advisory and management services fees and out-of-pocket expenses to an investment manager entity.

The management agreement is a binding legal agreement, generally between the fund's general partner on behalf of the fund and the fund's investment manager. This form management agreement provides an example of how to document the management fee and other elements of the fund and manager relationship.

What Is Funds Management? Funds management is the overseeing and handling of a financial institution's cash flow. The fund manager ensures that the maturity schedules of the deposits coincide with the demand for loans.

The key components of an IMA include identification of parties, scope of services, investment objectives and guidelines, investment restrictions, fees and expenses, performance measurement and reporting, risk management, confidentiality and data protection, termination and dispute resolution, and compliance with ...

In the financial world, the term "fund management" ultimately describes people and institutions that manage investments on behalf of investors. An example would be investment managers who fix the assets of pension funds for pension investors.

A funding agreement is an agreement between an issuer and an investor. While the investor provides a lump sum of money, the issuer guarantees a fixed rate of return over a time period. Funding agreements are popular with high-net-worth and institutional investors due to their low-risk, fixed-income nature.

An Individually Managed Account or IMA is a discretionary management agreement whereby clients delegate the day to day investment decisions and implementation of their chosen investment strategy to PPM while retaining the full beneficial ownership of their investments.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.