The California Eligible Directors' Stock Option Plan of Kyle Electronics is a comprehensive compensation program designed specifically for directors of the company who meet the eligibility criteria in California. This plan serves as a valuable tool to attract and retain highly qualified directors and align their interests with those of the company and its shareholders. This detailed description will provide an in-depth overview of the plan's key features, benefits, and potentially different types of stock option plans that may exist. The California Eligible Directors' Stock Option Plan of Kyle Electronics grants eligible directors the opportunity to purchase company stock at a predetermined price, known as the exercise price or strike price. This purchase option is usually offered as an incentive to encourage directors to contribute their expertise towards the long-term success of the company. By holding stock options, directors have the potential to benefit from the appreciation in the company's stock value over time. One type of stock option plan under this program may be the Non-Qualified Stock Option (NO) plan. Non-Qualified Stock Options allow eligible directors to purchase company stock at a predetermined price, which is often the fair market value of the stock on the grant date. These options can be exercised at any time within a specified period, typically up to ten years from the grant date. Upon exercise, the director pays the exercise price and acquires the shares, which can then be held or sold depending on their preference. Another type of stock option plan could be the Incentive Stock Option (ISO) plan. Incentive Stock Options offer eligible directors certain tax advantages compared to Non-Qualified Stock Options. To qualify for these tax advantages, SOS must adhere to specific requirements set forth by the Internal Revenue Service (IRS). For instance, the exercise price of SOS must be equal to or higher than the fair market value of the stock on the grant date. Additionally, SOS generally have a longer exercise period, typically up to ten years. The California Eligible Directors' Stock Option Plan aims to provide directors with the flexibility to choose the timing of exercising their options based on their individual financial goals and market conditions. It offers a valuable opportunity to participate in the company's growth and success, serving as a long-term incentive mechanism. By linking directors' compensation to the company's stock performance, it encourages them to make decisions that enhance shareholder value and aligns their interests with those of the shareholders. It is important to note that the specific details and provisions of the California Eligible Directors' Stock Option Plan may vary depending on the version adopted by Kyle Electronics and any amendments made over time. Directors who qualify for participation in this plan should refer to the official plan documents and consult with legal and tax professionals to fully understand the specifics and implications of their stock option grants.

California Eligible Directors' Stock Option Plan of Wyle Electronics

Description

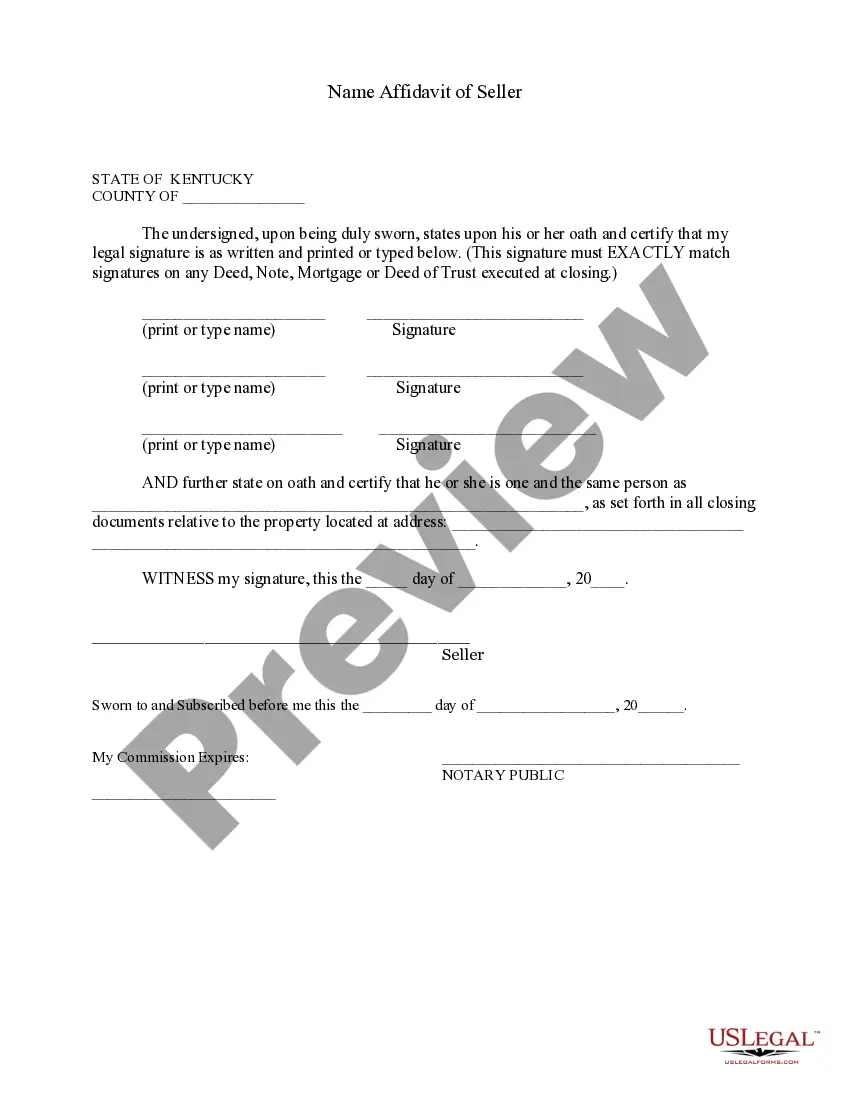

How to fill out California Eligible Directors' Stock Option Plan Of Wyle Electronics?

Finding the right legal file template might be a have a problem. Of course, there are a lot of layouts available on the Internet, but how can you get the legal type you need? Use the US Legal Forms web site. The support delivers 1000s of layouts, for example the California Eligible Directors' Stock Option Plan of Wyle Electronics, which can be used for company and private requirements. Every one of the kinds are checked by experts and meet up with federal and state needs.

When you are presently listed, log in in your bank account and then click the Acquire switch to get the California Eligible Directors' Stock Option Plan of Wyle Electronics. Make use of your bank account to check from the legal kinds you possess ordered previously. Visit the My Forms tab of your own bank account and acquire another version of the file you need.

When you are a brand new user of US Legal Forms, here are simple directions that you should follow:

- First, ensure you have chosen the appropriate type for the town/region. You may look through the shape while using Preview switch and read the shape description to make sure it will be the best for you.

- In the event the type is not going to meet up with your preferences, take advantage of the Seach field to discover the appropriate type.

- Once you are sure that the shape is proper, click the Buy now switch to get the type.

- Pick the prices strategy you need and type in the essential information and facts. Design your bank account and pay money for your order with your PayPal bank account or Visa or Mastercard.

- Select the file file format and down load the legal file template in your device.

- Complete, revise and produce and indication the received California Eligible Directors' Stock Option Plan of Wyle Electronics.

US Legal Forms is definitely the biggest collection of legal kinds that you can find various file layouts. Use the service to down load appropriately-produced documents that follow condition needs.