California Acquisition, Merger, or Liquidation

Description

How to fill out Acquisition, Merger, Or Liquidation?

If you wish to total, acquire, or print authorized papers layouts, use US Legal Forms, the most important selection of authorized kinds, that can be found on the web. Use the site`s simple and hassle-free look for to find the papers you require. Various layouts for enterprise and individual purposes are categorized by groups and says, or search phrases. Use US Legal Forms to find the California Acquisition, Merger, or Liquidation within a number of clicks.

When you are currently a US Legal Forms buyer, log in for your bank account and then click the Obtain option to get the California Acquisition, Merger, or Liquidation. You may also entry kinds you formerly acquired from the My Forms tab of the bank account.

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for that right town/country.

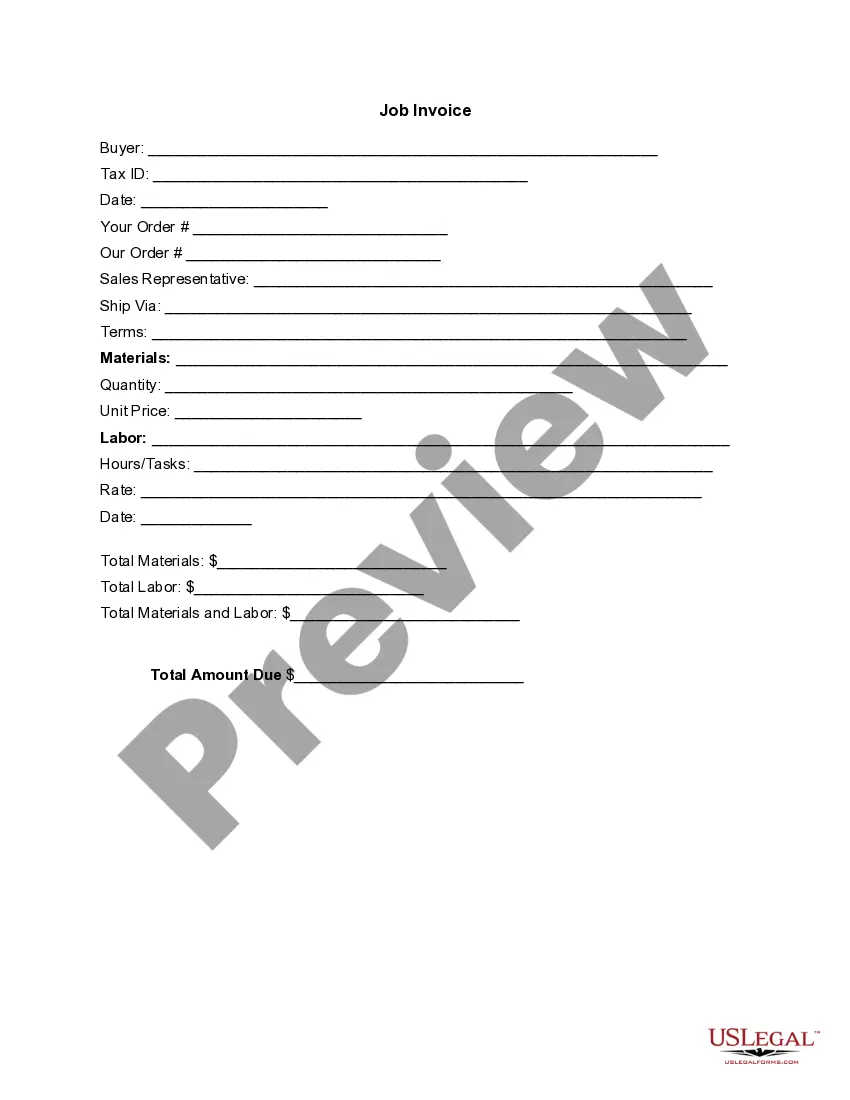

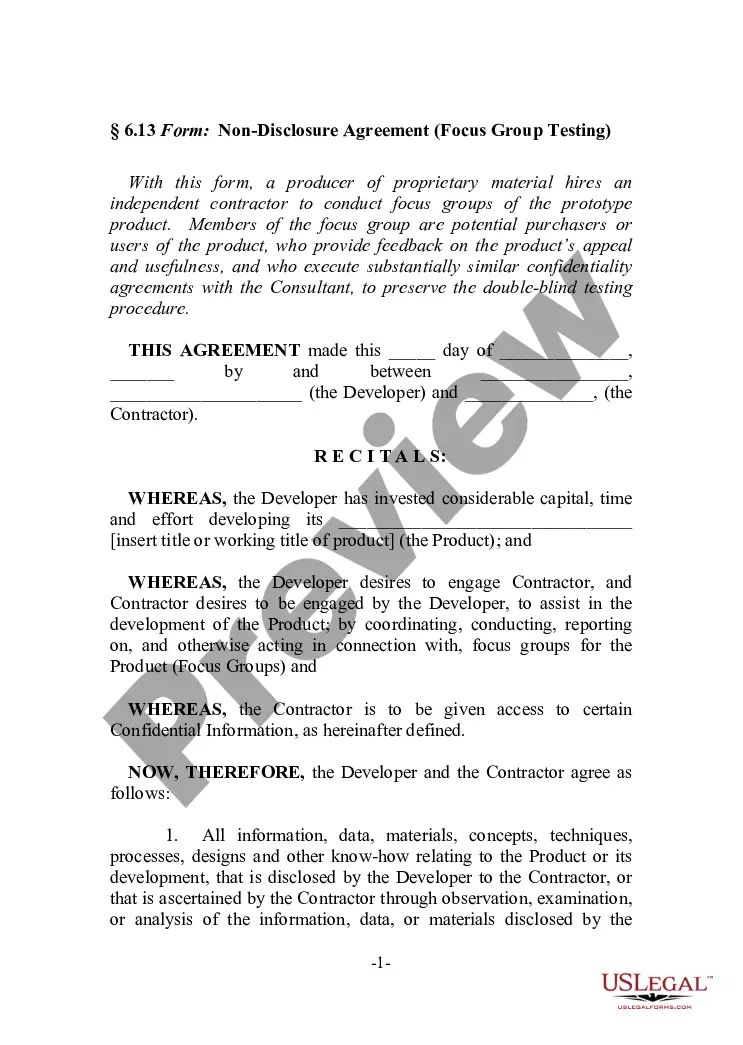

- Step 2. Take advantage of the Review choice to examine the form`s articles. Do not overlook to read the information.

- Step 3. When you are unhappy using the form, take advantage of the Look for discipline near the top of the monitor to find other variations of the authorized form template.

- Step 4. Once you have discovered the shape you require, click the Acquire now option. Choose the costs program you choose and put your credentials to sign up for an bank account.

- Step 5. Procedure the financial transaction. You should use your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Choose the format of the authorized form and acquire it on your own system.

- Step 7. Complete, modify and print or indication the California Acquisition, Merger, or Liquidation.

Each and every authorized papers template you get is your own property for a long time. You possess acces to each form you acquired within your acccount. Select the My Forms portion and select a form to print or acquire yet again.

Contend and acquire, and print the California Acquisition, Merger, or Liquidation with US Legal Forms. There are thousands of specialist and condition-certain kinds you may use for the enterprise or individual demands.

