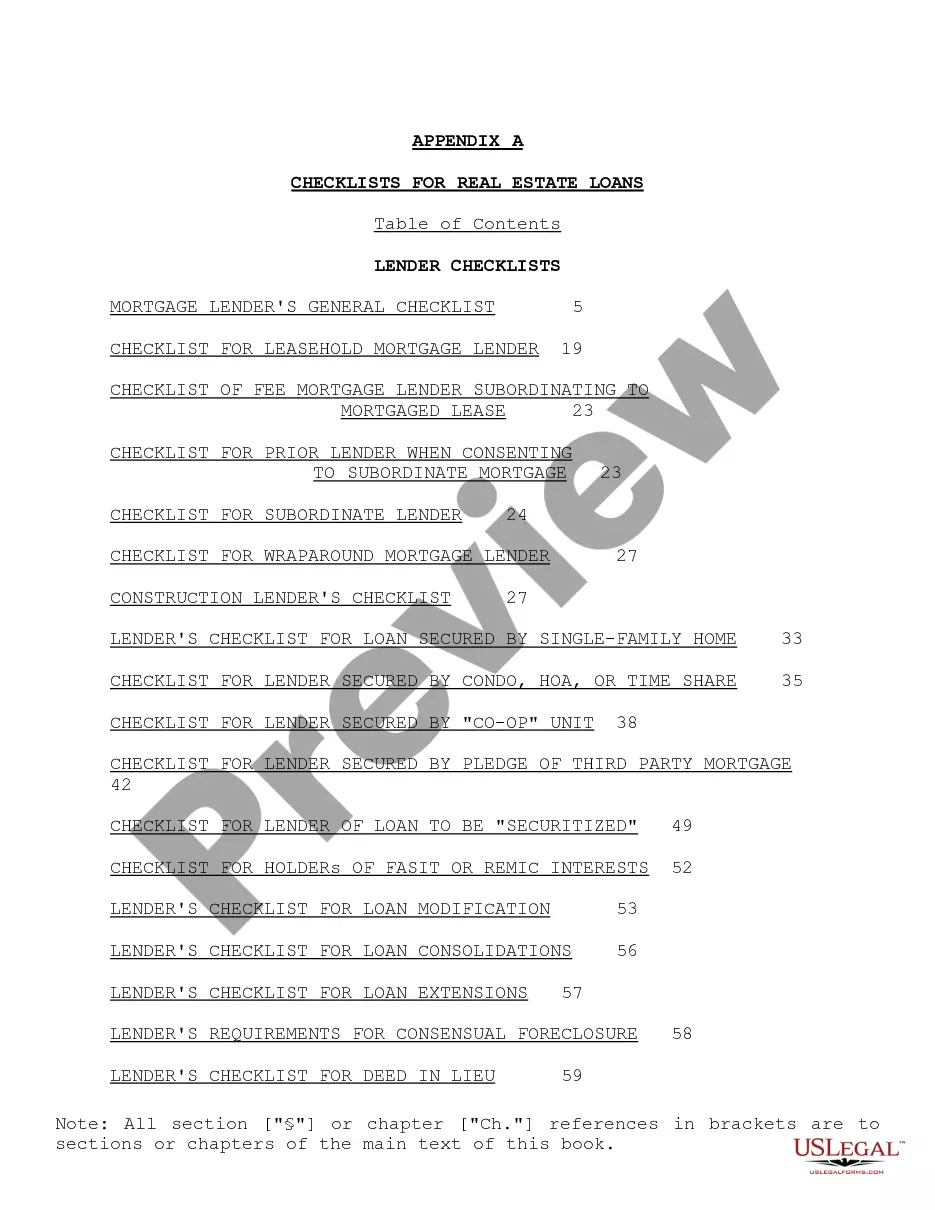

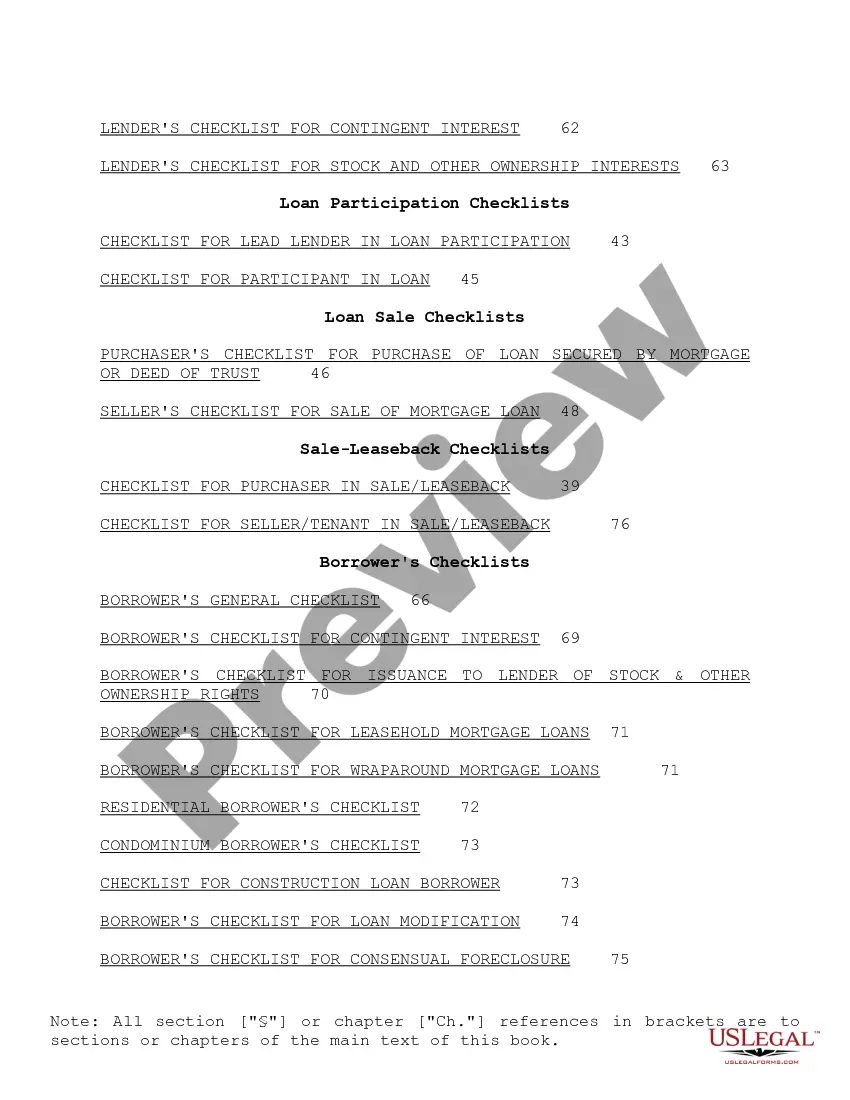

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

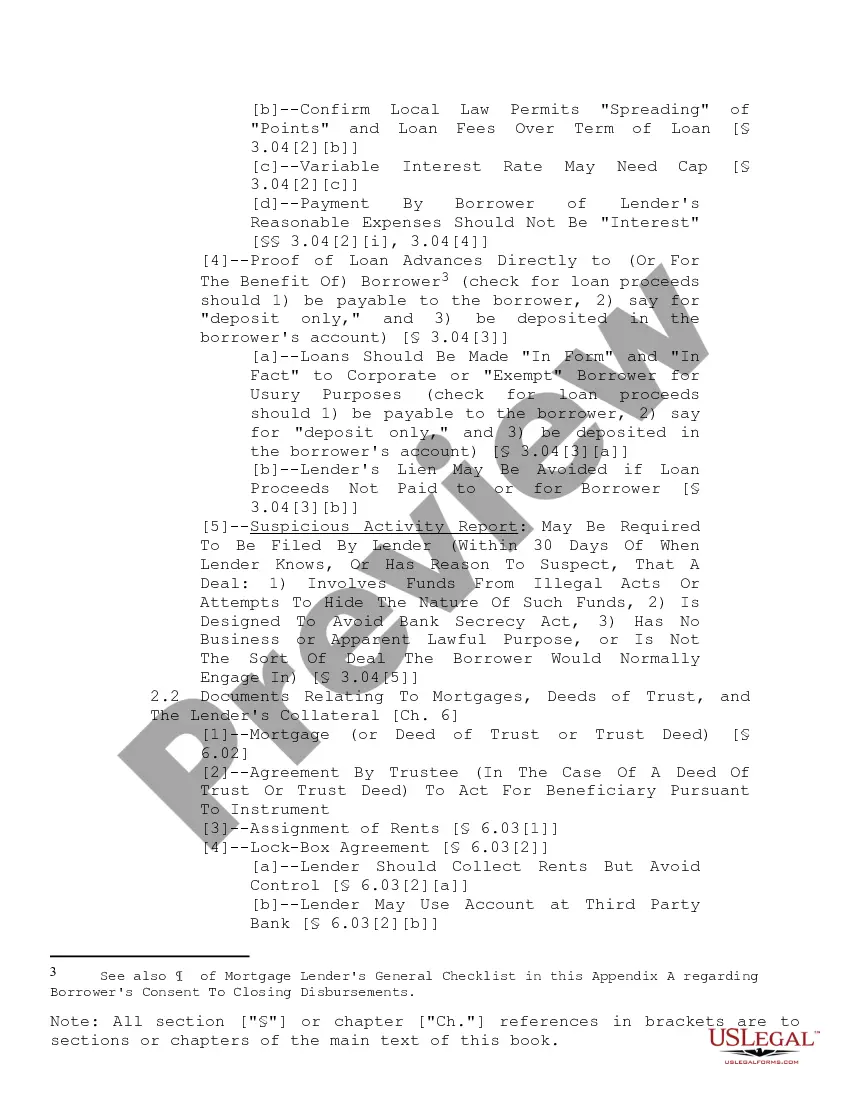

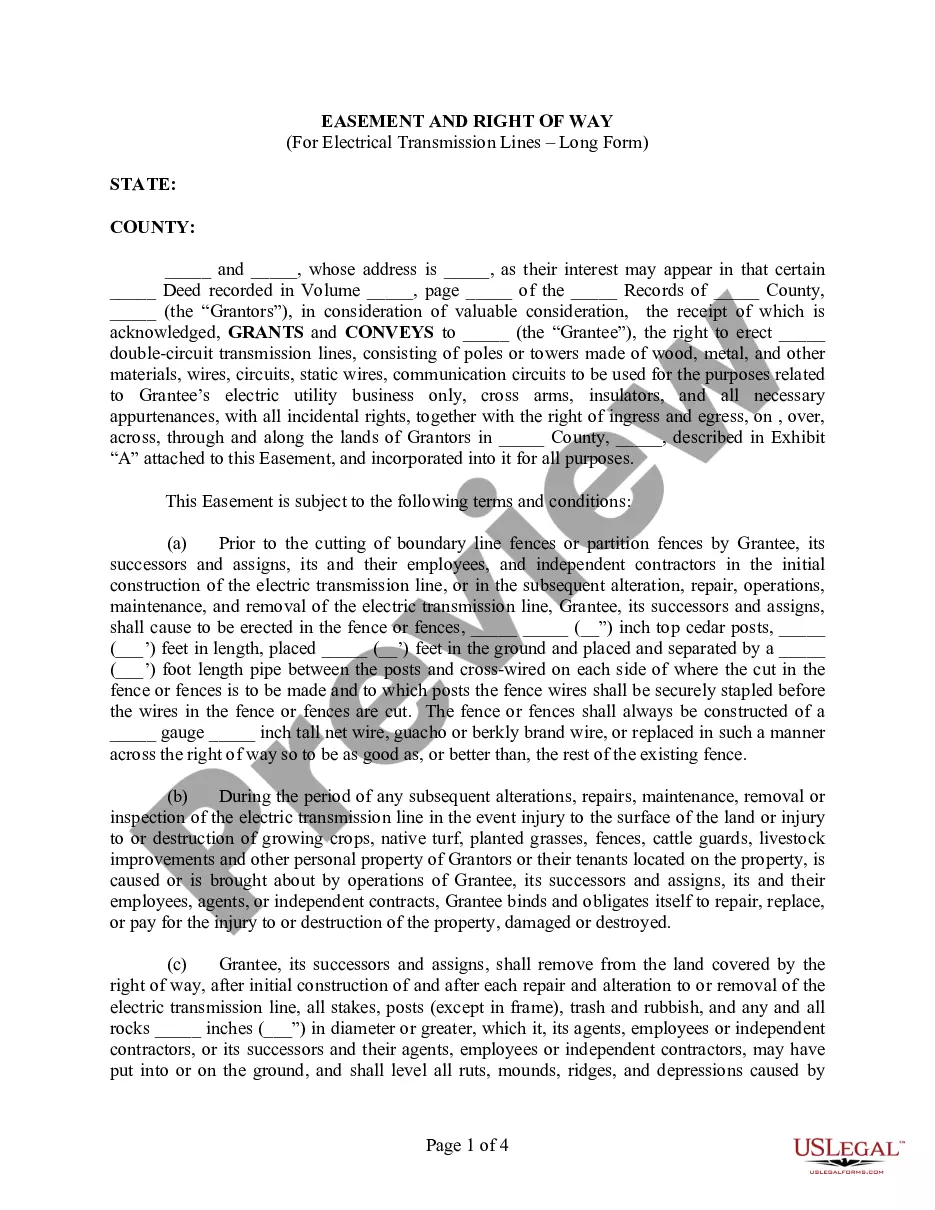

Title: California Checklist for Real Estate Loans: A Comprehensive Guide Introduction: Navigating the realm of real estate loans can be a complex undertaking, especially in California where the market is highly dynamic and regulations are stringent. To ensure a smooth lending process, it is essential to adhere to a California Checklist for Real Estate Loans. This guide aims to provide a detailed description of such a checklist, its key components, and any specific variations based on loan type. 1. Loan Application Checklist: The loan application checklist sets the foundation for any real estate loan process. It typically includes the following elements: — Personal information for all borrowers, such as Social Security numbers and contact details. — Financial documentation, including tax returns, W-2 forms, bank statements, and proof of assets. — Employment verification and history records. — Credit history reports and credit scores. — Documentation of any additional income sources. — A completed loan application form. 2. Property-related Checklist: This section focuses on verifying the viability of the real estate being financed. It encompasses the following aspects: — Clear title and title insurance— - Property appraisal report to assess its market