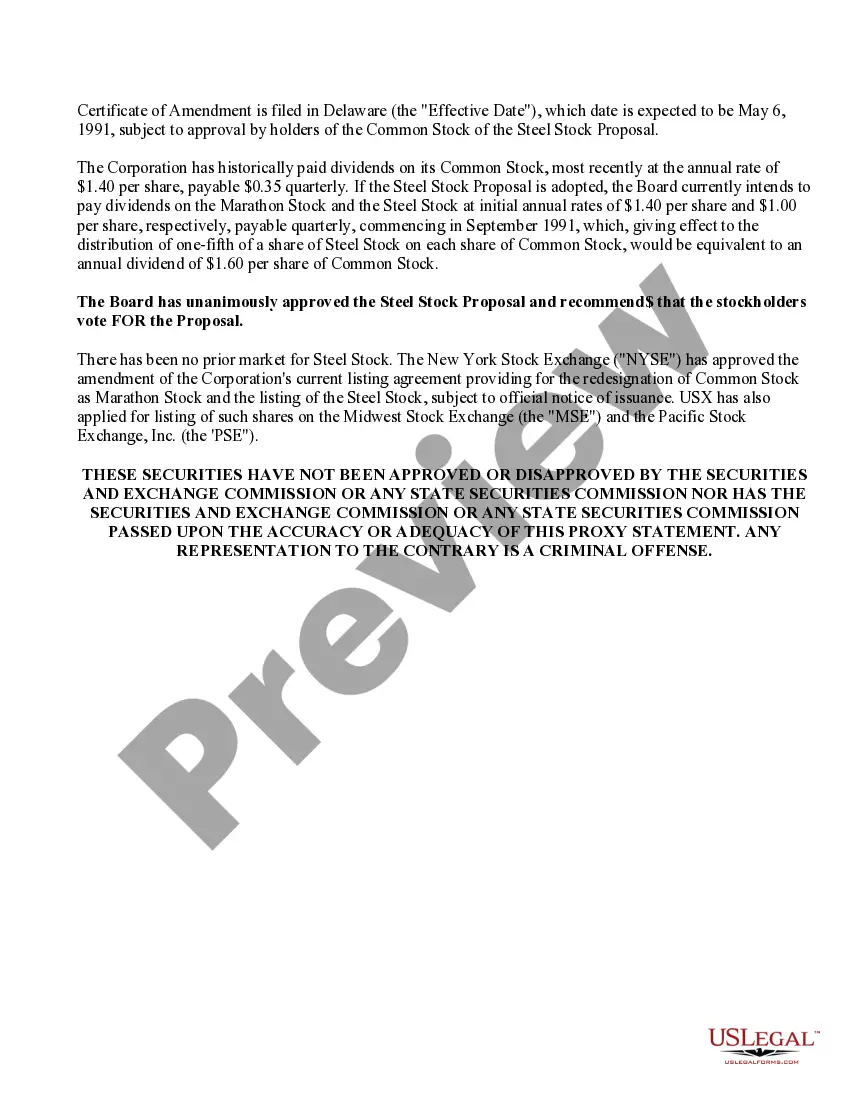

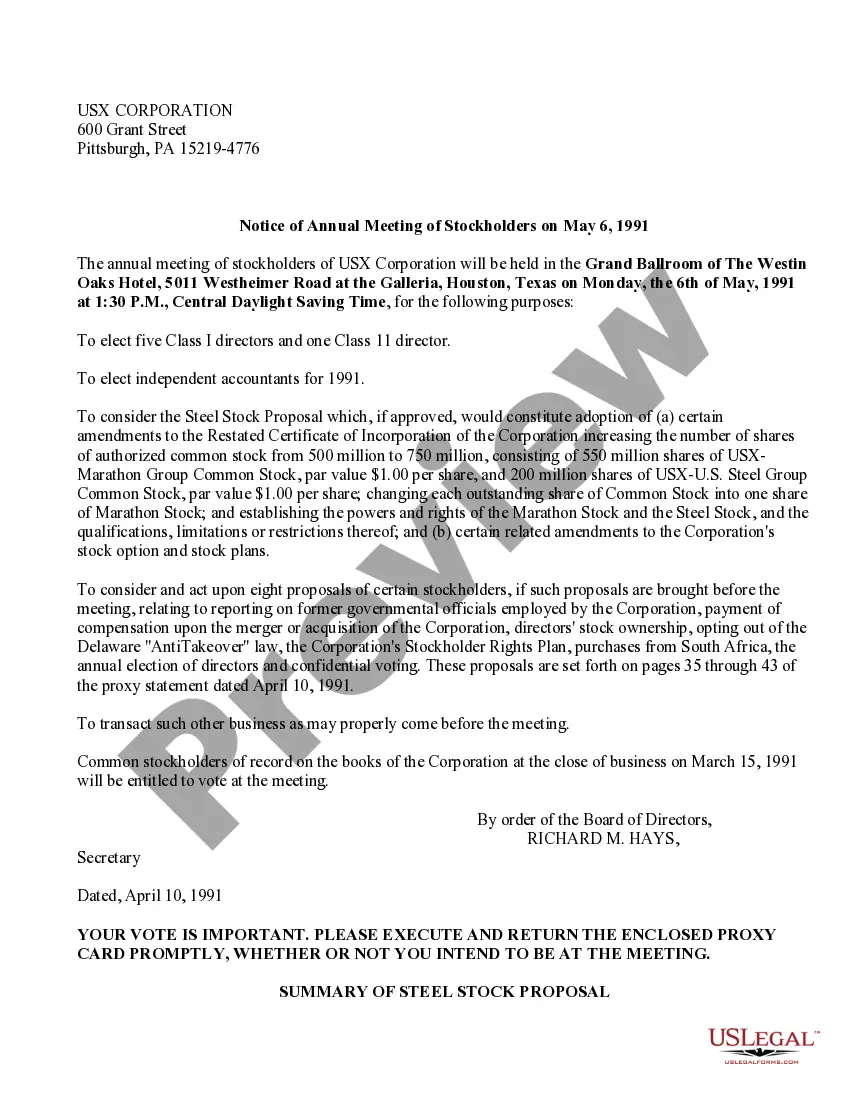

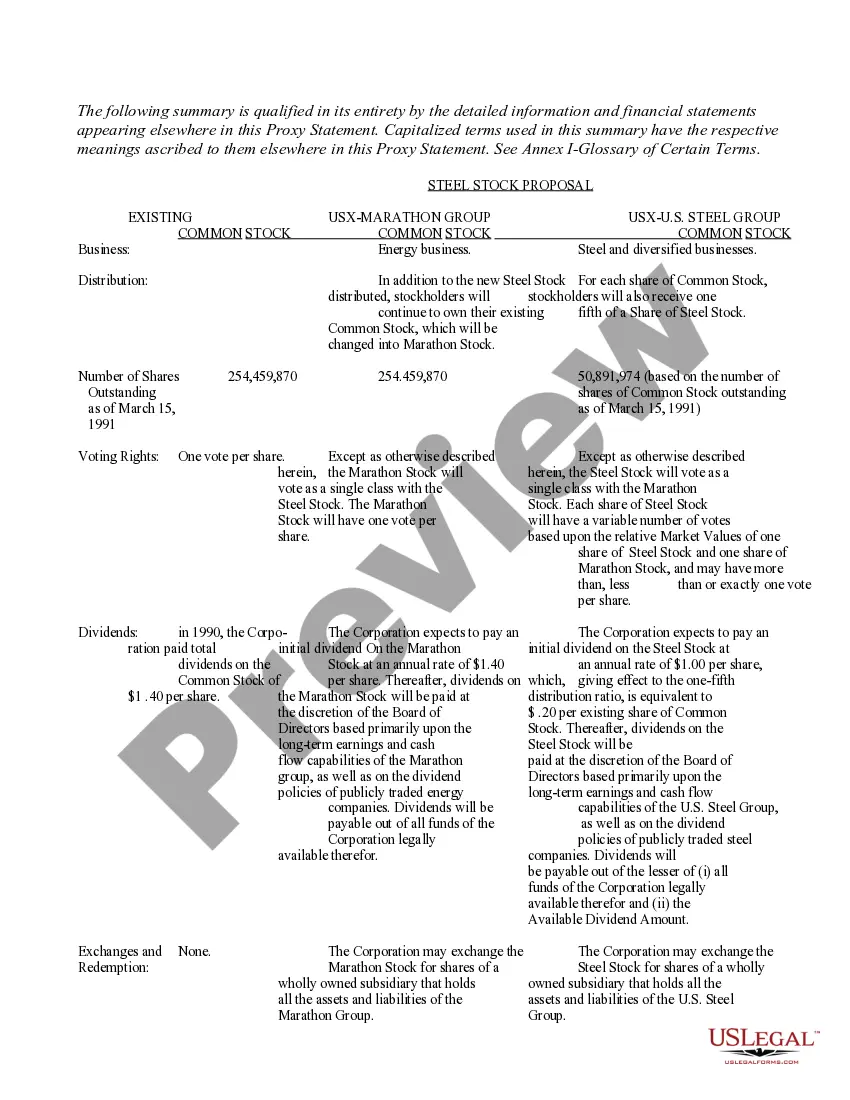

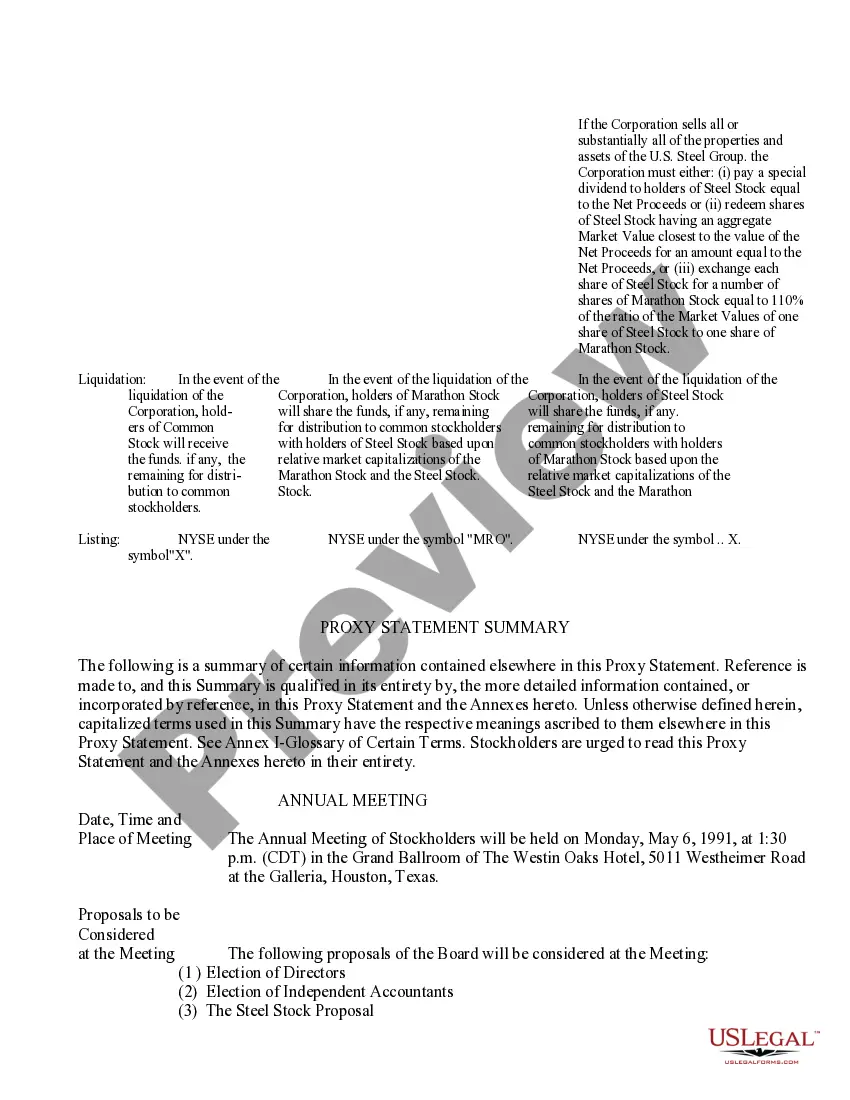

California Proxy Statement and Prospectus of US Corporation The California Proxy Statement and Prospectus of US Corporation provide crucial information about the company's operations, financials, and governance to its shareholders and potential investors. This comprehensive document ensures transparency and enables informed decision-making. The California Proxy Statement is a legal document that pertains to corporate governance. It is typically distributed to shareholders in advance of an annual general meeting or a special meeting. The proxy statement outlines key details about the meeting agenda, including proposals, director nominees, and any other matters requiring shareholder approval. Shareholders who cannot attend the meeting in person can allocate their voting rights to another party, known as a proxy. This document also illustrates any conflicts of interest or concerns related to the management, allowing shareholders to make well-informed decisions. On the other hand, the Prospectus serves as an in-depth informational tool for potential investors. This document is