California Amendment to Section 5c of Employment Agreement with Copy of Agreement between Company and CEO: A Comprehensive Guide Introduction: In the business world, employment agreements play a crucial role in establishing the relationship between a company and its CEO. Within California, these agreements are governed by various laws and regulations to ensure fairness and protection for both parties involved. One such provision is the California Amendment to Section 5c of an Employment Agreement, which addresses specific matters pertaining to compensation, benefits, and other crucial terms. Overview of Section 5c: Section 5c of an employment agreement typically focuses on the compensation and benefits package provided to the CEO. As executive positions come with significant responsibilities, this section aims to outline the intricate details of the CEO's remuneration, including base salary, bonuses, stock options, retirement plans, and any other incentives. Purpose of the California Amendment: The California Amendment to Section 5c of an Employment Agreement holds particular significance due to its alignment with the state's employment regulations. Its primary purpose is to ensure compliance with California state laws, which often have stricter guidelines when compared to federal laws. The amendment becomes necessary to incorporate relevant provisions that address compensation, benefits, and contractual obligations specific to CEOs within California. Key Elements within the Amendment: 1. Compliance with California Labor Code: California has numerous labor codes and statutes that protect employees' rights. The amendment should explicitly state that all components of the CEO's compensation, benefits, and employment conditions comply with these labor laws. 2. Minimum Wage and Overtime: California has a higher minimum wage requirement than the federal rate. Therefore, the amendment should specify the CEO's base salary to meet or exceed the state's minimum wage laws. It should also outline the provision for overtime pay, if applicable. 3. Bonuses and Incentives: California Amendment to Section 5c identifies how bonuses and incentives are structured. It may reference specific performance goals, objectives, or company targets that must be achieved for the CEO to be eligible for such additional compensation. 4. Equity-Based Compensation: If the CEO is granted stock options, restricted stock units, or other forms of equity compensation, the amendment should provide comprehensive details regarding vesting schedules, exercise periods, and any limitations imposed by California law. 5. Termination Provisions: The amendment should outline the CEO's entitlements in case of termination, whether it be due to resignation, retirement, or termination by the company. This may include severance pay, continued benefits, and any related conditions that are consistent with California labor laws. Other Types of California Amendments to Section 5c: While the core elements mentioned above are crucial to any amendment to Section 5c, additional variations may arise based on the specific circumstances and requirements of the company and the CEO. Some other potential types of amendments could include: — Amendment regarding relocation expenses: If the CEO is required to relocate for the position, this amendment would outline the specifics of the relocation package, including reimbursement for moving costs, temporary housing, and other related expenses. — Amendment addressing non-competition clauses: If the CEO's employment agreement contains non-competition or non-solicitation clauses, the amendment could establish the scope, length, and geographical limitations of such restrictions, ensuring compliance with California law. — Amendment regarding change of control provisions: In situations where a change of control or acquisition occurs within the company, this type of amendment would address the CEO's entitlements, including severance packages, stock options acceleration, and post-employment benefits. Conclusion: The California Amendment to Section 5c of an Employment Agreement is a crucial aspect of CEO contracts within the state. By incorporating this amendment, both the company and the CEO can ensure compliance with California labor laws and establish clear terms for compensation, benefits, and termination provisions. It is essential to draft this amendment with careful attention to detail and seek legal counsel to ensure all relevant legal requirements and best practices are met.

California Amendment to Section 5c of Employment Agreement with copy of agreement between Company and CEO

Description

How to fill out California Amendment To Section 5c Of Employment Agreement With Copy Of Agreement Between Company And CEO?

You are able to spend hrs on-line trying to find the authorized document format that suits the state and federal demands you need. US Legal Forms provides thousands of authorized forms that are examined by specialists. You can easily acquire or print out the California Amendment to Section 5c of Employment Agreement with copy of agreement between Company and CEO from my service.

If you already have a US Legal Forms bank account, you can log in and click the Acquire option. Next, you can total, revise, print out, or signal the California Amendment to Section 5c of Employment Agreement with copy of agreement between Company and CEO. Every authorized document format you get is yours eternally. To have an additional backup of the obtained form, check out the My Forms tab and click the corresponding option.

If you work with the US Legal Forms site the very first time, adhere to the simple directions below:

- Initial, be sure that you have selected the right document format for the area/area of your liking. Browse the form information to ensure you have selected the appropriate form. If offered, make use of the Review option to search through the document format at the same time.

- If you wish to locate an additional edition from the form, make use of the Research discipline to find the format that meets your requirements and demands.

- Upon having discovered the format you desire, just click Purchase now to carry on.

- Pick the rates strategy you desire, type your credentials, and register for a free account on US Legal Forms.

- Complete the financial transaction. You can utilize your charge card or PayPal bank account to pay for the authorized form.

- Pick the structure from the document and acquire it for your product.

- Make alterations for your document if necessary. You are able to total, revise and signal and print out California Amendment to Section 5c of Employment Agreement with copy of agreement between Company and CEO.

Acquire and print out thousands of document templates using the US Legal Forms web site, which offers the largest assortment of authorized forms. Use specialist and status-specific templates to tackle your small business or specific demands.

