California Proxy Statement of Bank of Montana System

Description

How to fill out Proxy Statement Of Bank Of Montana System?

Are you currently within a placement that you need files for both company or specific purposes just about every working day? There are a lot of legal papers themes available on the net, but locating versions you can rely on is not straightforward. US Legal Forms offers a huge number of form themes, much like the California Proxy Statement of Bank of Montana System, that happen to be published to fulfill state and federal specifications.

In case you are presently knowledgeable about US Legal Forms web site and also have your account, basically log in. Next, you are able to down load the California Proxy Statement of Bank of Montana System design.

Unless you have an profile and wish to begin to use US Legal Forms, adopt these measures:

- Find the form you will need and ensure it is for your correct city/state.

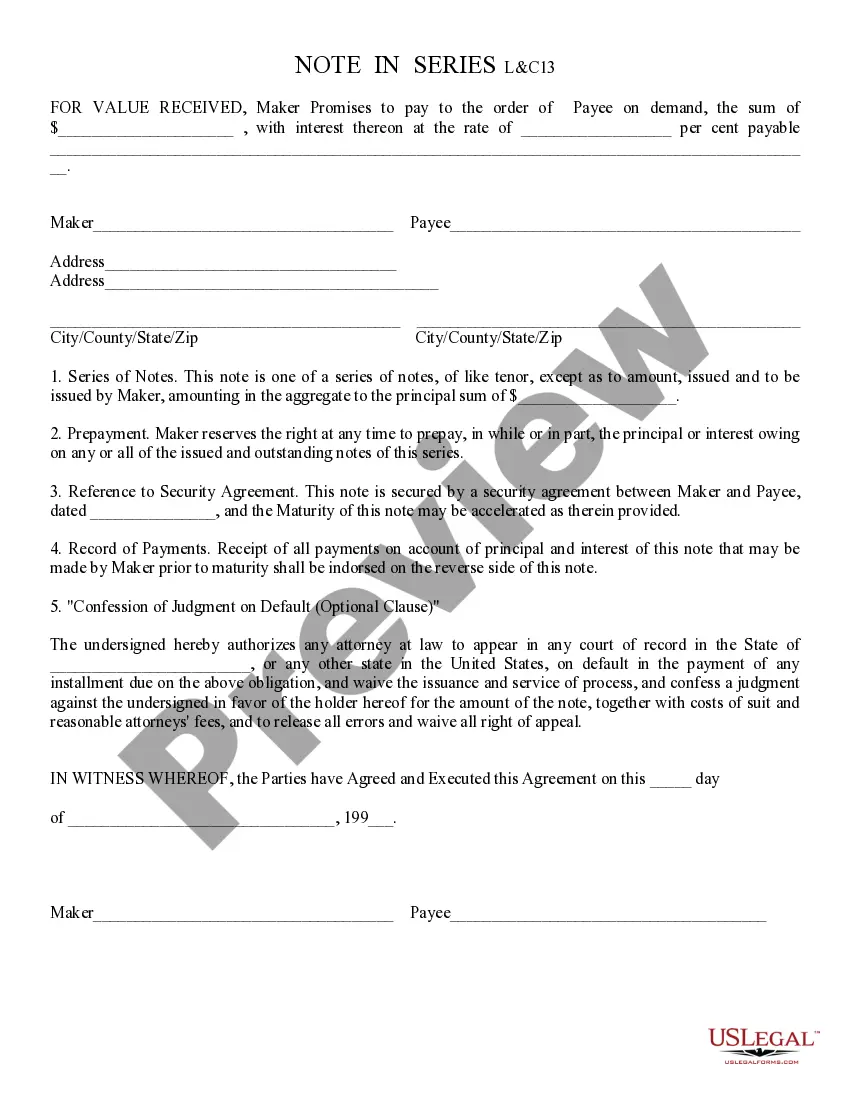

- Utilize the Preview option to examine the form.

- Read the explanation to actually have chosen the appropriate form.

- In the event the form is not what you`re seeking, utilize the Look for field to obtain the form that fits your needs and specifications.

- When you find the correct form, click Purchase now.

- Select the rates plan you desire, submit the desired information to generate your account, and purchase your order using your PayPal or Visa or Mastercard.

- Decide on a convenient file structure and down load your duplicate.

Discover all the papers themes you might have purchased in the My Forms food list. You can get a more duplicate of California Proxy Statement of Bank of Montana System at any time, if possible. Just select the required form to down load or produce the papers design.

Use US Legal Forms, by far the most substantial variety of legal varieties, to conserve some time and avoid blunders. The services offers appropriately produced legal papers themes which you can use for a selection of purposes. Make your account on US Legal Forms and begin creating your life a little easier.