California Approval of deferred compensation investment account plan

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

Have you been inside a situation the place you require paperwork for both business or person purposes virtually every day? There are a lot of legal document layouts accessible on the Internet, but finding kinds you can rely isn`t simple. US Legal Forms provides thousands of develop layouts, much like the California Approval of deferred compensation investment account plan, which can be composed in order to meet federal and state specifications.

If you are currently informed about US Legal Forms web site and have an account, basically log in. Afterward, you can acquire the California Approval of deferred compensation investment account plan format.

If you do not provide an accounts and wish to begin using US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is for that appropriate town/county.

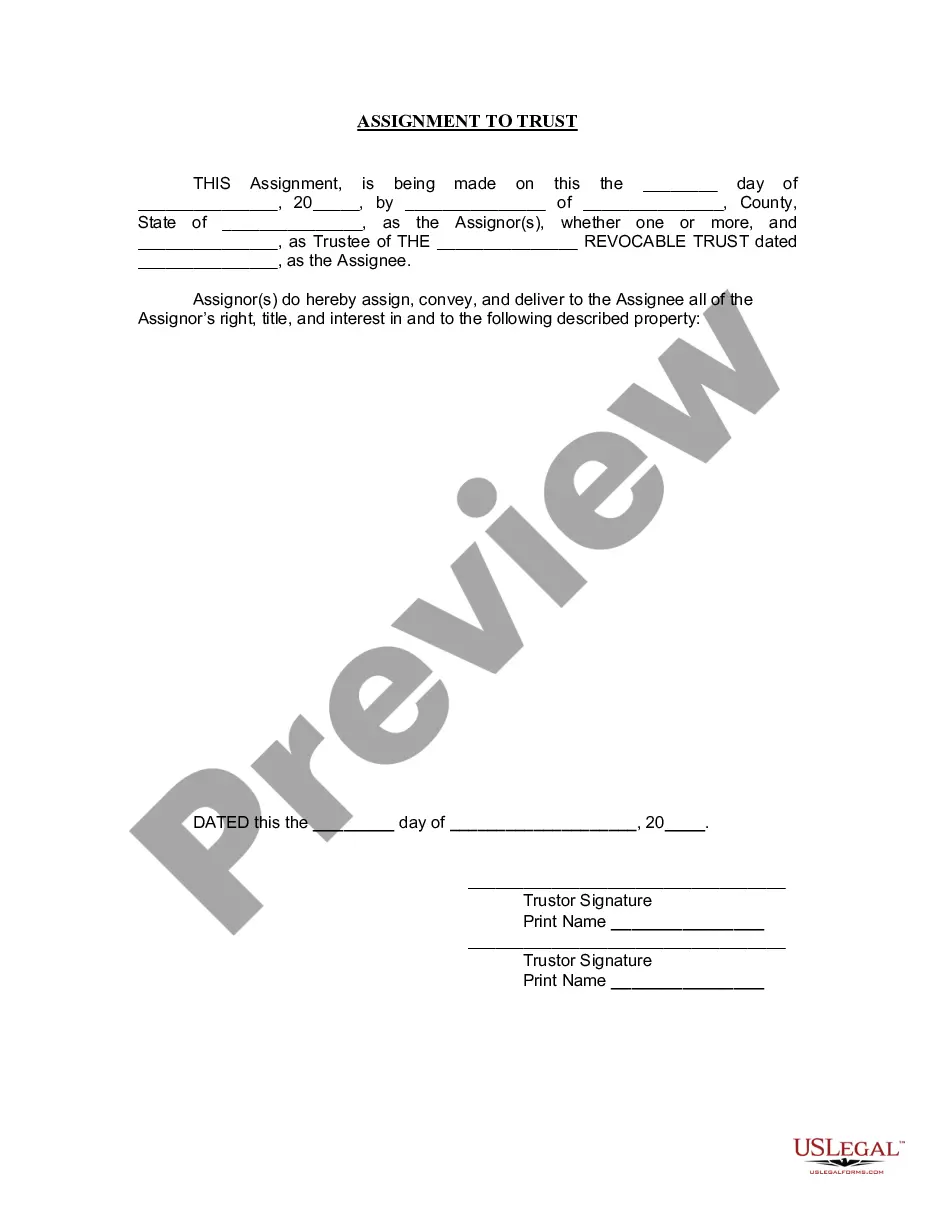

- Make use of the Review button to check the form.

- Read the description to actually have selected the appropriate develop.

- If the develop isn`t what you are trying to find, use the Look for industry to discover the develop that meets your needs and specifications.

- If you discover the appropriate develop, click on Buy now.

- Pick the prices plan you desire, fill in the specified details to produce your account, and buy your order utilizing your PayPal or charge card.

- Pick a convenient document formatting and acquire your backup.

Locate each of the document layouts you have bought in the My Forms menus. You can obtain a more backup of California Approval of deferred compensation investment account plan any time, if possible. Just click the required develop to acquire or produce the document format.

Use US Legal Forms, the most extensive selection of legal kinds, to save efforts and stay away from mistakes. The support provides skillfully produced legal document layouts that can be used for a selection of purposes. Create an account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

qualified deferred compensation (NQDC) plan is a type of nonqualifying plan that falls outside the Employment Retirement Security Income Act (ERISA). NQDC plans are also known as 409 (a) plans and golden handcuffs. Employers use such plans to attract and retain key executives and valuable employees.

Note: Your deferred compensation is not placed directly into an investment, but you designate investment choices for bookkeeping purposes. Your employer uses your choices as a benchmark to calculate the appropriate investment returns owed during the deferral period.

Because 457(b) plans are not governed by the same laws and regulations as 401(k) plans and 403(b) plans, they are considered ?non-qualified? and offer greater flexibility.

Nonqualified deferred compensation provides an excellent way to offer executives additional benefits beyond what's provided for the general employee base. Putting these plans into play may increase your ability to attract and retain top employee talent.

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

CalPERS 457 Plan The plan is a voluntary savings program that allows employees to defer any amount, subject to annual limits, from their paycheck on a pretax basis. In addition, employee contributions and their earnings, if any, can benefit from the power of tax-deferred compounding.

Legislation that created CalSavers stipulates employers must offer a retirement savings plan. If there's no workplace retirement plan in place, businesses must offer their employees CalSavers, the state-operated retirement savings plan ? or else face fines.