usually issued when a company plans to offer stocks, bonds, or other securities to the public. The Prospectus provides a detailed overview of US Corporation's business model, financial performance, risk factors, industry dynamics, and current market trends. Investors can evaluate the company's prospects, its historical financial information, and the potential risks associated with investing in US Corporation. This document enables investors to make informed decisions based on reliable data, reducing uncertainties. Different types or variations of the California Proxy Statement and Prospectus may arise, depending on the specific circumstances or events surrounding US Corporation. For instance, if the company plans a significant merger or acquisition, a proxy statement might be required to obtain shareholder approval for the transaction. Similarly, if US Corporation intends to make a public offering of its securities, a prospectus would be prepared to comply with relevant securities laws and regulations. In conclusion, the California Proxy Statement and Prospectus of US Corporation hold immense importance for both existing shareholders and potential investors. The proxy statement ensures transparent governance by allowing shareholders to express their viewpoints on critical matters, while the prospectus provides a comprehensive overview for investors to analyze the company's financials, risks, and growth prospects. Understanding these documents is essential for anyone seeking to make informed decisions about their investment in US Corporation.

California Proxy Statement and Prospectus of USX Corporation

Description

How to fill out California Proxy Statement And Prospectus Of USX Corporation?

If you have to total, obtain, or print out legal file themes, use US Legal Forms, the biggest collection of legal forms, which can be found on-line. Take advantage of the site`s easy and handy research to get the papers you will need. Numerous themes for company and personal uses are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to get the California Proxy Statement and Prospectus of USX Corporation within a number of clicks.

In case you are already a US Legal Forms client, log in to your account and click the Acquire option to have the California Proxy Statement and Prospectus of USX Corporation. Also you can gain access to forms you in the past delivered electronically inside the My Forms tab of your account.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for that correct town/nation.

- Step 2. Make use of the Preview choice to examine the form`s information. Do not overlook to read the information.

- Step 3. In case you are unhappy with all the type, make use of the Search industry towards the top of the display screen to get other variations of your legal type web template.

- Step 4. After you have discovered the form you will need, click the Buy now option. Choose the rates program you like and add your accreditations to sign up to have an account.

- Step 5. Procedure the purchase. You can utilize your bank card or PayPal account to perform the purchase.

- Step 6. Select the format of your legal type and obtain it on the product.

- Step 7. Total, edit and print out or sign the California Proxy Statement and Prospectus of USX Corporation.

Every single legal file web template you buy is your own permanently. You might have acces to each and every type you delivered electronically inside your acccount. Go through the My Forms segment and select a type to print out or obtain once again.

Compete and obtain, and print out the California Proxy Statement and Prospectus of USX Corporation with US Legal Forms. There are many skilled and condition-particular forms you may use to your company or personal requirements.