The California Stock Option Plan is a specialized program designed to provide executive officers with the opportunity to receive stock options as part of their compensation package. These stock options can be classified into two categories: Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS). Incentive Stock Options are a type of stock option that grant employees the right to purchase company stock at a predetermined price, known as the exercise price. These options are typically granted to executive officers as a form of performance-based incentive. SOS often come with tax advantages, as they are subject to favorable tax treatment if certain holding period requirements are met. Nonqualified Stock Options, on the other hand, are stock options that do not qualify for the same tax benefits as SOS. SOS are typically granted to executive officers as a more flexible compensation tool, as they do not have to conform to the strict requirements set forth by the Internal Revenue Code. SOS can be exercised at any time, subject to certain restrictions and conditions set by the issuing company. The main difference between SOS and SOS lies in their tax treatment. SOS, if held for a specified period, may qualify for long-term capital gains tax rates upon exercise and sale. SOS, on the other hand, are subject to ordinary income tax rates on the difference between the exercise price and the fair market value of the stock at the time of exercise. The California Stock Option Plan provides a framework for companies to grant these options to executive officers in compliance with state regulations. It ensures that the plan is administered fairly, that vesting schedules are established, and that all necessary legal requirements are met. In conclusion, the California Stock Option Plan is a comprehensive program that offers both Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS) to executive officers. Companies can tailor their stock option grants to align with their desired compensation strategies and to provide appropriate incentives to their key executives.

California Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

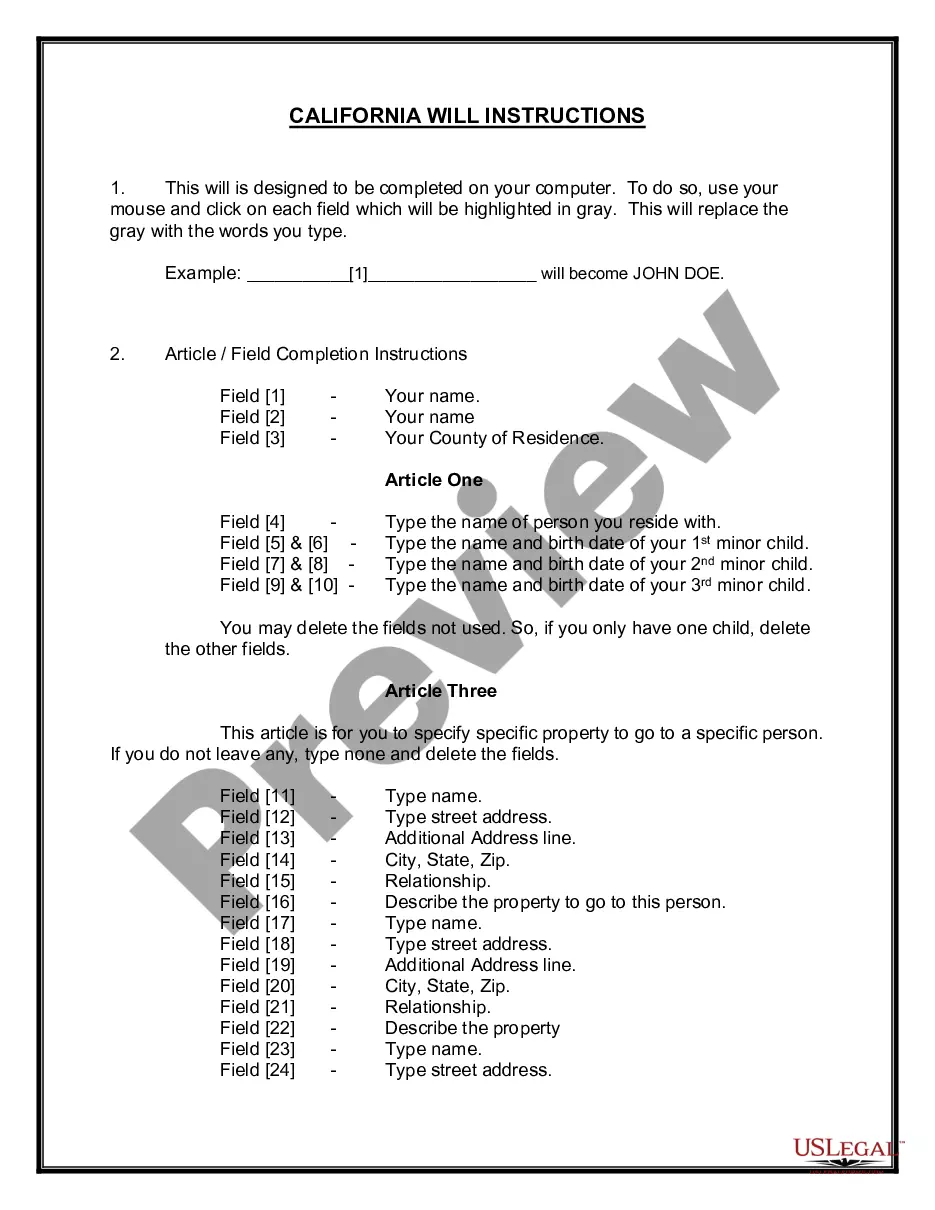

How to fill out California Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

If you wish to full, obtain, or print legal file web templates, use US Legal Forms, the biggest variety of legal types, that can be found on the Internet. Take advantage of the site`s basic and practical research to obtain the papers you require. A variety of web templates for company and personal reasons are sorted by types and states, or search phrases. Use US Legal Forms to obtain the California Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers in just a couple of click throughs.

Should you be presently a US Legal Forms buyer, log in in your accounts and click the Down load option to find the California Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers. You can also access types you previously saved from the My Forms tab of the accounts.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for the proper city/country.

- Step 2. Make use of the Review method to examine the form`s information. Never overlook to read through the explanation.

- Step 3. Should you be unhappy with all the kind, make use of the Lookup field at the top of the display screen to locate other versions from the legal kind design.

- Step 4. After you have identified the shape you require, go through the Buy now option. Pick the costs prepare you favor and add your accreditations to sign up for an accounts.

- Step 5. Approach the deal. You can use your credit card or PayPal accounts to complete the deal.

- Step 6. Select the formatting from the legal kind and obtain it on the system.

- Step 7. Total, edit and print or indicator the California Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers.

Every legal file design you acquire is your own property permanently. You possess acces to each kind you saved in your acccount. Go through the My Forms section and select a kind to print or obtain once again.

Compete and obtain, and print the California Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers with US Legal Forms. There are many professional and express-specific types you can utilize to your company or personal demands.

Form popularity

FAQ

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

A stock option may be worth exercising if the current stock price (also known as the fair market value or FMV*) is more than the exercise price.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

Now, we can have a look at the key difference between the two types. An ESPP qualified plan is designed and operates ing to Internal Revenue Section (IRS) 423 regulations, whereas a non-qualified ESPP does not meet those criteria.

Incentive Stock Options (ISO) are one example of a qualified stock option plan. With ISO plans, there is no tax due at the time the option is granted and no tax due at the time the option is exercised. Instead, the tax on the option is deferred until the time you sell the stock.

Non-qualified stock options are issued at a grant price. The grant price is the price at which you can buy the company stock. Your options come with a vesting schedule. During the time between the grant date of your options and the day they vest, you can't exercise your option.