Form popularity

FAQ

The merger doctrine in civil procedure stands for the proposition that when litigants agree to a settlement, and then seek to have their settlement incorporated into a court order, the court order actually extinguishes the settlement and replaces it with the authority of the court to supervise the behavior of the ...

A liquidation or administration can happen during or after an acquisition. An acquisition is a process that occurs when one company decides to take over the operations of another company.

A Standard Clause for a contract governed by California law, also known as a "merger" or "integration" clause, which integrates all previous negotiations, representations, warranties, and agreements into the contract and indicates a final agreement on the terms and provisions.

(a) Any one or more corporations may merge with one or more other business entities (Section 174.5). One or more domestic corporations (Section 167) not organized under this division and one or more foreign corporations (Section 171) may be parties to the merger.

The Doctrine of Merger in California real property law provides that when a greater and lesser estate are vested in the same person, the lesser estate may merge into the greater estate and the lesser estate be terminated.

In criminal law, if a defendant commits a single act that simultaneously fulfills the definition of two separate offenses, merger will occur. This means that the lesser of the two offenses will drop out, and the defendant will only be charged with the greater offense.

California Vehicle Code Section 22107 In other words: Drivers who are merging onto the freeway must not enter the adjacent lane until it is reasonably safe to do so. Drivers who are merging onto the freeway must use their turn signal to indicate that they are doing so.

However, over the years, three primary exceptions to this doctrine have been recognized by the courts: (1) mutual mistake; (2) misrepresentation; and (3) where a contractual provision in a preceding transaction document provides an independent or collateral undertaking, apart from the purpose of the deed.