The California Restricted Stock Plan of RPM, Inc. is a specialized stock incentive program designed for employees of RPM, Inc., a company based in California. This plan offers a unique opportunity for eligible employees to acquire company stock through restricted stock units (RSS). RSS is a form of equity compensation wherein employees are given the right to receive company stock at a future date, subject to certain conditions. Under the California Restricted Stock Plan of RPM, Inc., employees are granted a specified number of RSS based on their performance, tenure, or other predetermined criteria. The RSS are subject to a vesting schedule, meaning the employees must meet specific conditions, such as remaining with the company for a specified period of time, to obtain ownership of the stock. This approach ensures that employees have a vested interest in the long-term success of RPM, Inc. This type of stock plan offers several advantages to employees. Firstly, it provides them with an opportunity to share in the company's growth and success. As the value of the stock increases over time, employees have the potential to realize significant financial gains. Secondly, RSS often provide a sense of ownership and loyalty among employees, as they align their interests with those of the company. This can contribute to increased motivation, productivity, and retention rates. Additionally, the California Restricted Stock Plan of RPM, Inc. may encompass various types of RSS or offer different variations, depending on the specific needs and objectives of RPM, Inc. Some possible types of RSS under this plan could include performance-based RSS, time-based RSS, market-based RSS, or a combination thereof. Each type may involve different vesting criteria, evaluation periods, or performance metrics. The performance-based RSS are typically tied to specific performance goals, such as reaching revenue targets, achieving operational milestones, or increasing shareholder value. Time-based RSS, on the other hand, vest gradually over a predetermined period, incentivizing employees to remain with the company and contribute to its long-term success. Market-based RSS are linked to the overall performance of RPM, Inc. in comparison to its industry peers or stock market indices. In summary, the California Restricted Stock Plan of RPM, Inc. is a comprehensive stock incentive program that aims to reward and retain talented employees. With various types of RSS available, this plan enables employees to acquire company stock and benefit from its potential growth. By aligning the interests of employees with those of RPM, Inc., this plan fosters a sense of ownership, loyalty, and motivation, ultimately contributing to the company's overall success.

California Restricted Stock Plan of RPM, Inc.

Description

How to fill out California Restricted Stock Plan Of RPM, Inc.?

Have you been within a place in which you need papers for either enterprise or individual purposes nearly every time? There are a lot of lawful record layouts accessible on the Internet, but discovering versions you can rely is not easy. US Legal Forms provides thousands of develop layouts, just like the California Restricted Stock Plan of RPM, Inc., which can be composed to satisfy state and federal requirements.

In case you are already informed about US Legal Forms internet site and get your account, merely log in. Following that, it is possible to download the California Restricted Stock Plan of RPM, Inc. format.

If you do not provide an profile and need to start using US Legal Forms, follow these steps:

- Discover the develop you want and make sure it is to the proper area/area.

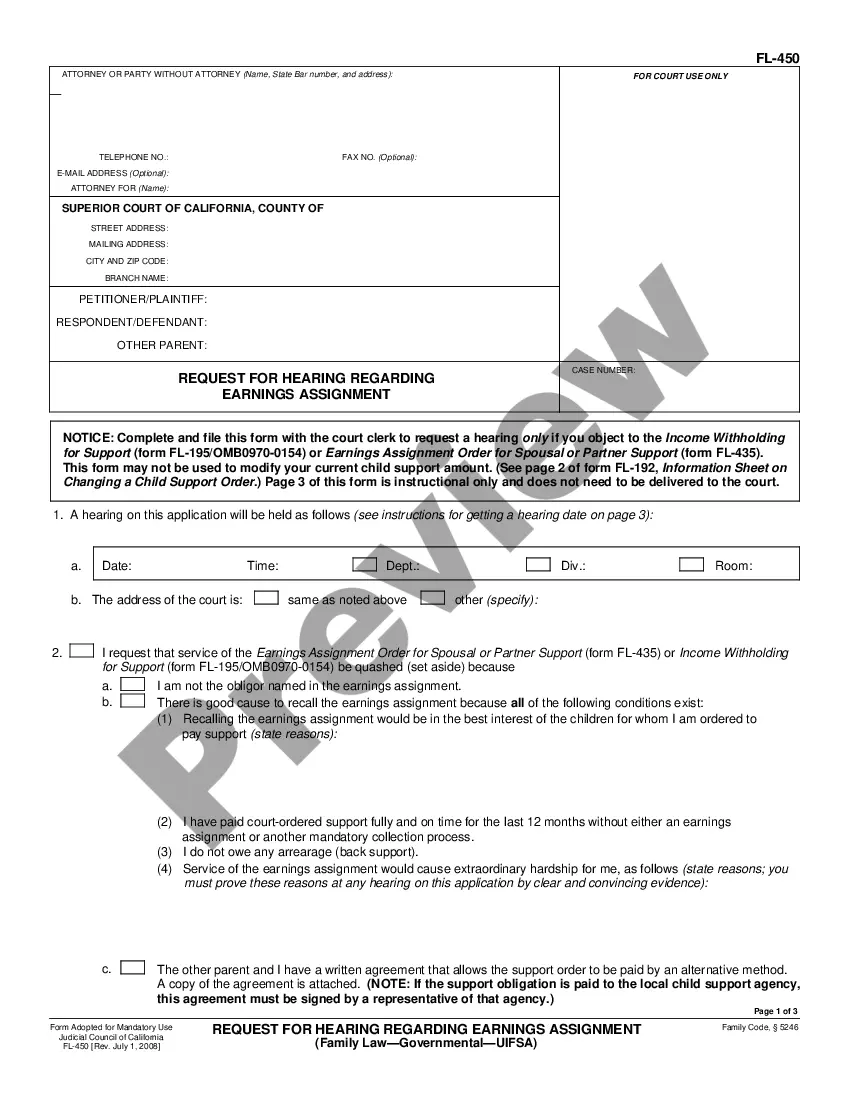

- Use the Review switch to review the form.

- Look at the explanation to actually have selected the right develop.

- In the event the develop is not what you`re searching for, make use of the Search field to find the develop that fits your needs and requirements.

- When you obtain the proper develop, just click Acquire now.

- Choose the pricing prepare you need, complete the specified information and facts to create your bank account, and pay for the order utilizing your PayPal or charge card.

- Pick a handy file formatting and download your backup.

Get all the record layouts you might have bought in the My Forms menu. You can aquire a further backup of California Restricted Stock Plan of RPM, Inc. whenever, if needed. Just click the required develop to download or printing the record format.

Use US Legal Forms, one of the most extensive selection of lawful forms, to save lots of time as well as stay away from errors. The service provides skillfully made lawful record layouts that can be used for an array of purposes. Create your account on US Legal Forms and begin making your way of life a little easier.