California Proposal to Approve Material Terms of Stock Appreciation Right Plan The California proposal to approve the material terms of a stock appreciation right plan is a significant initiative aimed at providing employees with an attractive incentive program. The plan allows employees to receive compensation based on the appreciation of the company's stock over a specified period. The stock appreciation right (SAR) plan is designed to motivate and reward employees by linking their performance directly to the company's financial success. It grants eligible employees the right to receive cash or stock equal to the increase in the company's stock price. Key Features of the California Proposal: 1. Employee Incentives: The plan aims to encourage employees to contribute to the company's growth by aligning their interests with stock price appreciation. Participants can benefit from the financial success of the company and share in its profits. 2. Performance-Based Compensation: The SAR plan provides a performance-based compensation structure, where the employees' rewards are directly tied to the company's stock performance. This helps foster a culture of ownership and accountability. 3. Long-Term Focus: The plan emphasizes long-term engagement and commitment from employees by incorporating vesting periods. This ensures that employees remain motivated to contribute to the company's sustained growth and success. 4. Flexibility in Payment: Upon exercising their SARS, participants have the freedom to choose whether they want to receive cash or stock, giving them flexibility to align with their individual financial objectives. Types of California Proposals to Approve Material Terms of Stock Appreciation Right Plan: 1. Tax-qualified SAR Plan: This type of plan complies with specific tax regulations and may offer tax advantages to both the company and its employees. 2. Non-Qualified SAR Plan: Unlike the tax-qualified plan, a non-qualified plan does not qualify for specific tax benefits but provides greater flexibility in its structure and eligibility requirements. 3. Performance-Based SAR Plan: This plan links the SAR awards to the achievement of predetermined performance goals or targets. It incentivizes employees to contribute directly to the company's strategic objectives. 4. Restricted Stock Appreciation Right (REAR) Plan: This plan grants SARS in tandem with restricted stock units (RSS), providing an additional layer of incentive by allowing employees to benefit from both stock price appreciation and ownership rights. The California proposal to approve the material terms of a stock appreciation right plan aims to attract, motivate, and retain talented employees by providing them with a valuable incentive tied to the company's financial success. By incorporating various types of plans, companies can tailor their SAR programs to meet their specific needs and objectives.

California Proposal to approve material terms of stock appreciation right plan

Description

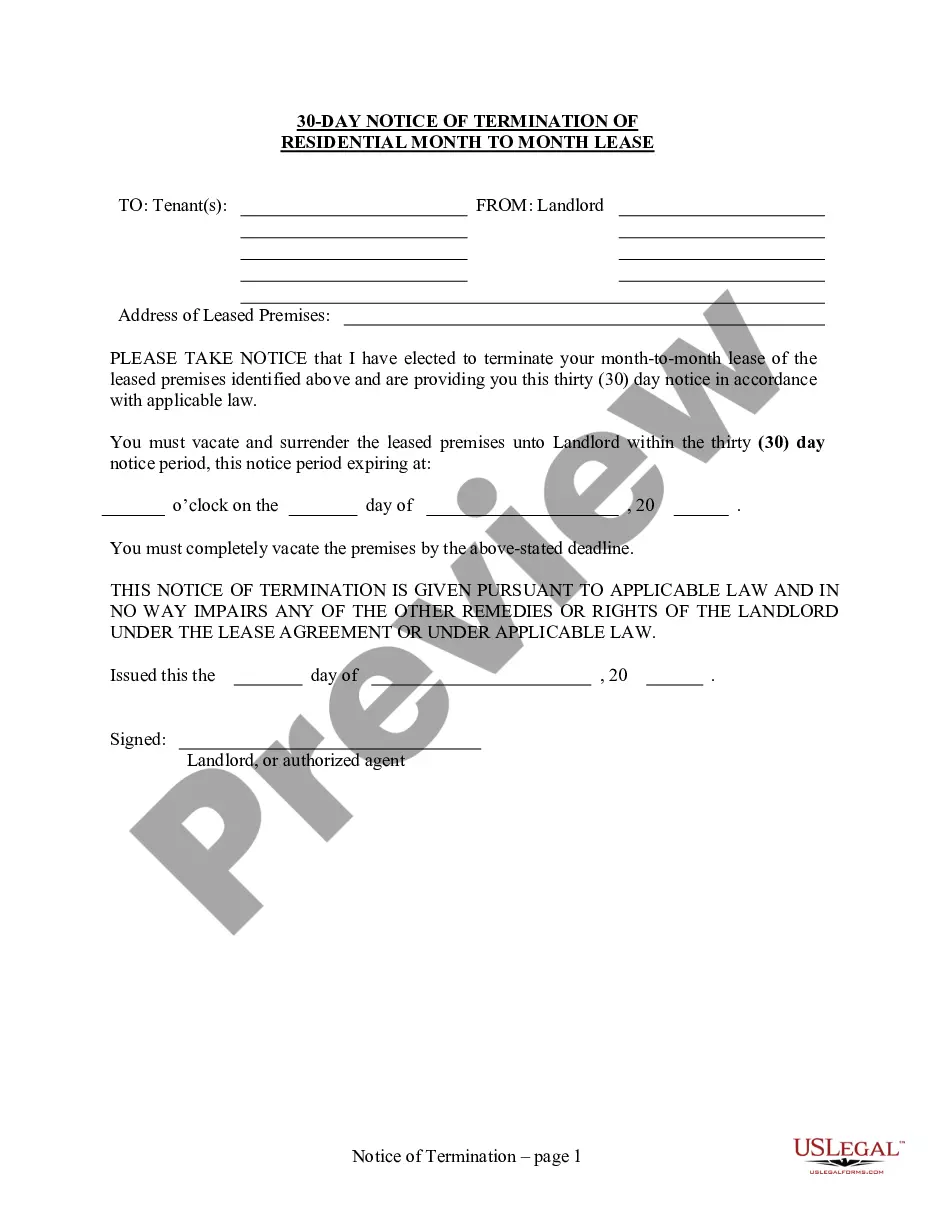

How to fill out California Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

If you want to comprehensive, down load, or print legal record web templates, use US Legal Forms, the largest assortment of legal kinds, which can be found on-line. Take advantage of the site`s easy and convenient search to find the files you want. Various web templates for business and personal functions are categorized by categories and says, or search phrases. Use US Legal Forms to find the California Proposal to approve material terms of stock appreciation right plan within a couple of clicks.

Should you be already a US Legal Forms buyer, log in for your profile and click the Acquire option to obtain the California Proposal to approve material terms of stock appreciation right plan. You can also access kinds you formerly delivered electronically inside the My Forms tab of your own profile.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the shape to the appropriate city/nation.

- Step 2. Utilize the Preview option to look through the form`s content. Do not overlook to learn the description.

- Step 3. Should you be unsatisfied with the kind, take advantage of the Look for field towards the top of the display to locate other versions of your legal kind template.

- Step 4. Upon having located the shape you want, click the Acquire now option. Select the prices plan you choose and add your credentials to register on an profile.

- Step 5. Method the financial transaction. You may use your bank card or PayPal profile to complete the financial transaction.

- Step 6. Pick the file format of your legal kind and down load it on the gadget.

- Step 7. Complete, edit and print or sign the California Proposal to approve material terms of stock appreciation right plan.

Every legal record template you acquire is the one you have for a long time. You possess acces to every single kind you delivered electronically in your acccount. Go through the My Forms portion and decide on a kind to print or down load again.

Remain competitive and down load, and print the California Proposal to approve material terms of stock appreciation right plan with US Legal Forms. There are thousands of specialist and state-particular kinds you can utilize to your business or personal requires.