value. — Inspection reports, including pest control, general home inspection, and other specialized inspections. — Copies of any existing leases or rental agreements (for investment properties). — Homeowners insurance details, including coverage and policy specifics. 3. Loan Underwriting Checklist: Once the initial application and property checks are complete, the loan underwriting checklist evaluates the borrower's eligibility and risk profile, scrutinizing the following factors: — Debt-to-income (DTI) ratio analysis— - Loan-to-value (LTV) ratio examination. — Verification of borrower assets and liabilities. — Analysis of credit history and credit scores. — Evaluation of income stability and employment history. 4. Loan Closing Checklist: Preparing for the loan closing stage involves assembling crucial documents and finalizing the loan terms. This checklist typically includes: — Escrow instructions and closing disclosure. — Loan estimate and final loan documentation. — Evidence of homeowners insurance coverage. — Completed property transfer documents, including title transfer and deeds. — Applicable government-issued identification for all parties involved. — Verification of closing costs and down payment amounts. — Satisfaction of any loan conditions and contingencies. Notable California Loan Types: While the general checklist applies to most real estate loans in California, there are also specific checklists tailored to certain loan types, including: — Conventional Loans: Follow the comprehensive California Checklist for Real Estate Loans. — FHA Loans: Incorporate additional requirements, such as property eligibility, mortgage insurance, and specific appraisal criteria. — VA Loans: Feature specific documentation for military service verification, eligibility, and more. — USDA Loans: Include verification of property location, income limits, and compliance with agricultural requirements. Conclusion: The California Checklist for Real Estate Loans acts as a crucial tool in ensuring a smooth loan approval process. Potential borrowers, lenders, and real estate professionals should pay meticulous attention to the various checklists, ensuring all necessary documentation and requirements are met. By adhering to these guidelines, individuals can enhance their chances of securing a successful real estate loan experience in California.Title: California Checklist for Real Estate Loans: A Comprehensive Guide Introduction: Navigating the realm of real estate loans can be a complex undertaking, especially in California where the market is highly dynamic and regulations are stringent. To ensure a smooth lending process, it is essential to adhere to a California Checklist for Real Estate Loans. This guide aims to provide a detailed description of such a checklist, its key components, and any specific variations based on loan type. 1. Loan Application Checklist: The loan application checklist sets the foundation for any real estate loan process. It typically includes