California Amendment of common stock par value

Description

How to fill out Amendment Of Common Stock Par Value?

You can commit hrs on the Internet searching for the legal papers template that fits the state and federal requirements you require. US Legal Forms supplies a large number of legal varieties that are evaluated by experts. It is simple to down load or printing the California Amendment of common stock par value from our support.

If you have a US Legal Forms account, you may log in and then click the Acquire switch. Following that, you may complete, revise, printing, or indicator the California Amendment of common stock par value. Each and every legal papers template you acquire is the one you have eternally. To obtain one more copy of the acquired form, go to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site for the first time, adhere to the basic recommendations below:

- First, make certain you have selected the correct papers template for your area/city of your choice. Browse the form description to ensure you have picked the proper form. If readily available, take advantage of the Review switch to check with the papers template as well.

- If you wish to locate one more model of the form, take advantage of the Search industry to find the template that fits your needs and requirements.

- Once you have located the template you want, just click Get now to move forward.

- Select the prices program you want, type in your references, and register for an account on US Legal Forms.

- Total the financial transaction. You may use your credit card or PayPal account to pay for the legal form.

- Select the formatting of the papers and down load it in your gadget.

- Make adjustments in your papers if possible. You can complete, revise and indicator and printing California Amendment of common stock par value.

Acquire and printing a large number of papers themes making use of the US Legal Forms website, that provides the most important collection of legal varieties. Use expert and condition-certain themes to handle your company or specific needs.

Form popularity

FAQ

Liabilities otherwise provided for are excluded from the Section 501 test.California Corporations Code Section 500 currently allows a corporation to make a distribution of cash or property to its shareholders only if:the amount of the corporation's retained earnings prior to the distribution equals or exceeds the ...

Code 5056(a). A member is any person with governance rights. If there is no pressing reason for members, a corporation should avoid the additional hassle and choose not to have members. Note that if there are no members other than the directors, the corporation will be treated as having no members.

(a) A verified complaint for involuntary dissolution of a corporation on any one or more of the grounds specified in subdivision (b) may be filed in the superior court of the proper county by any of the following persons: (1) One-half or more of the directors in office.

