California Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock

Description

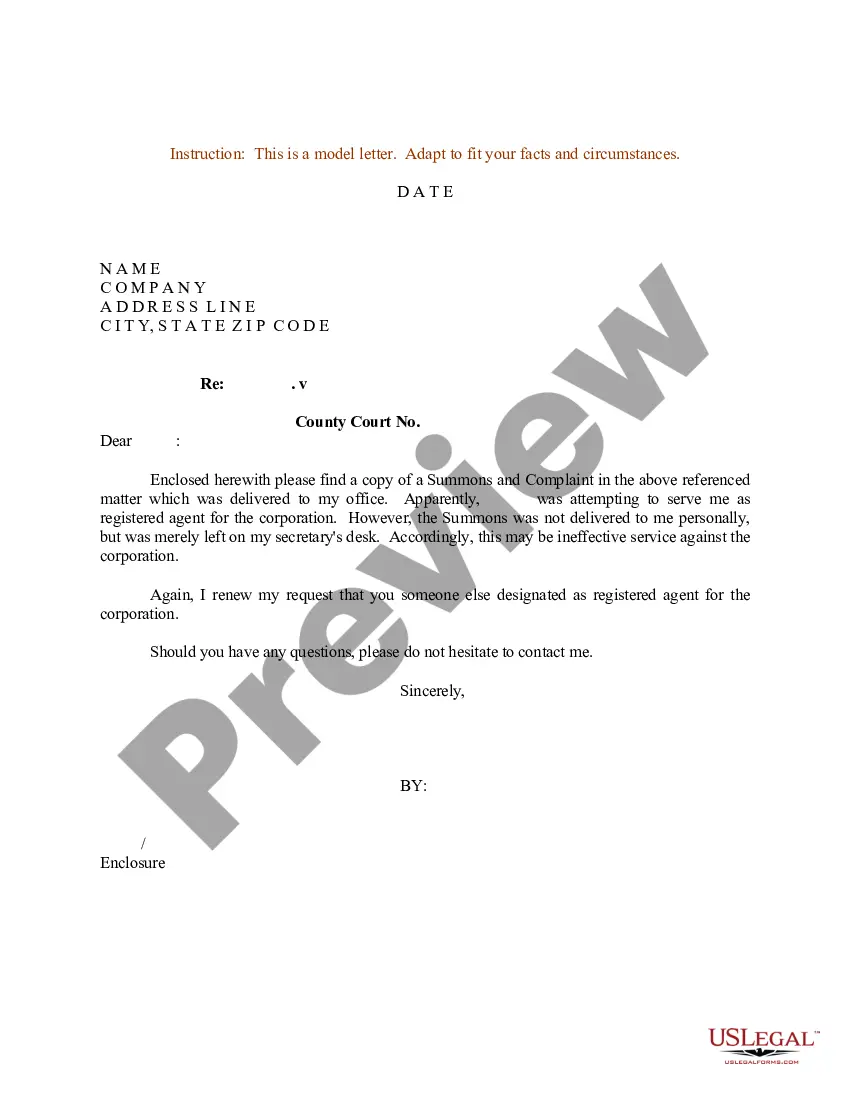

How to fill out Proposal To Amend Articles Of Incorporation To Effect A Reverse Stock Split Of Common Stock And Authorize A Share Dividend On Common Stock?

If you want to complete, down load, or printing legal document layouts, use US Legal Forms, the largest collection of legal types, which can be found on the Internet. Use the site`s easy and hassle-free lookup to discover the documents you require. Various layouts for organization and person purposes are sorted by groups and suggests, or key phrases. Use US Legal Forms to discover the California Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock with a few click throughs.

Should you be presently a US Legal Forms client, log in in your accounts and click on the Obtain switch to get the California Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock. You can also entry types you previously delivered electronically inside the My Forms tab of your respective accounts.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have chosen the form for the correct city/nation.

- Step 2. Utilize the Review choice to look through the form`s content material. Don`t overlook to read the information.

- Step 3. Should you be unhappy together with the form, use the Research area at the top of the display screen to discover other variations in the legal form web template.

- Step 4. Upon having discovered the form you require, select the Acquire now switch. Select the rates program you choose and include your qualifications to sign up for an accounts.

- Step 5. Procedure the purchase. You can use your credit card or PayPal accounts to accomplish the purchase.

- Step 6. Choose the structure in the legal form and down load it on your own gadget.

- Step 7. Total, modify and printing or indicator the California Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock.

Each legal document web template you get is yours for a long time. You possess acces to every single form you delivered electronically with your acccount. Go through the My Forms section and select a form to printing or down load yet again.

Contend and down load, and printing the California Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock with US Legal Forms. There are thousands of skilled and status-certain types you can use for your personal organization or person requirements.

Form popularity

FAQ

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

Every corporation and limited liability company is required to file a Statement of Information either every year or every two years as applicable. The Secretary of State sends a reminder to the business entity approximately three months prior to the date its filing is due.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

Current through the 2023 Legislative Session. "Stock split" means the pro rata division, otherwise than by a share dividend, of all the outstanding shares of a class into a greater number of shares of the same class by an amendment to the articles stating the effect on outstanding shares.

California Incorporation Filing Fee In addition, filing the California articles of incorporation including a filing carries a fee of $100, plus a $15 handling fee. You must also file an initial report giving detailed information about your company, which includes a fee of $25 and a $75 service fee.

For corporate name changes, you must first register the corporate name change with the Secretary of State's Office. If you only are adding a "DBA" to the existing corporate name, you do not need to make any changes with the Secretary of State's Office. The "DBA" cannot indicate a second corporation.

Articles of Incorporation must be amended to alert the state to major changes. Changes that qualify for state notification include changes to: address. company name.

In California, a corporation must authorize at least one share but may authorize any number. You, as the founder, can be the sole stockholder and own all authorized shares yourself, or you can issue shares to others who you desire to co-own the corporation.