Form popularity

FAQ

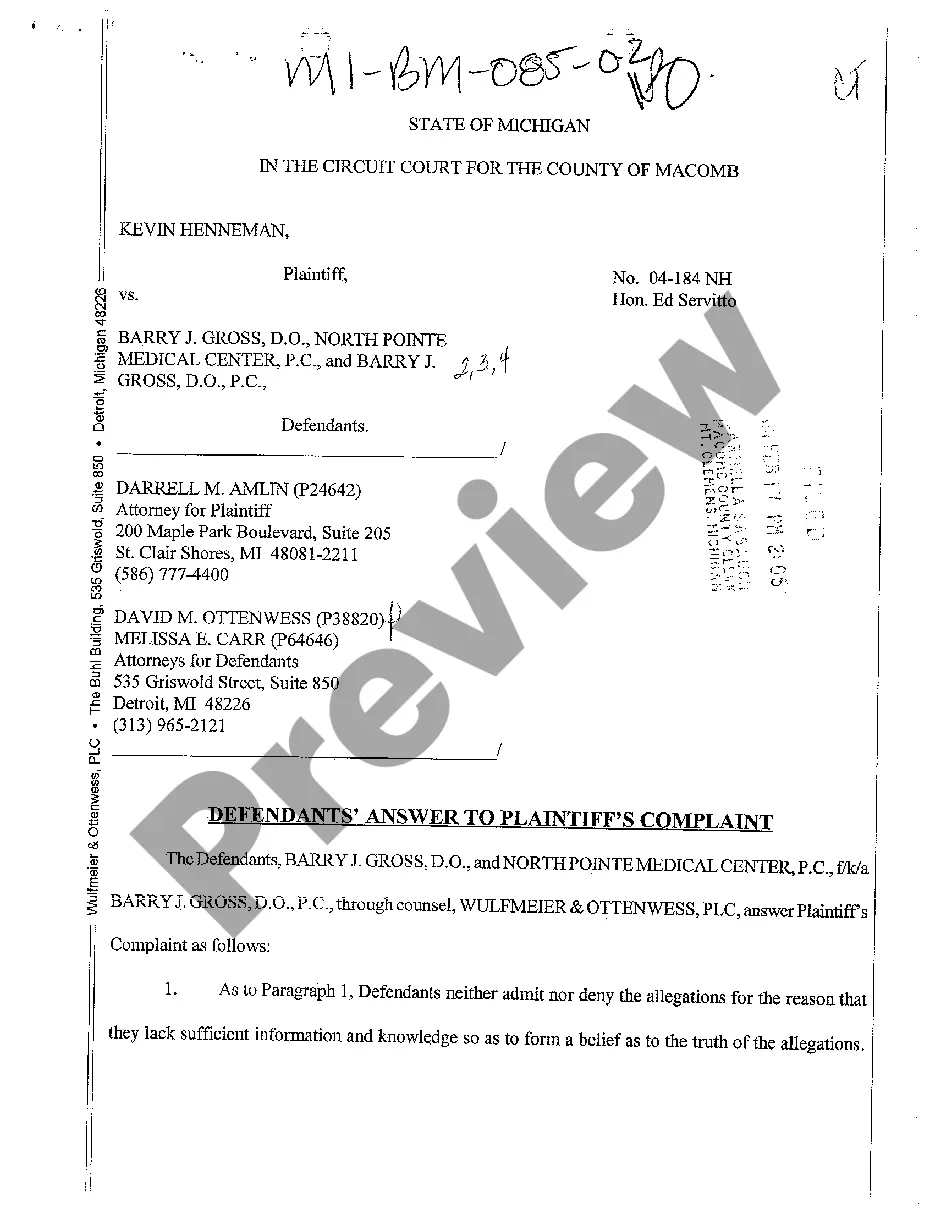

With an Employment Agreement Amendment you and the employee can agree upon changes to the original agreement, for instance in relation to salary, length of employment, or benefits. A copy of the original Employment Agreement should be attached to the final, signed Employment Agreement Amendment.

An addendum is for expanding upon information in a contract. It does not reverse or modify anything already included in the original agreement. An amendment alters one (1) or more existing clauses in an active employment contract.

A contract addendum is a post-contract attachment that modifies, alters, or totally changes some of the terms of a previously established contract. Typically, this adds something new to a preexisting document. Once all parties named in a contract agree to an addendum, it becomes a part of the new contract.

As a business owner or manager, the only way to amend an employment contract is with the permission of the employee herself. Look at the employment contract. ... Think of a new term you can add to the contract. ... Propose the change to the employee. ... Make amends to the original contract.

For example, a contract to manufacture widgets may have an addendum listing the specifications for said widgets. As this modifies the original document, it should be signed or executed with the same formalities, unless the original document states otherwise.

This Addendum accompanies and provides additional terms to the Contract of Employment between ___________________ _________________ (Name of Employer) and ___________________ _________________ (Name of Employee) on __________________ (Date of Signature of the Contract).

Term. Often, the initial term of a CEO contract is between two and five years. A key factor to consider is the variety of ways in which the term can end before the contract expires. The term and termination provisions are intimately intertwined and need to be coordinated.

Make sure the title of the new document makes clear that it is an addendum with reference to the original contract's name and date. Include the date the addendum is being added. Name all parties that the addendum is in reference to and the date when the new changes will take effect.