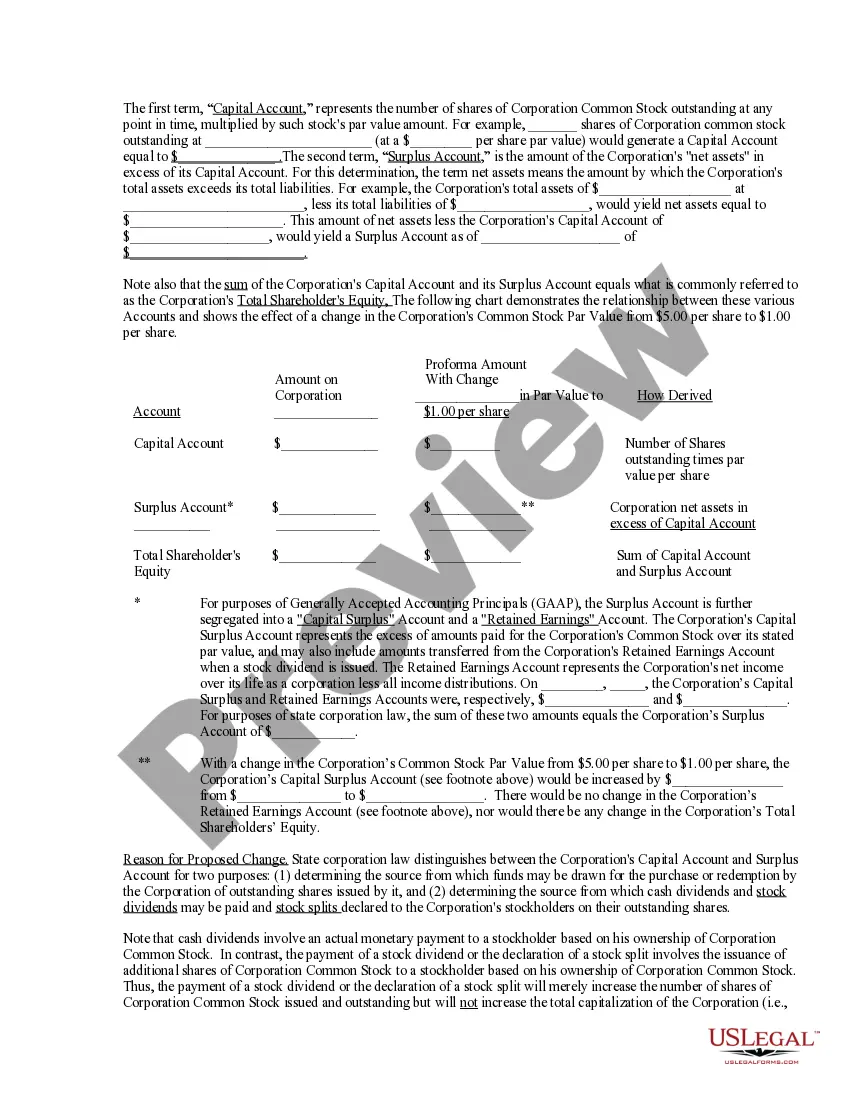

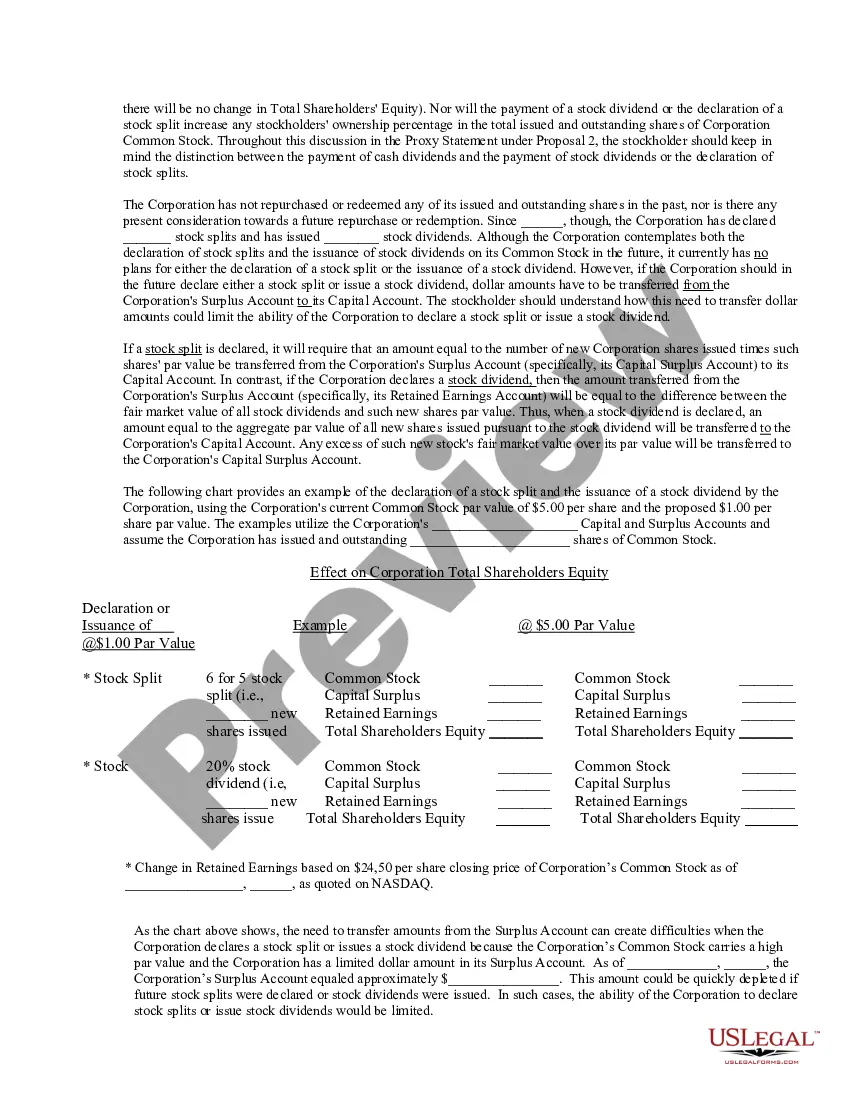

What is ?par value? and is it required? Par value is an antiquated concept for establishing minimum legal capital, which has been eliminated in California for many years. California, like Delaware, permits, but does not require, the issuance of stock with or without par value.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

Section 503: Section 503 concerns distributions to junior shares that affect cumulative dividends to senior shares that are in arrears.

The concept of treasury shares does not exist in some states, such as California, the laws of which provide that repurchased shares automatically are restored to the status of authorised but unissued shares (unless the company's organisational documents prohibit their reissuance).

Section 303 - Removal of directors (a) Any or all of the directors may be removed without cause if the removal is approved by the outstanding shares (Section 152), subject to the following: (1) Except for a corporation to which paragraph (3) is applicable, no director may be removed (unless the entire board is removed) ...