California Security ownership of directors, nominees and officers showing sole and shared ownership

Description

How to fill out Security Ownership Of Directors, Nominees And Officers Showing Sole And Shared Ownership?

US Legal Forms - one of many biggest libraries of lawful kinds in the States - provides a wide range of lawful record templates it is possible to down load or print. While using site, you can find a large number of kinds for enterprise and individual purposes, categorized by classes, claims, or search phrases.You can get the latest versions of kinds like the California Security ownership of directors, nominees and officers showing sole and shared ownership in seconds.

If you have a subscription, log in and down load California Security ownership of directors, nominees and officers showing sole and shared ownership from your US Legal Forms library. The Down load switch will show up on every type you look at. You have accessibility to all previously acquired kinds from the My Forms tab of your account.

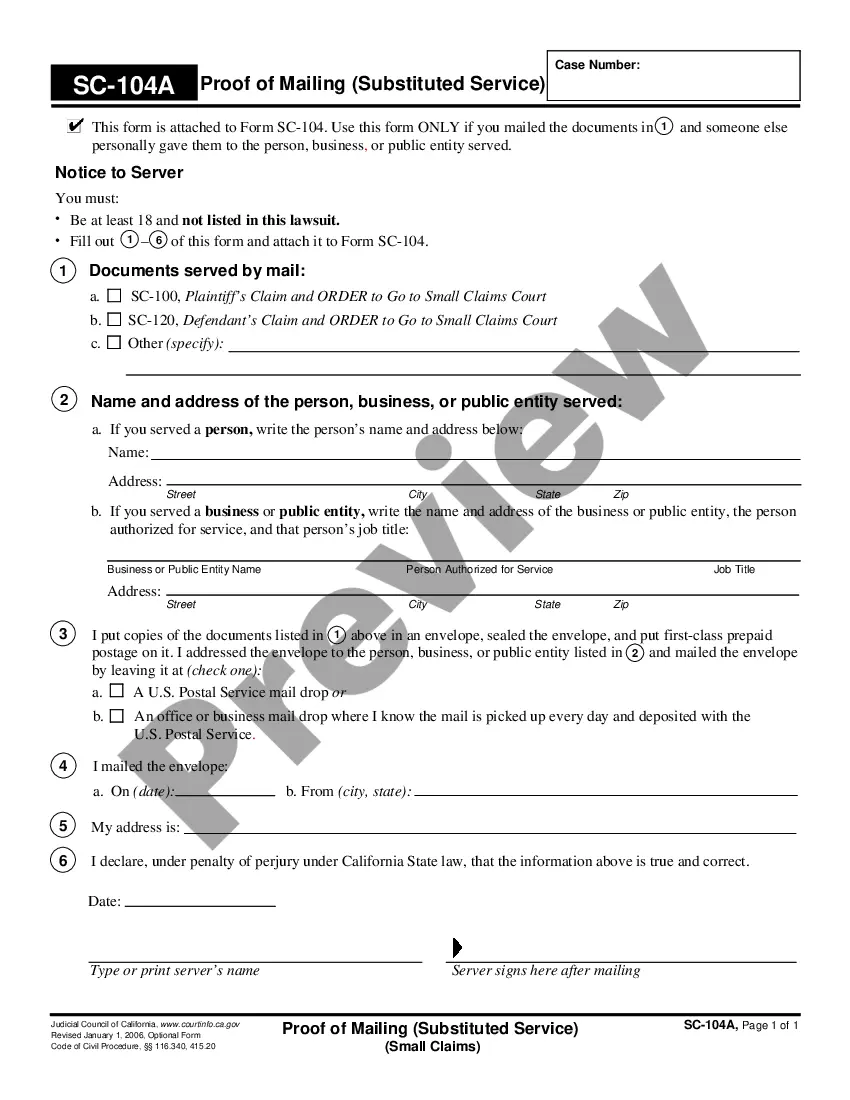

If you want to use US Legal Forms initially, listed here are simple directions to get you started out:

- Ensure you have picked the right type for your personal area/county. Click on the Preview switch to examine the form`s content material. Read the type description to actually have chosen the correct type.

- If the type doesn`t match your specifications, take advantage of the Research field near the top of the display to find the one who does.

- Should you be pleased with the shape, affirm your option by simply clicking the Purchase now switch. Then, opt for the prices strategy you favor and offer your qualifications to sign up for the account.

- Procedure the purchase. Utilize your charge card or PayPal account to perform the purchase.

- Find the structure and down load the shape in your gadget.

- Make alterations. Complete, change and print and sign the acquired California Security ownership of directors, nominees and officers showing sole and shared ownership.

Each design you added to your bank account does not have an expiry particular date and it is yours for a long time. So, if you want to down load or print one more copy, just check out the My Forms section and click on in the type you will need.

Get access to the California Security ownership of directors, nominees and officers showing sole and shared ownership with US Legal Forms, the most considerable library of lawful record templates. Use a large number of professional and status-distinct templates that meet your business or individual requirements and specifications.

Form popularity

FAQ

A beneficial owner of a company is any individual who, directly or indirectly, exercises substantial control over a reporting company, or who owns or controls at least 25 percent of the ownership interests of a reporting company.

If shares or rights are held by a nominee, the UBO will be the person for whom the nominee is acting. If the nominee is acting for a legal entity, then the UBO will be the person who exercises ultimate control over the legal entity.

A person or organization that has the right to receive income, profits, etc. from a property or investment that they own: Parents can put the investment in an account where the parent is the legal owner but the child is the beneficial owner.

The registered owner of shares held for the benefit of another person (the beneficial owner). The beneficial owner may choose to appoint a nominee because it does not wish to have the shares registered in its own name, or it may be required to appoint a nominee.

Beneficial Owner vs. A beneficiary is someone designated to receive money, property, or other benefits of assets via a trust or will. The difference between beneficial owner vs. beneficiary is that beneficiaries usually need to have ownership (either legal or beneficial) over the assets they benefit from.

Under financial regulations, a beneficial owner is considered anyone with a stake of 25% or more in a legal entity or corporation. Beneficial owners can also be considered anyone with a significant role in the management or direction of those entities, or any trusts that own 25% or more of an entity.