the following elements: — Personal information for all borrowers, such as Social Security numbers and contact details. — Financial documentation, including tax returns, W-2 forms, bank statements, and proof of assets. — Employment verification and history records. — Credit history reports and credit scores. — Documentation of any additional income sources. — A completed loan application form. 2. Property-related Checklist: This section focuses on verifying the viability of the real estate being financed. It encompasses the following aspects: — Clear title and title insurance— - Property appraisal report to assess its market value. — Inspection reports, including pest control, general home inspection, and other specialized inspections. — Copies of any existing leases or rental agreements (for investment properties). — Homeowners insurance details, including coverage and policy specifics. 3. Loan Underwriting Checklist: Once the initial application and property checks are complete, the loan underwriting checklist evaluates the borrower's eligibility and risk profile, scrutinizing the following factors: — Debt-to-income (DTI) ratio analysis— - Loan-to-value (LTV) ratio examination. — Verification of borrower assets and liabilities. — Analysis of credit history and credit scores. — Evaluation of income stability and employment history. 4. Loan Closing Checklist: Preparing for the loan closing stage involves assembling crucial documents and finalizing the loan terms. This checklist typically includes: — Escrow instructions and closing disclosure. — Loan estimate and final loan documentation. — Evidence of homeowners insurance coverage. — Completed property transfer documents, including title transfer and deeds. — Applicable government-issued identification for all parties involved. — Verification of closing costs and down payment amounts. — Satisfaction of any loan conditions and contingencies. Notable California Loan Types: While the general checklist applies to most real estate loans in California, there are also specific checklists tailored to certain loan types, including: — Conventional Loans: Follow the comprehensive California Checklist for Real Estate Loans. — FHA Loans: Incorporate additional requirements, such as property eligibility, mortgage insurance, and specific appraisal criteria. — VA Loans: Feature specific documentation for military service verification, eligibility, and more. — USDA Loans: Include verification of property location, income limits, and compliance with agricultural requirements. Conclusion: The California Checklist for Real Estate Loans acts as a crucial tool in ensuring a smooth loan approval process. Potential borrowers, lenders, and real estate professionals should pay meticulous attention to the various checklists, ensuring all necessary documentation and requirements are met. By adhering to these guidelines, individuals can enhance their chances of securing a successful real estate loan experience in California.